Looking for a Vehicle Valuation or HPI Check?

This is the editorial commentary to accompany the cap hpi guide to future residual values for used cars.

The content is as follows:

- gold book forecast accuracy

- Forecast changes this month

- Market overview

- gold book methodology

- Reforecast calendar 2017/2018

1. gold book Forecast Accuracy

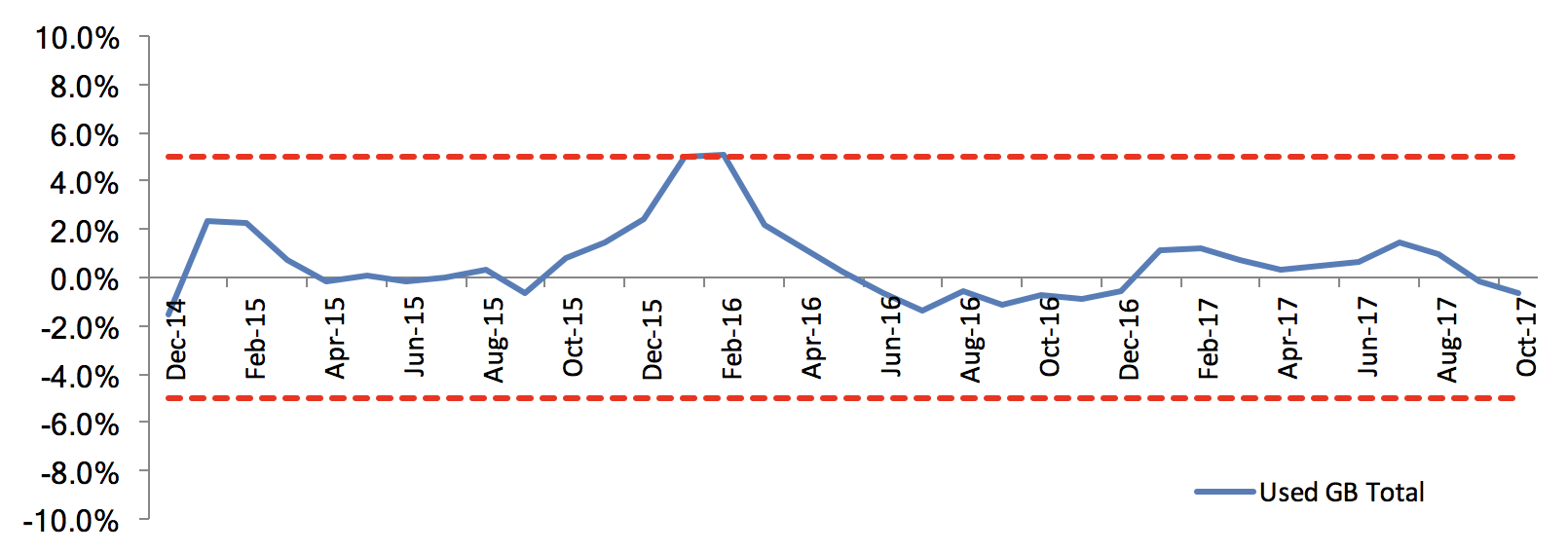

As gold book matures since its introduction in December 2013, we have the data to enable us to measure our results in terms of forecast accuracy. The accuracy target widely demanded by our customers is to be within 5% of actual values and we are pleased that, averaged across all models, gold book has been within this target since launch.

12 month results

Since measurement started our 12 month used forecasts have averaged +0.6% more than black book across all vehicle ids, and the most recent results show October 2016 12/20 gold book forecasts being -0.6% less than October 2017 12/20 black book.

The latest 12/20 used forecast differences for the major vehicle sectors are outlined below:

|

Row Labels |

Average of GB Diff (%) |

|

City Car |

-5.1% |

|

Executive |

-1.0% |

|

Lower Medium |

-1.0% |

|

MPV |

-2.1% |

|

Supermini |

0.0% |

|

SUV |

0.9% |

|

Upper Medium |

1.5% |

|

Grand Total |

-0.6% |

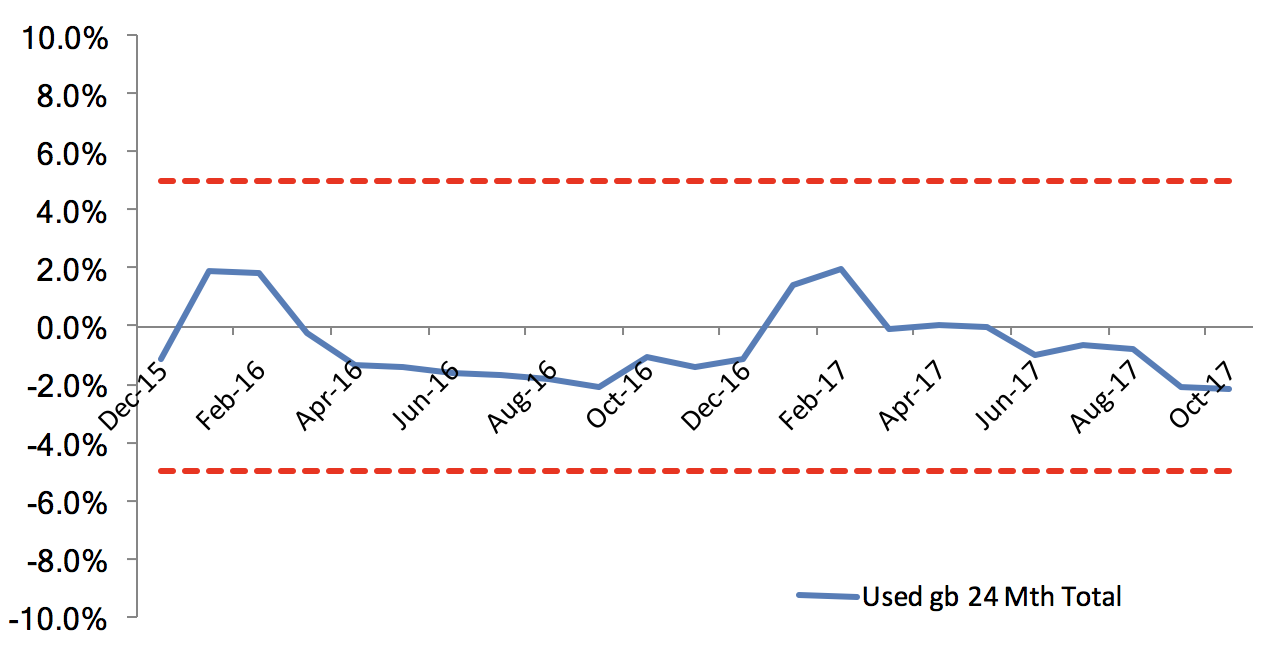

24 month results

Since measurement started our 24 month used forecasts have averaged -0.6% less than black book across all vehicle ids, and the most recent results show October 2015 24/40 gold book forecasts being -2.2% less than October 2017 24/40 black book.

The latest 24/40 used forecast differences for the major vehicle sectors are outlined below:

|

Row Labels |

Average of GB Diff (%) |

|

City Car |

0.3% |

|

Executive |

-2.4% |

|

Lower Medium |

-1.6% |

|

MPV |

-3.8% |

|

Supermini |

3.3% |

|

SUV |

-0.4% |

|

Upper Medium |

-3.2% |

|

Grand Total |

-2.2% |

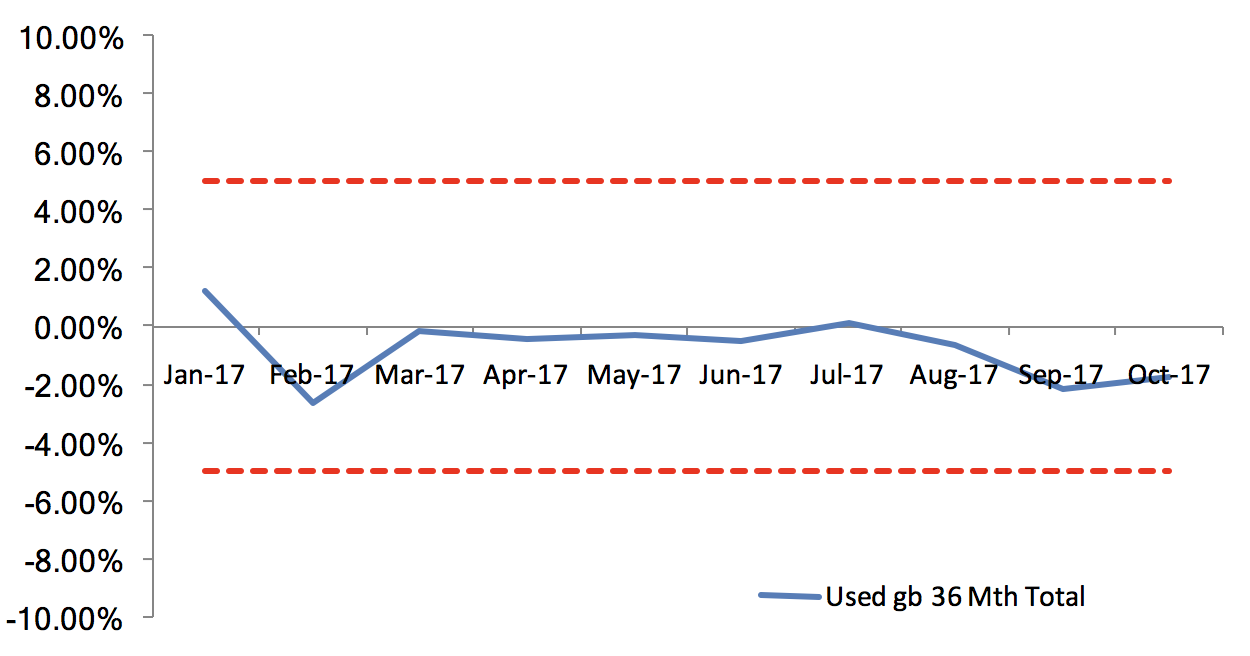

36 month results

Since measurement started our 36 month used forecasts have averaged -0.7% less than black book across all vehicle ids, and the most recent results show October 2014 36/60 gold book forecasts being -1.8% less than October 2017 36/60 black book.

Overall results

Although this remains the early stages, we continue to be extremely pleased with these initial results. We are taking advantage of our new methodology to implement a ‘virtuous feedback loop’, with each element of the forecast examined to determine how best to further improve the accuracy of our future value forecasts, while also reducing variation.

Our used market deflation (YOY%) assumptions, differentiated by age, vehicle sector and fuel type are still broadly in line with the current market at the vast majority of points.

We will continue to publish these results and share them with our customers.

2. Forecast changes this month:

This month, we publish our most recent reforecasts for the Lower Medium, Sports and Supercar sectors.

We have not changed our future market deflation assumptions for any of these sectors.

The last change to market deflation assumptions for the Lower Medium sector was in June 2017, when we implemented an assumption of approximately -6% p.a for diesel, and approximately -5% p.a. for petrol, due anticipated reduction in demand for used cars in this sector, especially diesel. During the last 12 months, black book deflation in the sector has consistently averaged around -5.3% p.a. for diesel, so we consider our slightly more pessimistic future deflation assumption to be still appropriate given the continuing high profile press coverage of diesel. Also during the last 12 months, black book deflation in the sector has averaged around -3.5% p.a. for petrol, but has shifted significantly from around -7.4% a year ago to close to zero in recent months. However we consider this a temporary market reaction to the diesel bad press, and expect that deflation will soon start returning to closer to our longer term assumption of -5%, as petrol values start to look expensive and as used petrol supply increases. We will continue to keep this under close review ahead of our next Lower Medium review.

In the Sports and Supercar petrol sectors there has also been a slight improvement in deflation over the last year, which we again expect to tail off in coming months. Therefore, we are continuing to apply our future deflation assumptions in the range of -3% to -4% p.a. in our forecasts.

The Sports diesel sector continues to be very small in term of model ranges and registrations, and we are continuing to apply a deflation assumption broadly in line with that for petrol.

3. Market Overview

Brexit negotiations are now underway but appear to be currently in deadlock, confirming our long held view that Brexit will be a complicated process that could take considerably longer than 2 year to complete. Full Brexit is now not expected to happen until 2021 at the end of the proposed transition period. The outcome will still not start to become clear for some time but future trade agreements which negatively impact the UK economy (and that of other major EU states) are still considered unlikely.

HM Treasury published new forecasts in August after the UK general election, which are a little more pessimistic than from the previous February forecasts, although these may have been influenced by Q1 data that was adversely impacted by the timing of Easter, and the number of working days compared to the previous year. The latest forecasts still do not forecast a recession and therefore remain in line with our own view, with a slight reduction in GDP in 2017 and 2018 but recovering thereafter. Not all ages and sectors of vehicle are directly impacted by GDP, and in some cases this will be offset by lower future registration volumes. Forecasts for inflation and unemployment show no obvious signs for concern.

We expect some mildly negative effects on the economy in the short to medium term, due to reduced business capital expenditure and investment, but expect consumer spending to continue to drive a stable economy. The protracted nature of the Brexit will allow time to assess the most likely outcome and future forecast published by HM Treasury, therefore at present we are planning to conform to our original timetable of sector reforecasts and do not consider it necessary to embark on wholesale reforecasts.

As leasing and PCP returns increase, values are broadly expected to decrease in line with previous seasonal aging patterns, with negative impact from a slowing economy mitigated by the effects of decreased supply of nearly new cars.

In 2017, despite an expected buoyant Q1 boosted by the VED changes, we expect new car registration volumes to fall. The movement in Exchange rates since the Brexit referendum is likely to make the UK less attractive for forced registrations in 2017, and registration volumes are increasing in a number of European countries, where the pent up demand for new cars may help divert some volume from the UK. Fairly high forced registration volumes continued in the early part of the year, with a pull from April into March due to VED changes, but registration volumes were -3.9% down on 2016 by the end of September, and we expect a further tailing off later in the year.

The trend in recent years for new car registrations has been a slow move away from diesel into petrol and alternative fuels, and for used diesel values to deflate slightly more than petrol values. However this varies by vehicle sector, and is most marked in small car sectors whereas in larger car sectors where diesel makes most sense, there has been little or no impact. We expect these trends to continue in future years, with some acceleration of diesel deflation (relative to petrol deflation) in the smaller car sectors. In recent months diesel values have held up well (in line with our future deflation assumptions), but petrol and hybrid values have been particularly strong as buyers seek an alternative to diesel where available. We consider this current strength is not sustainable beyond the short term and values will start to fall back as they start to look too expensive and use supply starts to increase.

Demand Outlook

The outlook for the UK economy is uncertain in the context of Brexit but the consensus of the latest independent forecasts for GDP is no cause for alarm. Making decisions on interest rate changes based on % unemployment is far less reliable than it has been in the past and we are continuing to investigate whether we can usefully integrate any additional labour market metrics into our regression modelling (currently % unemployment is one of 15 labour market metrics studied). The unemployment rate remains low at 4.3%, and wage growth remains relatively slow by historic standards, especially given current labour market conditions.

On 4th August 2016 the Bank of England base rate was cut from 0.5% to 0.25%, and interest rates are expected to remain low for the medium term. Although there is speculation of a small increase soon, any significant increase in base rates still seem unlikely until there is a combination of further improvements in wage growth and increases in rates of headline inflation.

CPI continues to creep up due to the sterling exchange rate and is now at +3.0%, the highest since March 2012, and exceeding the Bank of England’s lower limit of +2%. RPI is at 3.9%.

Oil prices remain very hard to predict. During October 2016, the OPEC countries agreed to an initial cut production, which was then extended for a further 9 months and helped to ensure market stability. Now that supply is returning to levels commensurate with demand, oil prices are likely to rise steadily over the forecast period, but fuel prices will remain well below historic levels unless there are significant currency movements against the US Dollar.

Wage growth remains reasonably healthy, although slow by historical standards; and price inflation is now increasing; so these conditions should continue to provide a positive impetus to the overall economy.

GDP growth for the UK was stronger than expected in Q416 (+0.6%) giving annualised growth of +2% over 2016 (compared to +2.2% over 2015). GDP fell back to 0.3% in Q1 2017 and remained at this level for Q2 2017. The most recent August publication of independent forecasts by HM Treasury (predicting a small drop in GDP in 2017 and 2018 followed by recovery) make even a marginal recession seem unlikely. In addition, the initial results for Q3 2017 of +0.4% exceeded expectations, driven by strong performance in services and manufacturing and some are now predicting as high as +2.0% for 2018.

Consumer and Business Confidence had continued to increase slowly as we had expected, although post the Brexit referendum we now expect to see a decline in overall business investment, reversing the medium term trend, particularly in the large corporate sector. Much of the previous export growth was driven by the service sector, but this has slowed in recent months and there have also been increases in manufacturing and domestic car output. Much of this activity reflected the shift in export focus from the Eurozone to emerging economies and this is likely to continue, despite fluctuating Eurozone demand (see below), although exports still remain below the long term average. The UK will remain within the European Economic Area for the foreseeable future and despite previous statements from the EU and the UK government, it is difficult to envisage a realistic scenario whereby motor vehicles would not be part of a tariff free arrangement in the future.

Forecasts for future house price increases vary dramatically by sector and especially by geography. Despite a view expressed by the Bank of England’s Financial Stability Committee that the buy to let sector could “amplify” any boom or bust in the housing market, any negative effects are likely to be centred on London, with the rest of the country significantly more insulated from the impact of any such downturn.

Supply Outlook

New car registrations for 2016 came in at 2.69 million, with short cycle volumes and forced registrations a significant factor for several manufacturers in the final weeks of the year. We originally expected the 2016 total to be slightly lower than 2015, with growth faltering from the second quarter onwards. However, forced registrations continued so that the year ended ahead of 2015.

Exchange rates are a major influence on the profitability of the UK new car market and they strongly influence eventual used vehicle volumes. Sterling rates against the Euro reduced as expected from around 1.43 in November 2015, to averaging 1.26 in April 2016 – equivalent to a -12% decrease in Euro revenue for the same vehicle sale - then fell further and have averaged around 1.12 in recent months. An increase in rates before the EU referendum exaggerated the falls following the vote, but rates remain slightly below our expectation. We had expected further modest short term reductions before a more gradual decrease in the Sterling rate against the Euro over the next 3 years, as growth continues to pick up in mainland Europe.

The shift in exchange rates will make the UK less profitable for manufacturers and the SMMT originally forecast reduced registrations for 2017 at around 2.55M. We believe the figure could be lower depending on the impact on forced registrations, despite an expected buoyant Q1 2017 that was 6.2% up on Q1 2016 due to the effect of VED changes due in April. By the end of September, registrations were down -3.9% compared to 2016 and we expect this trend to continue. If any manufacturers continue to pursue market share at the expense of profitability, then the impact on used values will continue to worsen, and we will continue to apply a number of specific model adjustments in gold book which have been outlined in gold book iQ.

The UK economic situation looks likely to continue to offset any remaining weakness in the Eurozone and Sterling is set to remain at a level that should limit manufacturers’ scope for heavy discounting at the end of 2017.

New car registrations in other key European market continue to grow as a result of the release of pent up demand. In the three years before the financial crisis, France, Germany, Italy and Spain represented an annual combined volume of almost 9.4 million units, and have recovered to 7.7 million in 2015 and then 8.3M in 2016, suggesting there is further growth to come. Spanish growth may well slow in 2017 following the removal of scrappage incentives, but the other key markets appear to be growing steadily and vehicle lead times are expected to increase.

4. Gold Book Methodology:

Overview

All of our future residual values are based on the gold book methodology. Our values take current month black book values as a starting point (uplifted for model changes where necessary), are moved forward according to age/sector/fuel specific year on year deflation assumptions regarding future used car price movements, and are then subjected to additional adjustments by the Editorial Team. Finally the values are moved forward by the next month’s seasonality adjustments which are differentiated by sector and fuel type and are based on analysis of historical black book movements.

All of these assumptions and adjustments are available for scrutiny to our customers through our gold book iQ product. For years our customers have been asking for transparency in automotive forecasting and we have delivered a ground-breaking product to provide exactly that.

With an increasing number of customers subscribing to gold book iQ, we are entering into a range of debates and discussions around both our overall forecasting methodology and individual elements of the forecasts for particular vehicles. This is expected to evolve over time into a ‘virtuous circle’, with the feedback looping back into the forecast process and delivering continuous improvement. We are embracing a new era of customer communication, with a greatly improved quality of interaction and debate around our forecast values.

A cycle of changes to our seasonality assumptions was completed in summer 2016 and these assumptions will be reviewed again within approximately 12 months’ time.

Changes may be actioned wherever there is reason to do so outside of the sector reforecast process and we continue our monthly Interproduct analysis with our black book colleagues exactly as before. This has intensified following the availability of our short term forecast data (gold book 0-12, now available to customers), which incorporates detailed exception reporting at a cap hpi ID level and will also be used increasingly going forward to manage the relationships between black book and gold book.

Our used gold book methodology was designed to feature 5 mileage bandings (rather than the 3 bandings which have traditionally been published) and the mileages tabulated in our database are now much more relevant to the age of the individual vehicle and are differentiated by sector and fuel type. Our used forecasts are also now available out for 5 years into the future for all vehicles currently up to 5 years old today. Our Windows, ASCII and SQL products remain technically the same, with the only changes being the methodology behind the forecast data and the selected mileages which are tabulated.

Forecasting Model Development – gold book & iQ

gold book iQ was launched in December 2013 and gives unparalleled transparent insight into the assumptions used to produce our forecasts. The feedback from customers to date has been extremely positive and we believe gold book iQ will represent a new benchmark in truly market leading forecasting. More details are available here: http://business.cap.co.uk/products-and-services/gold-book-iQ

Our short term forecast product, gold book 0-12, (also marketed as black book +12) has now been launched and is available to customers. This is a live, researched product with a dedicated Editor (Rob Hester) and fills a gap in our previous forecast coverage. See link to a previous podcast: http://www.cap.co.uk/en/cap-extras/its-the-saturday-morning-meeting-on-motor-trade-radio/

Following feedback on our gold book iQ product, from September 2016 we have added more detail into the commentary for each model range reforecast in sector reviews. We will continue to review and enhance commentary in future months as we carry out each sector review.

Forecast Output

Individual forecasts are provided in pounds and percentage of list price for periods of twelve to sixty months with mileage calculations up to 200,000.

Each forecast is shown in grid format with specific time and mileage bands highlighted for ease of use.

All forecast values include VAT and relate to a cap hpi clean condition and in a desirable colour.

Parallel Imports

Particular care must be taken when valuing parallel imports. Vehicles are often described as full UK specification when the reality is somewhat different. These vehicles should be inspected to ensure that the vehicle specification is correct for the UK. Parallel imports that are full UK specification and first registered in the UK can be valued the same as a UK-sourced vehicle.

Grey Imports

cap hpi gold book does not include valuations for any grey import vehicles, (i.e. those not available on an official UK price list).

New Prices

All new car prices in gold book include VAT and delivery.

5. Reforecast Calendar 2017/2018:

Monthly Product

Sector 1

Sector 2

Sector 3

Sector 4

Dec-17

Jan-18

Feb-18

Mar-18

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep 18

Oct-18

Nov-18

City Car

SUV

Upper Medium

MPV

Lower Medium

City Car

SUV

Upper Medium

MPV

Lower Medium

City Car

SUV

Supermini

Electric

Executive

Convertible

Sports

Supermini

Electric

Executive

Convertible

Sports

SuperMini

Electric

Large Executive

Coupe Cabriolet

Supercar

Large Executive

Coupe Cabriolet

Supercar

Luxury Executive

Luxury Executive

UK Senior Editor Forecast Car Values

+44 (0) 113 222 2067

andrew.mee@cap-hpi.com