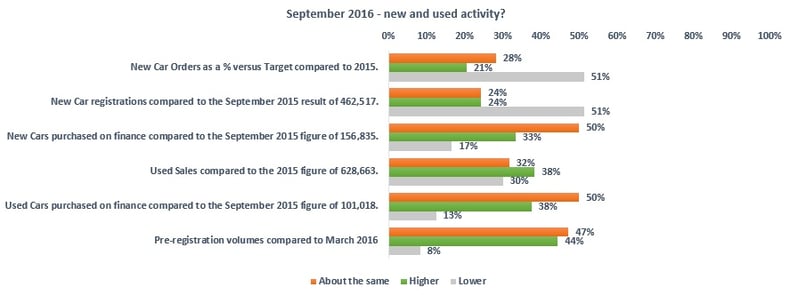

Dealers are expecting lower sales in September than the bumper figure of 462,517 new registrations in 2015.

In a new study from cap hpi, 51% of dealers stated that new car registrations in September would be lower than 2015. The remaining sentiment is split equally between an equal or higher performance.

A third, 33%, of dealers, believe that finance penetration on new vehicles will increase in September. Half said that September would achieve a similar result of 156,835 new cars purchased on finance as in 2015.

With a positive year-to-date for used car sales, the majority of those surveyed indicated that they believed that September 2016 could see the same or better result than we experienced in September 2015 of 628,663 sales.

Similar to the new cars purchased on finance, half cited that September 2016 would be about the same as 2015 of 101,018 used cars purchased on finance and 38% indicating it could be higher.

When comparing pre-registration activity in September to March, 92% believed it would be the same or higher, with the minority of 8% citing a lower result.

Philip Nothard, consumer and retail specialist at cap hpi, said: “Following a slow start to August, overall dealers are positive with the current trading month. They see the market as stable, with a good balance between supply and demand, and it’s clear the market is following established seasonal trends.

“However, concerns over the quality of available stock remain, and a longer-term concern about increasing volumes and the possibility of the market overloading with a glut of the same ex-fleet, ex-manufacturer vehicles.

“The survey shows September performance will be defined by the manufacturer. We are likely to see an increase in pre-registration short-term rental activity, but this varies by manufacturer and model.

“The success that some of the expanding dealer groups are experiencing is notable. The impact of Brexit isn’t showing any obvious signs on the network's performance, as overall it seems stable and in line with expectations and seasonality.”

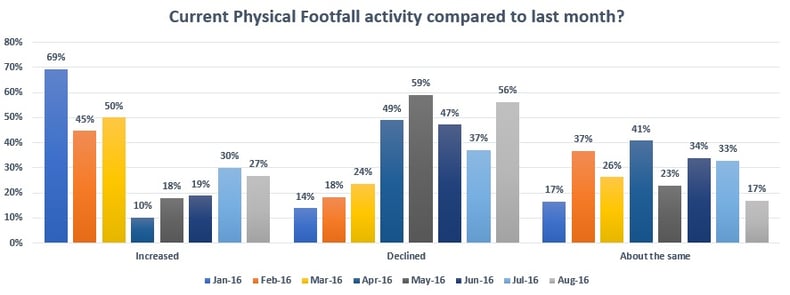

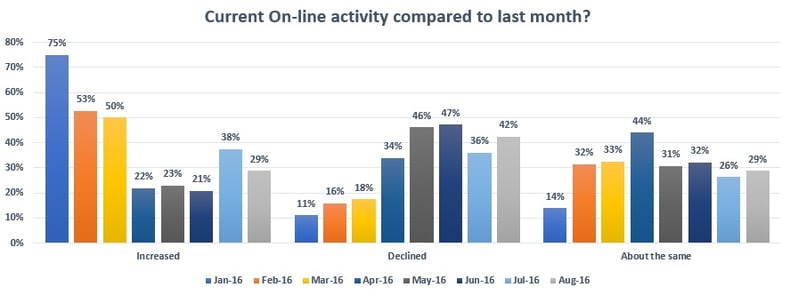

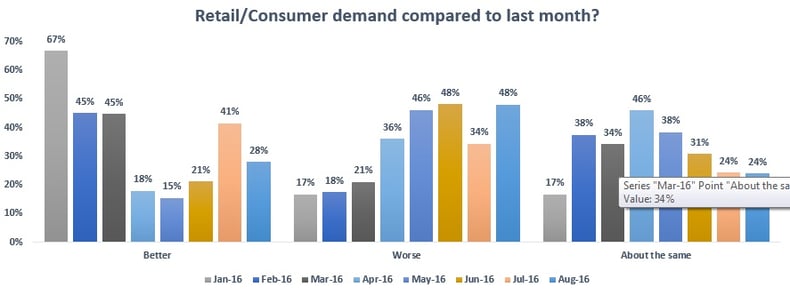

Consumer demand weakened in August with the majority of dealers reporting a decline in footfall activity, an increase from 41% in 2015 to 56%. Online activity has seen a positive result compared to 2015, with 29% of respondents indicating an increase in activity, a 13% improvement, although those citing a decline had increased from 35% to 42%.

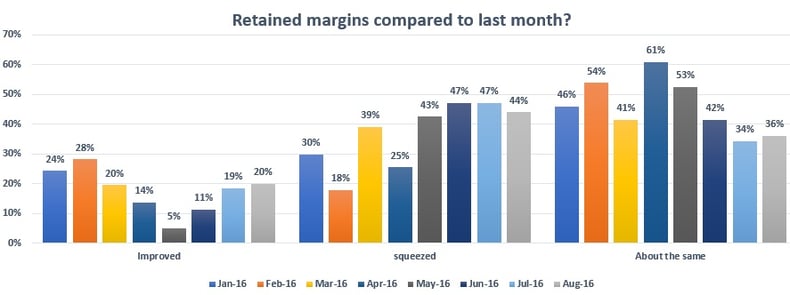

Margin retention has seen a positive start to Q3 against Q2, as 20% reported an improvement in August compared to last month and up 10% on August 2015. The percentage of those indicating further compression remains at 44%, the same as this time last year.

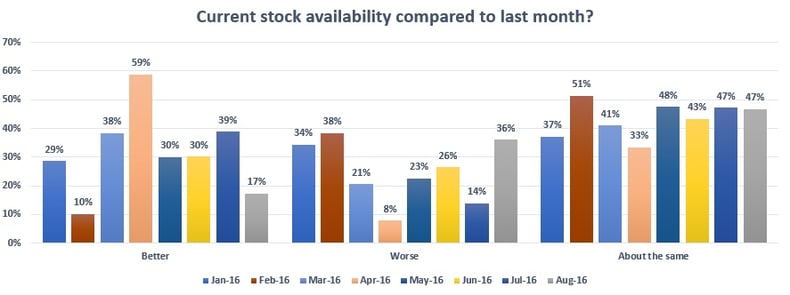

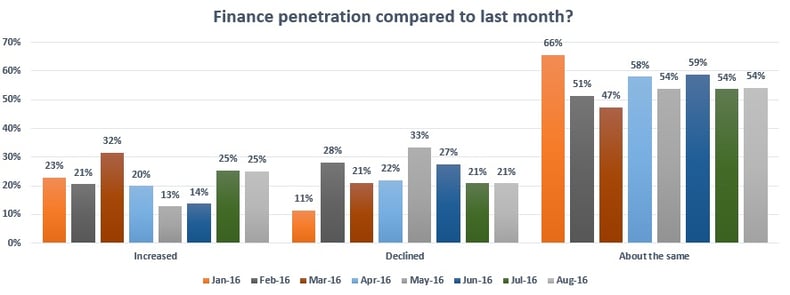

The expected seasonal trends impacted stock availability, with 17% of dealers reporting stock availability had improved, 36% said it had worsened since last month. The results indicate a similar performance of finance penetration, with 54% of those responding indicating little or no change, and 25% citing an increase.

While 48% of dealers reported an improvement in consumer demand in July, the August result of 28% shows slight easing, however, it remained in line with the sentiment at this point last year.

51% indicated a lower order take against target than at the same stage in 2015, while 21% reported higher demand, and 28% said it had remained the same.