Looking for a Vehicle Valuation or HPI Check?

Welcome to the third of our new style overviews, previously known as the ‘gold book new car editorials’. Our aim is to bring you improved content and layout, making it easy to identify new and revised information. As always, any customer feedback on this new format would be appreciated: e-mail andrew.mee@cap-hpi.com

The new structure is as follows:

- Headlines - key changes and additions to the overview this month

- Reforecast details this month

- Market conditions

- Historic forecast accuracy

- Forecast methodology

- Sector reforecast schedule 2019-2020

1. Headlines - key changes and additions to the overview this month

Forecast changes

The overall average change in new car forecasts between last month and this month is approximately +4.3% at 36/60, which is in line with the normal expectation of the seasonal change for full year forecasts between these months, which includes a plate change.

This month, we publish new reforecasts for the City Car and Supermini sectors. The overall impact of the changes to forecasts for these sectors at 36/60 is +4.8%

Following customer feedback, we have included for the first time a summary of historic reforecast changes for these sectors, going back to mid 2017 when the behaviour of current values for petrol and diesel started to diverge.

Details of all values revised by ±5% can be found via the following link: Monthly Reports

See section 2 for more details on forecast changes.

New model ranges added to our forecasts

Audi TT RS, Audi Q8, BMW 7 Series, DS DS 3 Crossback, Mazda Mazda3, and Volvo V60.

We have also included McLaren products in our forecasts for the first time: McLaren 540, McLaren 570, McLaren 600, McLaren 650 McLaren 675, McLaren 720

New model ranges to which new derivatives have been added

Alfa Romeo Giulietta, Audi RS3, Citroen C3, Citroen C4 Cactus, Fiat 500, Fiat 500X, Hyundai i20, Infiniti Q50, Jaguar XF, Jeep Compass, Land Rover Range Rover Sport, Mazda MX-5, Nissan Qashqai, Skoda Kodiaq, Skoda Octavia, Tesla Model S, Tesla Model X, Vauxhall Grandland X, Volkswagen Arteon, Volkswagen California, Volkswagen Polo, Volkswagen T-Cross, Volkswagen Touran, Volvo V60, Volvo V90, Volvo XC60 and Volvo XC90.

Market Conditions Changes

New independent forecasts for the UK economy were published by HM treasury on 20th February. Despite uncertainty over Brexit, the new forecasts for GDP, Inflation and Unemployment remain positive for the next 5 years.

SMMT figures show UK new car registrations for January 2019 were down -1..3% against 2017, with diesel down -20.3%; broadly in line with our expectations.

The used car market remains strong, but as we predicted, the excessive strength of petrol cars in particular continues to decline, and our forecasts assume that this will continue through 2019. Diesel values continue to hold up well, and our forecasts assume that this too will continue.

See section 3 for more details on market conditions changes.

Historic Forecast Accuracy Changes

We continue to see a gradual improvement in historic petrol forecast accuracy, as the strength in current market values for petrol, caused by anti-diesel press, is starting to diminish as we predicted. In addition, our sector reforecasts since early 2017 have taken this strength into account, and this will flow into future accuracy results, starting with 12 month forecasts.

See section 4 for more details on accuracy.

2. Forecast details this month:

This month, we publish our new reforecasts for the City Car and Supermini sectors.

The overall impact of the changes at 36/60, split by sector and fuel type, is as follows:

|

SECTOR |

UNDERLYING FORECAST CHANGE |

SEASONAL ELEMENT |

OBSERVED CHANGE December to january |

|

City Car Petrol City Car Diesel Supermini Petrol Supermini Diesel |

-1.5% +0,4% +1.1% +0.0% |

+4.3% +4.6% +4.5% +4.7% |

+2.8% +5.0% +5.6% +4.7% |

We have not revised our future market deflation assumptions for these sectors, but we are likely to review them in the next reforecasts in 5 months’ time.

The changes to underlying forecasts therefore reflect the movement in current values (black book) since the last reforecast 5 months ago.

Over this period the strength in petrol City Cars which started in 2017 has rapidly diminished, resulting in a slightly reduced average underlying forecast.

There is now only one diesel City Car model range available (Ford KA Plus).

Over the same period the strength in petrol Supermini cars has also fallen away a little, but they remain strong, resulting in a slightly increased average underlying forecast.

There are now only nine diesel Supermini model ranges available, as manufacturers reduce diesel availability in the smaller car sectors. Values have held up well over the last 5 months, probably helped by falling volumes of used supply, resulting in no movement to the average underlying forecast.

The tables below summarise the 36/60 forecast changes for these sectors since the middle of 2017, when petrol strength became apparent. It can be seen that the base forecasts (before monthly seasonality is applied) were increased to reflect the then current strength of petrol, though it must be emphasised that our forecasts always assumed values would fall in the future (as is now happening). Although our historic (petrol) forecasts for these sectors are now proving to have been under-forecast, this history of improved forecasts should mean that accuracy will improve in future.

|

Book Month |

Sector |

Underlying Forecast Change |

Seasonal element |

Observed Change vs previous month |

|

Oct-18 |

City Car Petrol |

4.2 |

0.2 |

4.4 |

|

May-18 |

City Car Petrol |

0.1 |

-2.2 |

-2.1 |

|

Dec-17 |

City Car Petrol |

3.3 |

-2.6 |

0.7 |

|

Jul-17 |

City Car Petrol |

-1.4 |

-1.2 |

-2.5 |

|

Book Month |

Sector |

Underlying Forecast Change |

Seasonal element |

Observed Change vs previous month |

|

Oct-18 |

Supermini Petrol |

4.3 |

0.5 |

4.8 |

|

May-18 |

Supermini Petrol |

1.0 |

-1.7 |

-0.7 |

|

Dec-17 |

Supermini Petrol |

1.2 |

-2.7 |

-1.5 |

|

Jul-17 |

Supermini Petrol |

1.7 |

-1.3 |

0.4 |

For diesel cars in the Supermini sector, the base forecast changes have been less positive, reflecting the relative lack of strength of diesel values, until the latter part of 2018.

|

Book Month |

Sector |

Underlying Forecast Change |

Seasonal element |

Observed Change vs previous month |

|

Oct-18 |

Supermini Diesel |

2.2 |

0.4 |

2.6 |

|

May-18 |

Supermini Diesel |

0.7 |

-1.7 |

-1.0 |

|

Dec-17 |

Supermini Diesel |

-2.1 |

-2.5 |

-4.6 |

|

Jul-17 |

Supermini Diesel |

-3.9 |

-1.2 |

-5.1 |

As part of the current sector reforecast, we have also amended walk-ups on the following models, to align them to the latest black book research. A common theme was to increase the walk-ups for automatic transmission in City Cars, as technology has improved and desirability has increased.

City Car:

- Abarth 500/595/695: Full review of all trim walk-ups

- Fiat 500: Auto transmission walk-up increased

- Fiat Panda: Auto transmission walk-up increased

- Hyundai i10: Auto transmission walk-up increased

- Peugeot 108: Auto transmission walk-up increased; GT Line trim walk-up increased

- Seat Mii: Full review of all walk-ups

- Skoda Citigo: Full review of all walk-ups

- Suzuki Celerio: Auto transmission walk-up increased

- Vauxhall Adam: Full review of all walk-ups

- Vauxhall Viva: Full review of all walk-ups

- VW Up: Full review of all walk-ups

Supermini

- Alfa Mito petrol: Auto transmission walk-up increased; 170ps engine walk-up increased

- Citroen C3 petrol: Auto transmission walk-up increased

- Dacia Sandero petrol: 90ps engine walk-up increased

- Fiat Punto: Auto transmission walk-up increased; 105ps engine walk-up increased

- Ford Fiesta petrol and diesel: full review of all trim walk-ups; in particular Vignale walk-ups increased

- Renault Clio petrol: 120ps engine walk-up increased

Other forecast changes this month (in addition to sector reforecasts)

Lexus ES: reforecast to align depreciation profile to expected position, resulting in decreased forecasts.

Lexus RX: change to walk-up for Premium Pack following receipt of new information from the manufacturer, resulting in decreased forecasts.

Mercedes Benz C Class petrol and diesel: reforecast following black book and gold book inter-product analysis, resulting in decreased forecasts.

Skoda Kodiaq: 190ps engine walk-up reduced to align with latest black book research, resulting in decreased forecasts.

Seasonality changes

In line with our gold book methodology, all other model ranges which are outside of the sector reforecasts and outside of the other changes listed above, have had their forecasts moved forward from month to month by seasonal factors which are differentiated by sector and fuel type and are based on analysis of historical black book movements.

3. Market Overview

The economy

Options for the outcome of Brexit continue to range from no deal to a soft exit deal, and possibly no exit at all if another referendum is held. Our view remains that even under a no deal scenario, a pragmatic trade deal will subsequently be made for the automotive sector that is so important for many European economies. Such a deal should reduce the probability of significant list price increases and disruption to new car supply. However even if new car supply were to be disrupted for a period, this could have a positive impact on used car values. Therefore we are still planning to conform to our original timetable of sector reforecasts and do not consider it necessary to embark on a concurrent reforecast of every sector at the same time. We will of course continue to monitor the situation very closely.

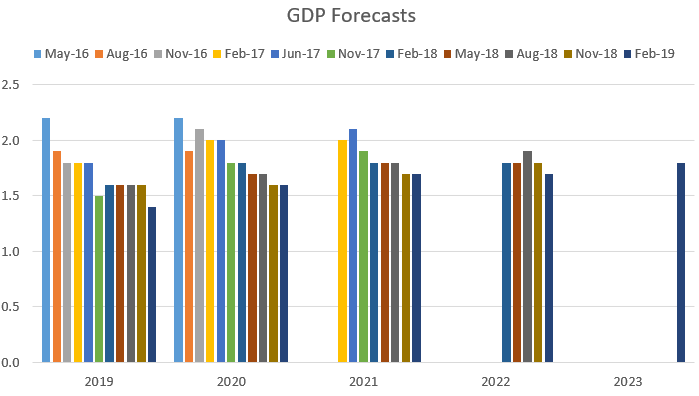

Despite uncertainty over Brexit, the outlook for the UK economy remains unchanged. New independent economic forecasts were published by HM Treasury in February, and these still do not forecast a recession, so remain in line with our own view. Compared with the previous November forecasts, the only significant change is a reduction in the average GDP forecast for 2019.

These forecasts are consistent with the recent history of GDP growth. Figures from ONS show that GDP grew by 0.4% in the three months to October, slower than the 0.6% in the three months to September (which had been better than expected). These figures are broadly in line with the trend in quarterly growth since 2016, with the UK economy continuing a trajectory of consistent but sluggish growth.

Not all ages and sectors of vehicle are directly impacted by GDP, but for those that are then in some cases lower future registration volumes will offset reduced GDP.

CPI is currently running at 1.8% (January 2019); and the average of the latest independent forecasts (February 2019) are for it to remain around 2% over the next 5 years.

Unemployment is currently running at 4.0% (February 2019); and the average of the latest independent forecasts (February 2019) are for it to remain around 4% over the next 5 years.

Interest rates are expected to remain low for the medium term. Any significant further increase in base rate still seem unlikely until there is a combination of further improvements in wage growth and increases in rates of headline inflation.

Wage growth remains reasonably healthy, although slow by historical standards, and price inflation is now more stable, so these conditions should continue to provide a positive impetus to the overall economy.

Oil prices seem to have stabilised following following the recent decision by OPEC and others to curb output.

Forecasts for future house price increases vary dramatically by sector and especially by geography. Despite a view expressed by the Bank of England’s Financial Stability Committee that the buy to let sector could “amplify” any boom or bust in the housing market, any negative effects are likely to be centred on London, with the rest of the country significantly more insulated from the impact of any such downturn.

Supply Outlook

Exchange rates are a major influence on the profitability of the UK new car market and they strongly influence eventual used vehicle volumes. Sterling rates against the Euro reduced from around 1.43 in late 2015 to around 1.14 by late 2017, where they have broadly remained. This has limited manufacturers’ scope for heavy discounting and forced registration activity in the UK.

New car registrations in other key European markets continue to grow because of the release of pent up demand, allowing manufacturers to divert volume to these markets. In the three years before the financial crisis, France, Germany, Italy and Spain represented an annual combined volume of almost 9.4 million units. They have recovered to 7.7 million in 2015, 8.3M in 2016, 8.7M in 2017 and 8.85M in 2018, suggesting there is still further growth to come, despite a contracting market in Italy and sluggish growth in Germany.

As a result of the exchange rate position and the capacity of other markets, UK new car registrations for 2017 reflected a ‘true market’ and came in at 2.54M compared with 2016’s 2.69 million (down -5.7%), Most of that fall came from diesel registrations (down -17.1%) as a result of ongoing bad press about air pollution.

2018 registrations finished at -6.8% less than 2017, the further fall being due in part to the production and delivery issues caused by WLTP changes; and diesel registrations were down -29.6% compared with 2017, resulting in 31.7% market share, with most of the volume shift still being into petrol cars.

Looking to the next few years, and subject to the outcome of Brexit, we expect the total UK market to stabilise, with 2019 volume similar to but probably less than 2018, and with some growth in the outer years if GDP forecasts materialise and exchange rates remain relatively stable. The shift out of diesel will continue, but the rate of decline will slow down as we reach the hard core of drivers for whom diesel makes sense, and there could be return to diesel from some drivers who switched to petrol but have not liked the increase in fuel costs. There should be increased take-up of alternative fuelled vehicles but this is very dependent on taxation incentives and charging infrastructure. Petrol will remain the dominant fuel type.

Year to date registrations for 2018 (to the end of January) were down -1.6% against 2018, with diesel down -20.3%; broadly in line with our expectations.

Demand outlook and impact on future used values

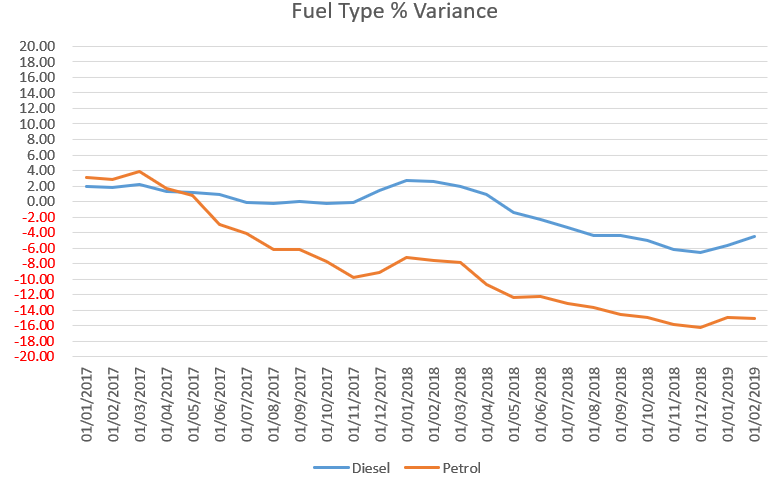

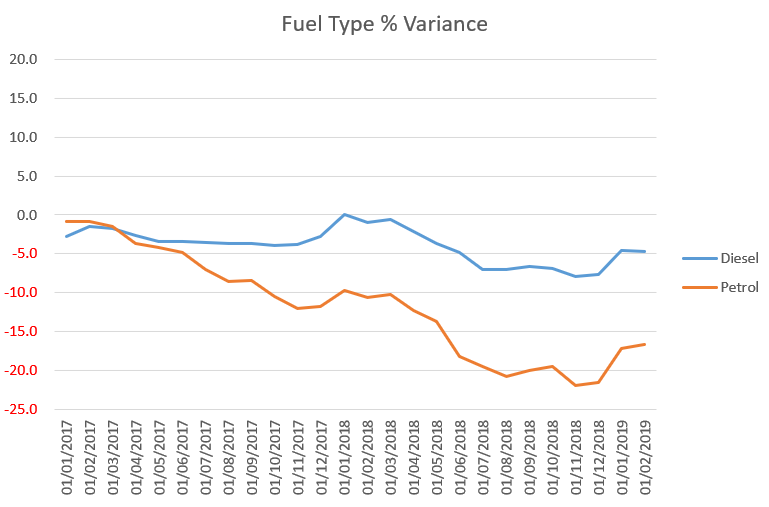

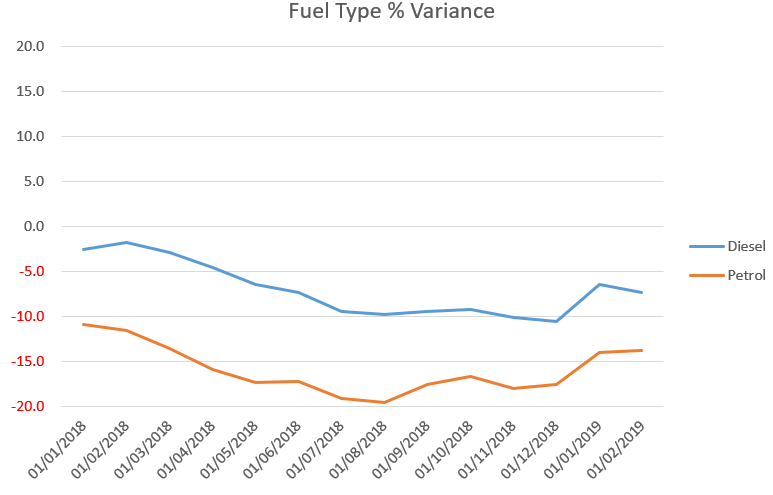

Contrary to the new car market where diesel share has declined sharply, used diesel values have continued to hold up well (broadly in line with our historic future deflation assumptions) as demand has continued to meet supply

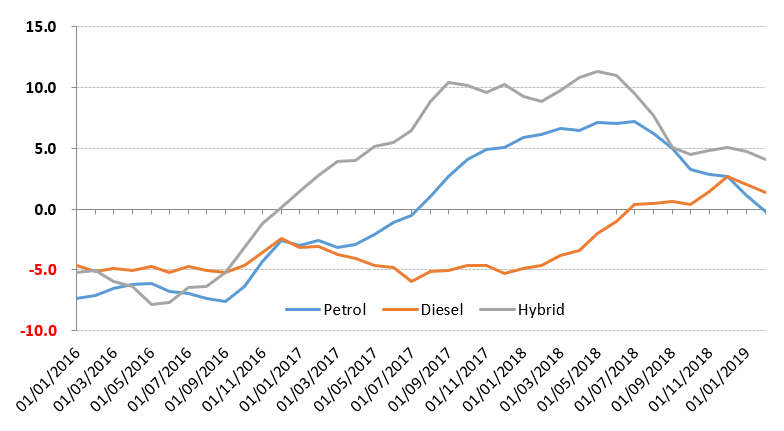

Petrol and hybrid values have been particularly strong (exceeding our historic future deflation assumptions) as buyers seek an alternative to diesel where available. We have always considered this strength will not be sustainable beyond the short term, and there is now clear evidence that the petrol and hybrid market is starting to cool as these cars look too expensive and used supply of these fuel types starts to increase.

In recent months, diesel values have in fact strengthened a little as WLTP has affected the number of part exchanges coming onto the market, and fleets have held onto cars while they await Brexit developments.

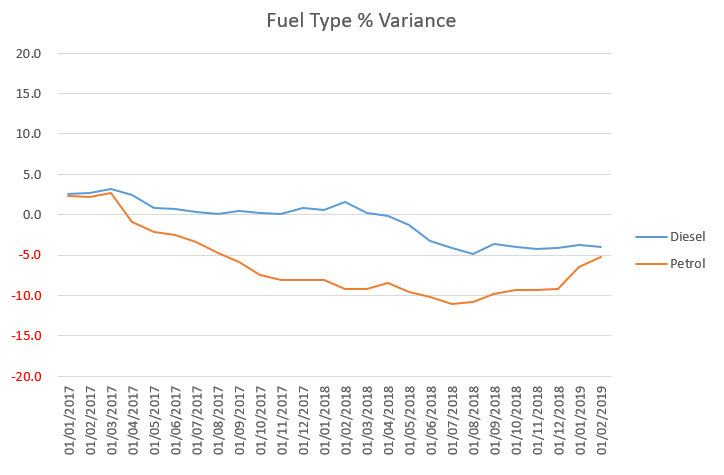

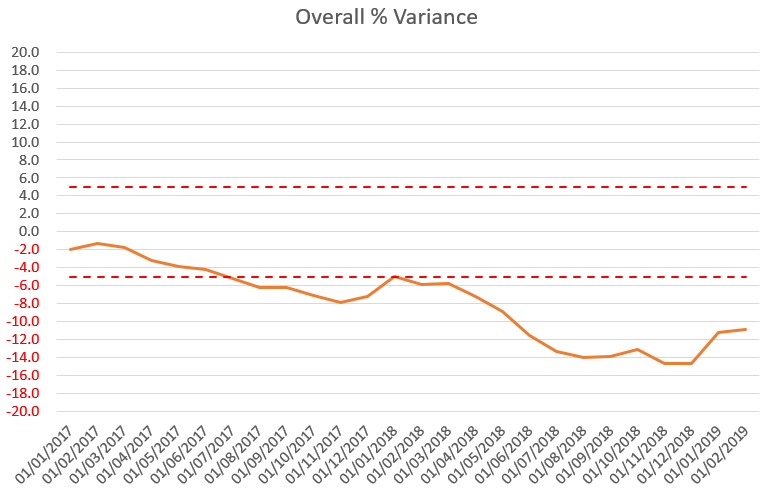

The following chart shows the average year-on-year change in value of the same model (cap id) at 36/60k, split by fuel type.

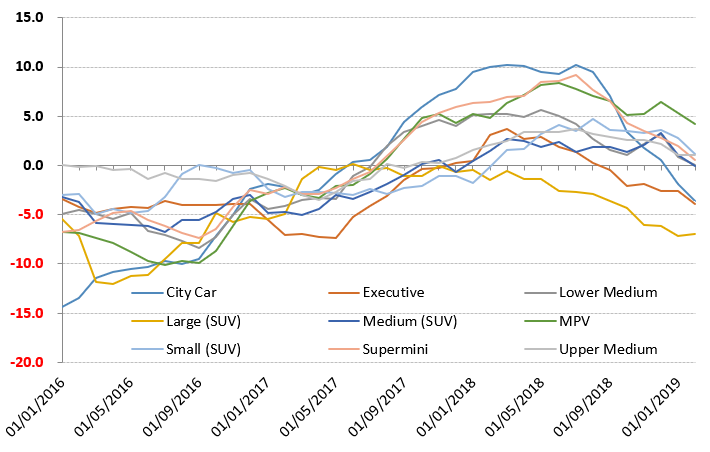

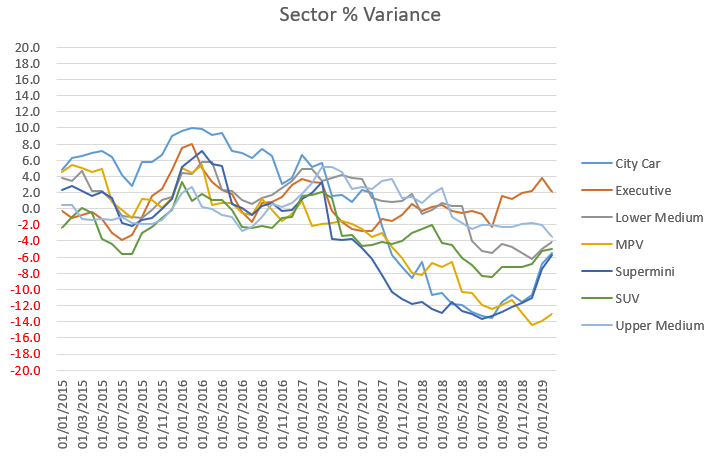

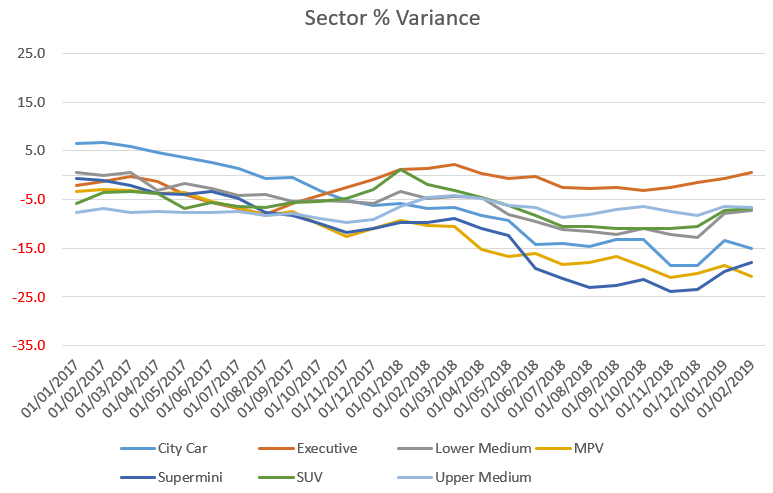

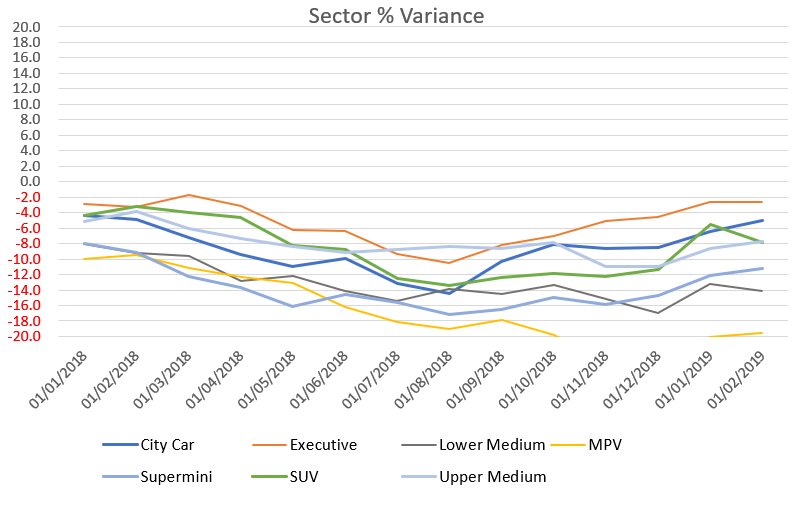

In the main vehicle sectors, petrol values have shown the same trends of growing strength since early 2017, and declining strength since mid-2018. These trends are the mirror image of our petrol forecast accuracy results (see section 4).

It is worth noting that City Car, recently the strongest sector, has now moved into deflation, consistent with our forecasting assumption, and we expect the other sectors will follow the same path as we go through 2019.

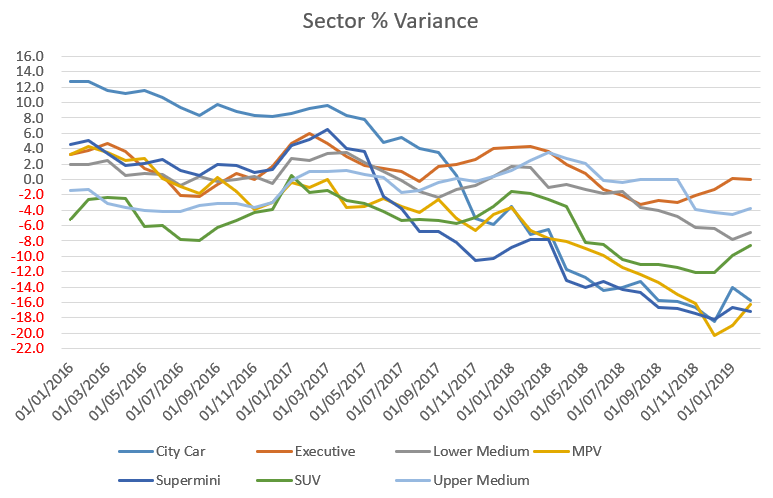

The following chart shoes the average year-on-year change in value of the same model (cap id) at 36/60k, split by sector, for petrol cars.

Looking to the next few years, we expect the supply/demand equation to re-stabilise across all fuel types, subject to the outcome of Brexit. Our forecast assumptions are for year-on year deflation broadly in the range of -3% to -6% per annum, varying by sector and fuel type.

There will be an increase in supply of used diesel cars coming onto the market until 2020, as a result higher registration volumes up until 2017. However we expect demand will meet this supply, unless there is widespread implementation of city charging zones for diesel cars in this period, or significant government legislation changes affecting the running costs of diesel cars. We do not consider either of these actions to be likely.

4. Historic Forecast Accuracy:

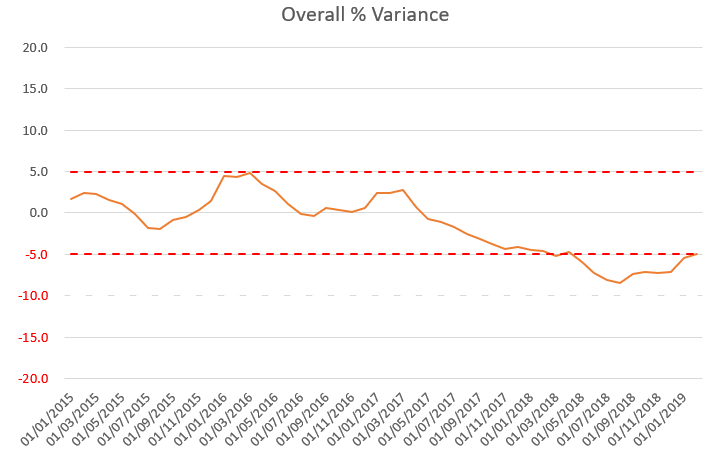

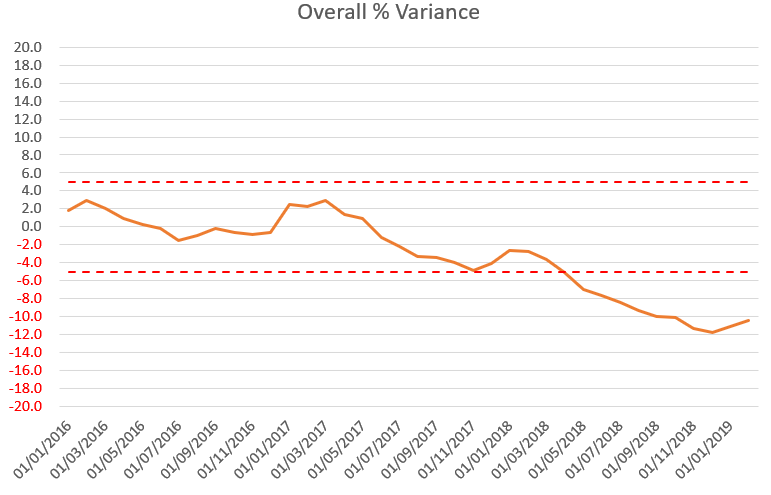

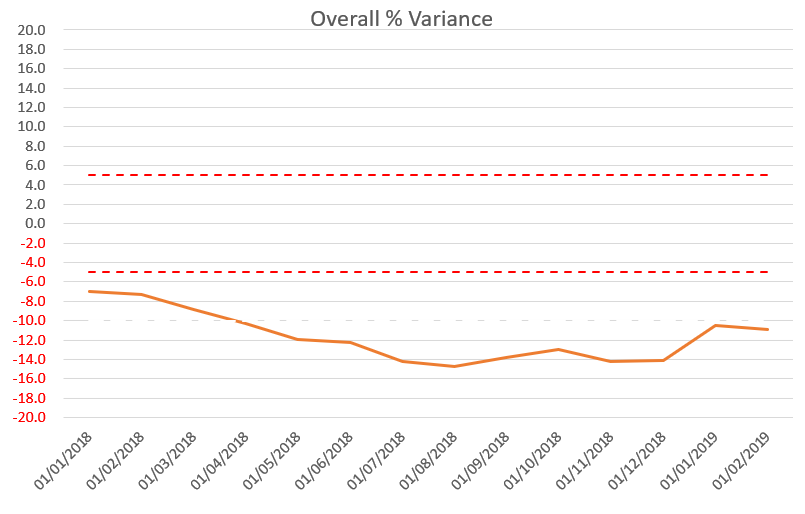

Since the introduction of gold book at the end of 2013, we have been able to track the accuracy of historic forecasts against current (black book) values. This tracking is longest for 12 month forecasts (tracked since January 2015) and shortest for 60 month forecasts (tracked since January 2019).

Overall we are satisfied that accuracy results are generally been within the +/- 5% target agreed with customers, but recognise that results have been affected by the unexpected strength of petrol values which started in 2017 as a result of anti-diesel press. Diesel forecast accuracy has generally been within target, while petrol forecast accuracy has fallen outside of target since 2017.

We have always stated that the strength of petrol values was unsustainable, and although the strength lasted a little longer than we expected, it is now starting to diminish as used petrol volumes increase.

Our historic forecast accuracy is now starting to improve as a result of this market correction of petrol values, and also as a result of historic sector reforecasts that took petrol strength into account now starting to flow through in to the accuracy results. This flow is happening first with 12 month forecasts, then with 24 month forecasts, etc.

Therefore the tracking charts below all show the same general pattern of returning to improving results, with the difference to target being less for 12 month forecasts (reforecast most recently); and being more for longer term forecasts (reforecast less recently).

City Car forecast accuracy, followed by Supermini, have been most volatile over the long term, partly as a result of variable manufacturer behaviour regarding forced registrations, and partly because their low pound values results in relatively large percentage figures.

More recently, MPV forecast accuracy has been affected by the strength in values due to demand outstripping supply; but sector reforecasts have taken this into account, and will flow through into improved results in the future.

12 month results

Since measurement started our 12 month forecasts have averaged -1.5% less than black book across all vehicle ids, and the most recent results show February 2018 12/20 gold book forecasts being -4.9% less than February 2019 12/20 black book.

The most recent results for these main sectors are as follows:

|

BB Month |

City Car |

Executive |

Lower Medium |

MPV |

Supermini |

SUV |

Upper Medium |

|

01/02/2019 |

-5.5 |

2.1 |

-4.1 |

-13.0 |

-5.8 |

-5.0 |

-3.5 |

24 month results

Since measurement started our 24 month forecasts have averaged -3.2% less than black book across all vehicle ids, and the most recent results show February 2018 24/40 gold book forecasts being -10.4% less than February 2019 24/40 black book.

The most recent results for these main sectors are as follows:

|

BB Month |

City Car |

Executive |

Lower Medium |

MPV |

Supermini |

SUV |

Upper Medium |

|

01/02/2019 |

-15.8 |

0.0 |

-6.8 |

-16.3 |

-17.2 |

-8.6 |

-3.8 |

36 month results

Since measurement started our 36 month forecasts have averaged -8.0% less than black book across all vehicle ids, and the most recent results show February 2016 36/60 gold book forecasts being -11.0% less than February 2019 36/60 black book.

The most recent results for these main sectors are as follows:

|

BB Month |

City Car |

Executive |

Lower Medium |

MPV |

Supermini |

SUV |

Upper Medium |

|

01/02/2019 |

-15.0 |

0.5 |

-7.3 |

-20.7 |

-18.0 |

-6.8 |

-6.6 |

48 month results

Since measurement started our 48 month forecasts have averaged -11.6% less than black book across all vehicle ids, and the most recent results show February 2015 48/80 gold book forecasts being -10.9% less than February 2019 48/80 black book.

The most recent results for these main sectors are as follows:

|

BB Month |

City Car |

Executive |

Lower Medium |

MPV |

Supermini |

SUV |

Upper Medium |

|

01/02/2019 |

-5.0 |

-2.7 |

-14.1 |

-19.5 |

-11.3 |

-7.8 |

-7.7 |

60 month results

This month we have our second set of results for 60 month forecasts, and these average -8.7% less than February 2019 black book values, similar to our 48 month results.

We will provide further analysis and trending as we move through 2019.

5. Gold Book Methodology

Overview

All of our future residual values are based on the gold book methodology. Our values take current month black book values as a starting point (uplifted for model changes where necessary), are moved forward according to age/sector/fuel specific year on year deflation assumptions regarding future used car price movements, and are then subjected to additional adjustments by the Editorial Team. Finally, the values are moved forward by the next month’s seasonality adjustments which are differentiated by sector and fuel type and are based on analysis of historical black book movements.

All of these assumptions and adjustments are available for scrutiny to our customers through our gold book iQ product. For years our customers have been asking for transparency in automotive forecasting and we have delivered a ground-breaking product to provide exactly that.

With an increasing number of customers subscribing to gold book iQ, we are entering into a range of debates and discussions around both our overall forecasting methodology and individual elements of the forecasts for particular vehicles. This is expected to evolve over time into a ‘virtuous circle’, with the feedback looping back into the forecast process and delivering continuous improvement. We are embracing a new era of customer communication, with a greatly improved quality of interaction and debate around our forecast values.

Changes may be actioned wherever there is reason to do so outside of the sector reforecast process and we continue our monthly Interproduct analysis with our black book colleagues exactly as before. This has intensified following the availability of our short term forecast data (gold book 0-12, now available to customers), which incorporates detailed exception reporting at a cap hpi ID level and will also be used increasingly going forward to manage the relationships between black book and gold book.

Forecasting Model Development - gold book & iQ

gold book iQ was launched in December 2013 and gives unparalleled transparent insight into the assumptions used to produce our forecasts.

Our short-term forecast product, gold book 0-12, (also marketed as black book +12) was launched shortly afterwards. This is a live, researched product with a dedicated editor and fills a gap in our previous forecast coverage.

Following feedback on our gold book iQ product, from September 2016 we have added more detail into the commentary for each model range reforecast in sector reviews.

In December 2017 we introduced a daily feed of forecasts for new models launched onto the market, so that customers do not have to wait until the next month to receive these forecasts.

Forecast Output

Individual forecasts are provided in pounds and percentage of list price for periods of twelve to sixty months with mileage calculations up to 200,000.

Each forecast is shown in grid format with specific time and mileage bands highlighted for ease of use.

All forecast values include VAT and relate to a cap hpi clean condition and in a desirable colour.

All new car prices in gold book include VAT and delivery.

Parallel Imports

Particular care must be taken when valuing parallel imports. Vehicles are often described as full UK specification when the reality is somewhat different. These vehicles should be inspected to ensure that the vehicle specification is correct for the UK. Parallel imports that are full UK specification and first registered in the UK can be valued the same as a UK-sourced vehicle.

Grey Imports

cap hpi gold book does not include valuations for any grey import vehicles, (i.e. those not available on an official UK price list).

6. Reforecast Calendar 2019/2020:

Monthly Product

Sector 1

Sector 2

Sector 3

Sector 4

Apr-19

May-19

June-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

SUV

Upper Medium

MPV

Lower Medium

City Car

SUV

Upper Medium

MPV

Lower Medium

City Car

SUV

Upper Medium

Electric

Executive

Convertible

Sports

Supermini

Electric

Executive

Convertible

Sports

Supermini

Electric

Executive

Large Executive

Coupe Cabriolet

Supercar

Large Executive

Coupe Cabriolet

Supercar

Large Executive

Luxury Executive

Luxury Executive

Luxury Executive

UK Senior Editor Forecast Car Values

+44 (0) 113 222 2067

andrew.mee@cap-hpi.com