Looking for a Vehicle Valuation or HPI Check?

The New Year got off to a tremendous start in the used LCV Wholesale Market judging from the auctions we attended. Despite the continuing bad weather and treacherous travelling conditions on some auction days, the halls were bustling with all types of buyers and there was a definite sense of eagerness-to-buy in the air. Hall bidding was fast and furious at times and more than matched by on-line buyers who were clearly having no difficulty mouse-clicking from their milder ambient surroundings. More often than not opening bids were flashing up on the displays before vehicles had come to rest in front of the rostrum and long before potential hall buyers had caught the eye of the auctioneers. It’s not always possible to judge how busy the internet is from the floor of the hall, however we are reliably informed that auctioneers can often see fifty or more potential buyers logged on to a sale at any given time and that typically on-line buyers account for around 40% of sales. The apparent ever-increasing popularity of on-line buying appears to be having a knock-on effect on the dynamics inside the auction halls too in that some hall buyers seem to be holding back and waiting to see how much interest there is on the internet before bidding on vehicles.

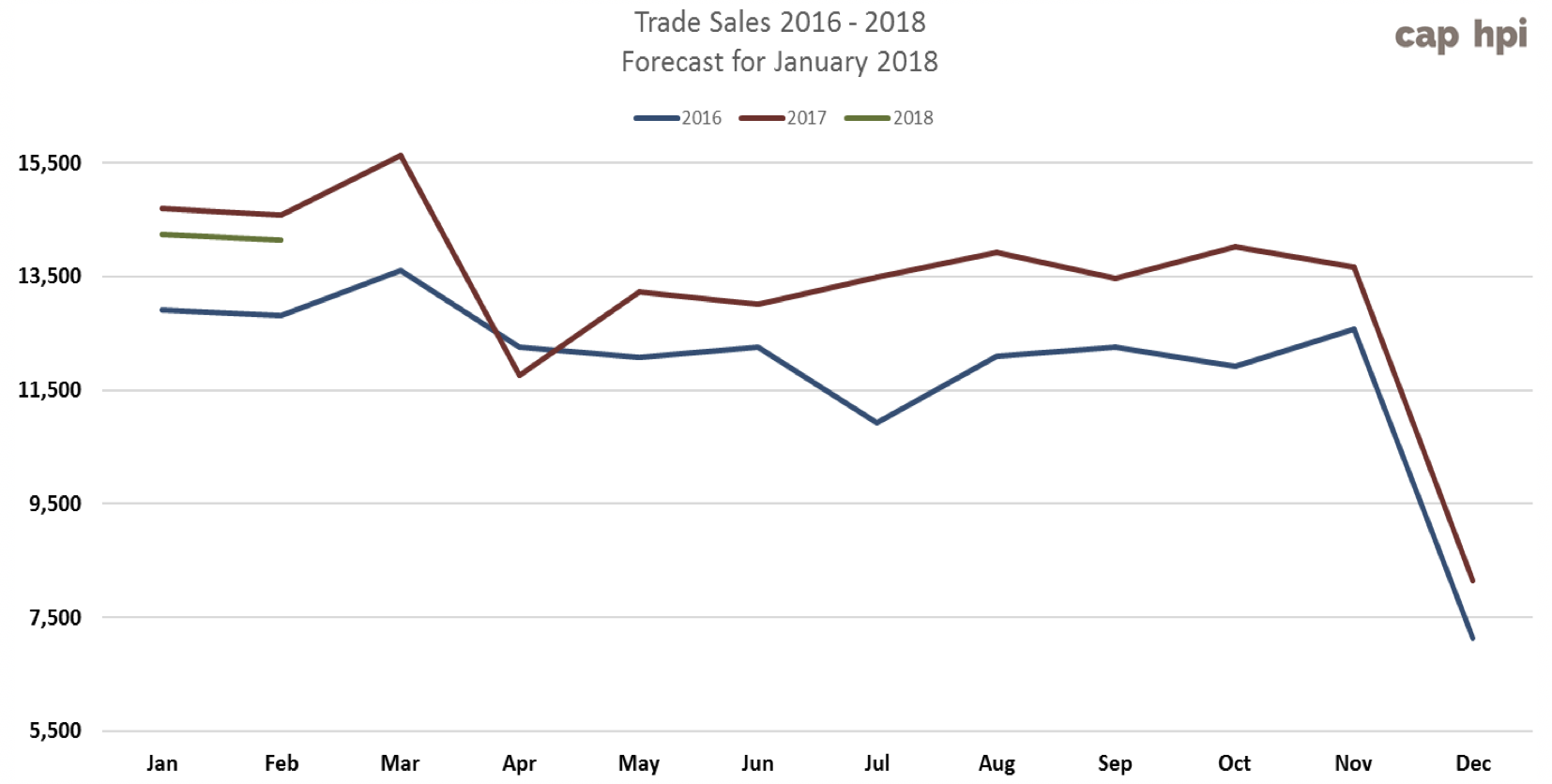

Our Trade Sales Forecast for January shows the sales volume to be slightly lower than the same period in 2017 but considerably higher than 2016. It’s early days of course but with no Brexit Referendum or General Election looming, as far as we know, we ought to see a steady increase in sales volume up until around the Easter holidays provided supply can be maintained.

At the sales we attended, apart from a very obvious shortage of Mercedes Sprinter panel vans, supply was plentiful and there was a considerable choice of vehicles on sale for trade and private buyers alike. Analysis of the auction sale catalogues revealed that January auction entries were up by 2% when compared to December. It’s worth noting that, even though December was a short month in terms of the number of auctions held, entries were only down by 1% compared to November so the impact of the Christmas Holidays was negligible. Normally it would be reasonable to assume that auction entries for January would include an increased number of vehicles that didn’t sell in December.

Monthly auction catalogue entries

Feb-17

Mar-17

Apr-17

May-17

Jun-17

Jul-17

Aug-17

Sep-17

Oct-17

Nov-17

Dec-17

Jan-18

Auction Entries % Var

0%

9%

-28%

7%

-2%

4.50%

-2%

-25%

19%

5%

-1%

2%

Average age (Months)

59

60

62

59

59

57

61

59

60

61

58

59

Average Mileage

74127

73214

74310

72879

72264

74050

73821

72201

73283

76,195

72451

72,318

Based on our daily analysis of auction catalogues we estimate that the average number of re-entries were running at just below 32% throughout 2017 whilst for January this increased to almost 36.7%. From this we can deduce re-entries increased by 4.7% so in fact, fresh stock entering the market in January was actually lower than December and the 2017 average. The average age of vehicles increased from 58 months to 59 Months whilst recorded mileage remained much the same increasing by just under 200 miles from 72,129 to 72,318.

We don’t see any reason for alarm regarding supply and we fully expect stock levels to remain relatively high in the medium term. Our rationale behind this is that last year’s anticipated increase in supply, which was based on the record number of 3 year old vehicles in the LCV parc, didn’t actually materialise in the numbers we expected. Whether or not the bulk of these were initially on longer contracts or having contracts extended remains to be seen but what cannot be denied is that they will have to come back at some point.

|

|

November 2017 |

December 2017 |

January 2018 |

|||

|

LCV Sector |

Market Share |

Performance |

Market Share |

Performance |

Market Share |

Performance |

|

City Van |

4.11% |

98.27% |

3.99% |

98.19% |

4.43% |

97.30% |

|

Small Van |

27.14% |

98.46% |

29.28% |

97.22% |

26.31% |

97.35% |

|

Medium Van |

27.33% |

100.23% |

28.54% |

98.46% |

28.58% |

98.80% |

|

Large Van |

19.52% |

99.69% |

16.73% |

98.87% |

17.95% |

98.64% |

|

Over 3.5T |

0.24% |

101.17% |

0.14% |

99.12% |

0.23% |

95.20% |

|

4x4 Pick-up Workhorse |

2.14% |

99.63% |

1.99% |

98.10% |

1.75% |

98.47% |

|

4x4 Pick-up Lifestyle SUV |

11.38% |

98.32% |

10.96% |

98.82% |

11.74% |

98.94% |

|

Forward Control Vehicle |

0.11% |

98.01% |

0.24% |

95.51% |

0.18% |

103.21% |

|

Chassis - Derived |

5.66% |

99.90% |

5.58% |

97.47% |

5.98% |

96.32% |

|

Mini-bus |

0.78% |

97.32% |

0.91% |

99.47% |

0.98% |

95.04% |

|

Vat Qualifying |

1.42% |

98.39% |

1.56% |

95.26% |

1.68% |

95.66% |

|

Total Market |

100.00% |

99.26% |

100.00% |

98.08% |

100.00% |

98.09% |

In January the average price performance of all used LCVs against Red Book was down by around 1.9% at 98.09% whilst the cumulative effect of all price adjustments made for January (based on a 3 year 60K plate ) is -2.2%. As always some sectors fared better than others and the following chart aims to show how those price adjustments have affected the various LCV sectors.

February LCV Used Guide Price Movements 3 Year/60k

LCV Sector

Average % Movement

Average £ Movement

City Van

-0.56%

-£19

Small Van

-3.63%

-£157

Medium Van

-0.57%

-£57

Large Van

-1.28%

-£114

Over 3.5T

-1.42%

-£149

4x4 Pick-up Workhorse

0.30%

£37

4x4 Pick-up Lifestyle SUV

-0.63%

-£69

Forward Control Vehicle

-2.03%

-£212

Chassis - Derived

-4.68%

-£433

Mini-bus

-2.95%

-£291

Vat Qualifying

-3.20%

-£338

Whilst auction catalogue entries always specify colour, it’s the guide values of White vans that you will see printed in the auction catalogues.

White remains the colour choice for most new LCV buyers, however, increasingly we are seeing more and more vans in other colours entering the used wholesale market. The chart below is intended as a guide to illustrate how more or less in percentage terms you would expect to pay for a vehicle in any of the colours listed. For example, if you were bidding on a Silver van in the City Van sector you can expect to pay on average 2.05% more than you’d pay for the same van in White. The values shown in this table are based on actual trade sales of vehicles at open auctions and that at any given time the market values of vehicles are dependent on many other factors such as supply volume and condition.

|

Colours |

City Van |

Small Van |

Medium Van |

Large Van |

4x4 Workhorse |

4x4 Lifestyle |

Mini-bus |

VAT Qualifying |

|

White |

CAP Avg |

CAP Avg |

CAP Avg |

CAP Avg |

CAP Avg |

CAP Avg |

CAP Avg |

CAP Avg |

|

Silver |

2.05% |

3.29% |

2.63% |

4.59% |

0.75% |

0.87% |

-0.95% |

1.68% |

|

Blue |

-0.63% |

-0.26% |

2.22% |

0.05% |

0.97% |

0.57% |

-1.53% |

1.36% |

|

Black |

3.67% |

4.34% |

3.79% |

3.56% |

1.70% |

0.62% |

3.63% |

|

|

Grey |

4.20% |

5.03% |

4.02% |

3.39% |

1.95% |

0.93% |

4.03% |

|

|

Red |

0.31% |

-0.80% |

1.22% |

-1.56% |

0.39% |

-0.18% |

1.48% |

|

|

Yellow |

-3.43% |

-3.96% |

-6.61% |

-7.83% |

||||

|

Green |

-0.25% |

-2.49% |

-3.30% |

-2.48% |

1.11% |

-0.04% |

4.39% |

|

|

Orange |

-2.11% |

6.88% |

1.13% |

1.06% |

||||

|

Brown |

1.14% |

5.17% |

1.51% |

-1.56% |

Top 10 models driving the used LCV Market

The Top 10 tables below gives you a clear picture of the makes and models in the main LCV sectors that are driving the prices in the used LCV Market. Arranged in order of their respective share of total sector sales, the percentage CAP performance is based on actual recorded sales at open auctions.

Since our guide values reflect the market prices of basic vans in plain white as they appear in the vehicle manufacturer’s price lists, some of guide price movements you might see in this edition may not correlate directly with the sales performances shown in the tables since these include vehicles in all colours and specifications.

|

CAP Id |

City Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||

|

24217 |

NEMO DIESEL - 1.3 HDi Enterprise [non Start/Stop] |

6.38% |

96.1% |

99.6% |

||||||||||||||

|

24216 |

NEMO DIESEL - 1.3 HDi LX [non Start/Stop] |

5.70% |

90.3% |

107.2% |

||||||||||||||

|

20784 |

FIESTA DIESEL - 1.4 TDCi 70 Van |

5.03% |

87.5% |

97.0% |

||||||||||||||

|

21886 |

CORSAVAN DIESEL - 1.3 CDTi 16V 95ps ecoFLEX Van [Start/Stop] |

4.70% |

79.7% |

87.7% |

||||||||||||||

|

24233 |

BIPPER DIESEL - 1.3 HDi 75 Professional [non Start/Stop] |

4.70% |

101.3% |

94.1% |

||||||||||||||

|

26326 |

FIESTA DIESEL - 1.6 TDCi ECOnetic Van |

4.36% |

96.1% |

96.2% |

||||||||||||||

|

21678 |

ASTRAVAN DIESEL - Club 1.7 CDTi ecoFLEX Van |

3.69% |

97.2% |

97.7% |

||||||||||||||

|

30873 |

TRANSIT COURIER DIESEL - 1.6 TDCi Trend Van |

3.69% |

98.4% |

94.9% |

||||||||||||||

|

26324 |

FIESTA DIESEL - 1.5 TDCi Van |

3.69% |

101.5% |

99.5% |

||||||||||||||

|

15854 |

FIESTA DIESEL - 1.4 TDCi Van |

3.36% |

84.4% |

94.1% |

||||||||||||||

|

A market price movement of -1% has been applied to most models in this sector with the exceptions listed below. The guide values of Ford Courier have changed significantly in this edition. The guide values for this model have remained the same since around August 2017 which is when they started to appear in small numbers at auctions. The average sale price performance fluctuated between 97% and 100% for several months but sales volumes remained low. Last month’s sales volumes increased considerably whilst average sales performance dropped to 94.7%. Consequently we have applied a tempered price movement of -3% in this edition.

|

||||||||||||||||||

|

CAP Id |

Small Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||||||||||||||

|

18445 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg Enterprise 75ps |

13.32% |

99.3% |

98.9% |

||||||||||||||||||||||||||

|

20709 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Van |

4.80% |

98.8% |

106.4% |

||||||||||||||||||||||||||

|

18572 |

DOBLO CARGO SWB DIESEL - 1.3 Multijet 16V Van |

4.61% |

93.7% |

93.3% |

||||||||||||||||||||||||||

|

15182 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg LX 75ps |

3.91% |

101.0% |

97.0% |

||||||||||||||||||||||||||

|

18446 |

BERLINGO L1 DIESEL - 1.6 HDi 850Kg Enterprise 90ps |

3.52% |

97.8% |

95.3% |

||||||||||||||||||||||||||

|

26515 |

CITAN LONG DIESEL - 109CDI Van |

2.18% |

89.3% |

88.1% |

||||||||||||||||||||||||||

|

24234 |

COMBO L1 DIESEL - 2000 1.3 CDTI 16V H1 Van |

2.05% |

92.7% |

95.5% |

||||||||||||||||||||||||||

|

18202 |

PARTNER L1 DIESEL - 625 1.6 HDi 75 Professional Van |

1.86% |

99.1% |

97.2% |

||||||||||||||||||||||||||

|

28263 |

CADDY C20 DIESEL - 1.6 TDI 75PS Startline Van |

1.86% |

91.9% |

92.3% |

||||||||||||||||||||||||||

|

26630 |

KANGOO DIESEL - ML19dCi 75 eco2 Van |

1.79% |

94.4% |

95.0% |

||||||||||||||||||||||||||

|

Very little change in the Sector Market Share last month and the headline performance figures however, average prices performance remains at just over 2.5% below the guide. Whilst only a -1% downward market price movement has been applied to this sector there have been numerous price changes at range level which are listed below. In particular the price differentials between the various models in the Berlingo and Partner (2008-2013) model ranges have been reviewed and reset in order to more accurately reflect current market sentiment. The guide values of individual models of new shape Connect have been revised again in order to reflect actual price performance we are seeing in the market.

|

||||||||||||||||||||||||||||||

CAP Id

Medium Van

Sector Share

%CAP

%CAP White Only Condition Adjusted

24636

TRANSPORTER T28 SWB DIESEL - 2.0 TDI BlueMotion Tech 84PS Van

3.60%

113.2%

112.3%

24314

VIVARO SWB DIESEL - 2.0CDTI [115PS] ecoFLEX Van 2.9t Euro 5

3.54%

87.4%

90.4%

18442

DISPATCH L1 DIESEL - 1000 1.6 HDi 90 H1 Van Enterprise

3.03%

95.8%

96.8%

25441

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van

2.97%

97.9%

97.0%

25446

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van

2.86%

96.6%

96.7%

26570

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van ECOnetic

2.40%

97.5%

97.5%

22582

DISPATCH L2 DIESEL - 1200 2.0 HDi 125 H1 Van Enterprise

2.34%

91.5%

88.9%

20560

VITO LONG DIESEL - 113CDI Van

2.28%

71.7%

92.5%

25437

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van

2.00%

95.9%

94.7%

24325

VIVARO LWB DIESEL - 2.0CDTI [115PS] Van 2.9t Euro 5

2.00%

99.2%

98.1%

The Medium Van sector is the largest in terms of the sheer number of models available and the amount of research data we collect each month. As such it also serves as barometer for how the used LCV market is performing as a whole. Whilst last month’s sale performance was up by around 0.13%, on average prices were running at around 1.2% below the guide. A downward market price movement of -1% has been applied to this sector however there have been numerous price adjustments at model range level which are listed below.

CITROEN DISPATCH E6 (16- ) VAN (-3%)

PEUGEOT EXPERT (07-16) VAN (-3%)

FIAT TALENTO (16- ) VAN (-2%)

RENAULT TRAFIC (14-16) dCi VAN (-2%)

FORD TRANSIT CUSTOM VAN E6 (16- ) (0%)

TOYOTA PROACE (12-16) (0%)

FORD TRANSIT CUSTOM VAN E6 (17- ) (0%)

VAUXHALL VIVARO (14-16) VAN (-2%)

M-B VITO E6 (15- ) CDi VAN (-5%)

CITROEN DISPATCH (96-07) VAN (-3%)

NISSAN NV300 (16- ) VAN (-2%)

NISSAN PRIMASTAR (02-06) dCi VAN (-2%)

NISSAN PRIMASTAR (06-15) dCI VAN (-2%)

NISSAN PRIMASTAR (03-04) PET VAN (-2%)

PEUGEOT EXPERT E6 (16- ) VAN (-3%)

RENAULT TRAFIC (06-14) dCi VAN (-2%)

RENAULT TRAFIC E6 (16- ) dCi VAN (-2%)

RENAULT TRAFIC (08-09) dCi FRIDGE (-2%)

TOYOTA PROACE E6 (16- ) (0%)

VAUXHALL VIVARO (11-14) VAN (-2%)

VAUXHALL VIVARO E6 (16- ) VAN (-2%)

VW T5 TRANSPORTER (10-15) VAN (0%)

CITROEN DISPATCH (07-16) VAN (-3%)

RENAULT TRAFIC (01-06) dCi VAN (-2%)

FIAT SCUDO (07-17) VAN (0%)

RENAULT TRAFIC (01-07) PET VAN (-2%)

FORD TRANSIT CUSTOM VAN (12-17) (-2%)

VAUXHALL VIVARO (06-11) VAN (-2%)

CAP Id

Large Van

Sector Share

%CAP

%CAP White Only Condition Adjusted

26863

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van

4.58%

83.5%

93.8%

9104

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 85ps

3.83%

93.7%

98.8%

22129

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 100ps

2.75%

103.7%

102.6%

30637

TRANSIT 350 L3 DIESEL RWD - 2.2 TDCi 125ps H3 Van

2.66%

98.4%

98.5%

21705

CRAFTER CR35 LWB DIESEL - 2.0 TDI 136PS High Roof Van

2.08%

99.0%

96.6%

22246

TRANSIT 350 LWB DIESEL RWD - High Roof Van TDCi 125ps

1.91%

81.7%

92.5%

31707

BOXER 335 L3 DIESEL - 2.2 HDi H2 Professional Van 130ps

1.66%

103.2%

103.4%

31217

RELAY 35 L3 DIESEL - 2.2 HDi H2 Van 130ps Enterprise

1.66%

95.0%

98.7%

22130

TRANSIT 280 SWB DIESEL FWD - Low Roof Van ECOnetic TDCi 100ps

1.66%

99.6%

100.0%

31886

MOVANO 35 L3 DIESEL FWD - 2.3 CDTI H2 Van 110ps

1.58%

88.0%

89.5%

At 98.64% the average price performance of large vans was running at just under 1.5% below the guide values last month. After taking into account colour, condition we have applied downward market movement of -1% to most models in this sector apart from the exceptions listed below. A severe shortage of Sprinter at auctions appears to have had a positive effect on the market prices of some of its competitors, notably VW Crafter, Renault Master and Ford Transit.

Further adjustments have also been carried out on the mileage depreciation rates of Sprinter models in this edition.

CITROEN RELAY E6 (16- ) VAN (0%)

VAUXHALL MOVANO (10-17) VAN (-2%)

VAUXHALL MOVANO E6 (16- ) VAN (-2%)

VW CRAFTER E6 (16-17) VAN (0%)

VW CRAFTER (17- ) VAN (0%)

FORD TRANSIT (06-14) T250 - T300 VAN (0%)

CITROEN RELAY (14-16) VAN (0%)

M-B SPRINTER (06-13) 2-SERIES VAN (1%)

M-B SPRINTER (13- ) 2-SERIES VAN (-2%)

M-B SPRINTER (06-13) 3-SERIES VAN (1%)

M-B SPRINTER (13- ) 3-SERIES VAN (-2%)

M-B SPRINTER CNG (09-13) SERIES-3 VAN (1%)

PEUGEOT BOXER (14-16) VAN (1%)

VAUXHALL MOVANO (03-10) VAN (-2%)

RENAULT MASTER (10-17) dCi VAN (0%)

VW CRAFTER (06-17) VAN (0%)

RENAULT MASTER (14-16) dCi WINDOW VAN (0%)

VAUXHALL MOVANO (99-04) VAN (-2%)

RENAULT TRUCKS MASTER (14-16) VAN (0%)

CAP Id

4x4 Pick-up Workhorse

Sector Share

%CAP

%CAP All Colours Condition Adjusted

21665

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 144

7.84%

95.6%

95.6%

26500

NAVARA DIESEL - Double Cab Pick Up Visia 2.5dCi 144 4WD

6.86%

100.4%

100.4%

16756

HILUX DIESEL - HL2 2010 D/Cab Pick Up 2.5 D-4D 4WD 144

6.86%

107.6%

109.2%

18668

L200 LWB LB DIESEL - Double Cab DI-D 4Work 4WD 134Bhp [2010]

5.88%

97.4%

101.6%

16571

RANGER DIESEL - Pick Up Double Cab XL 2.5 TDCi 4WD

3.92%

90.1%

95.6%

22413

RANGER DIESEL - Pick Up Double Cab XL 2.2 TDCi 150 4WD

3.92%

96.4%

103.0%

38351

HILUX DIESEL - Active D/Cab Pick Up 2.4 D-4D

3.92%

98.6%

98.6%

18666

L200 LWB DIESEL - Club Cab DI-D 4Work 4WD 134Bhp [2010]

3.92%

96.0%

96.0%

11064

DEFENDER 90 SWB DIESEL - Hard Top TDCi

3.92%

142.6%

21676

DISCOVERY DIESEL - Commercial Sd V6 [255] Auto

2.94%

95.5%

95.5%

As always, overall sales volumes remain low in this sector with very little change in both sales volumes and price performance month on month. Whilst price performance was up slightly on average it remained just over 1.5% below the guide. Consequently a downward market price movement of -1% has been applied to most models with only two exceptions which are listed below.

Ford Ranger (15- ) Workhorse values have been realigned in this edition which has resulted in a downward price movement of -6%.

Land Rover Defender model have had a general price increase of +2.5% in this edition in order to reflect the extraordinary prices they are currently making which often don’t bear any relation to age, mileage and condition.

FORD RANGER (15- ) CHASSIS PICK-UP WORK (-6%)

LAND ROVER (11-16) DEFENDER 90 110 130 TDCi (2.5%)

HGV MARKETPLACE

CAP Id

4x4 Pick-up Lifestyle SUV

Sector Share

%CAP

%CAP All Colours Condition Adjusted

18622

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD 176Bhp

4.61%

100.7%

97.8%

19135

NAVARA DIESEL - Double Cab Pick Up Tekna 2.5dCi 190 4WD

4.45%

100.8%

100.8%

25079

AMAROK A32 DIESEL - D/Cab Pick Up Highline 2.0 BiTDI 180 BMT 4MTN Auto

4.29%

99.8%

100.6%

18623

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD Auto 176Bhp

3.34%

96.3%

97.2%

22419

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 4WD Auto

3.18%

96.7%

96.7%

21668

HILUX DIESEL - Invincible D/Cab Pick Up 3.0 D-4D 4WD 171

3.18%

97.8%

95.2%

35284

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD

3.02%

98.9%

98.9%

22415

RANGER DIESEL - Pick Up Double Cab Limited 2.2 TDCi 150 4WD

3.02%

100.7%

95.6%

35285

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD Auto

2.86%

98.3%

98.3%

21669

HILUX DIESEL - Invincible D/Cab Pick Up 3.0 D-4D 4WD 171 Auto

2.70%

107.2%

102.8%

Overall the Lifestyle SUV sector performed well last month with average price performance running just over 1% under the guide price. Whilst a -1% downward market movement has been applied to most models in this sector there are number of exceptions which are listed below. The most notable are Fiat Fullback, where all models have gone down by 5% and 2001-2007 L200 which have gone down by -3%. Toyota Hi-Lux (2010-2016) Invincible models have gone down by -3% to reflect current market prices.

The new Mercedes X Class appears in Red Book for the first time this month. As we don’t expect to see any in the used LCV market for some time, the guide values are based on historical trends of other makes and models newly introduced into this sector. These values may change in subsequent editions according to how the sector performs as a whole even if none appear in the used market. We are aware of the high level of interest in this new model and as used examples start to appear we expect sold prices to remain high initially and may even increase until used volumes increase and the trade market priced is determined.

FIAT FULLBACK (16- ) LIFE (-5%)

VW AMAROK (11-17) LIFE (0%)

MERCEDES-BENZ X CLASS DIESEL (2017- ) * New

MITSUBISHI L200 (01-07) TD/TD 113 LIFE (-3%)

NISSAN NAVARA E6 (16- ) LIFE (0%)

NISSAN NAVARA (10-16) LIFE (0%)

TOYOTA HILUX E6 (16- ) LIFE (0%)

TOYOTA HILUX (01-10) PICK-UP LIFE (0%)

FORD RANGER (11-16) PICK-UP LIFE (-2%)

NISSAN NAVARA (03-05) LIFE (0%)

NISSAN NP300 NAVARA (16-16) LIFE (0%)

NISSAN NAVARA (05-07) LIFE (0%)

TOYOTA HILUX (10-16) D-4D LIFE (0%)

NISSAN NAVARA (06-10) LIFE (1%)

Auctions have started the year pretty well. The first sale of the New Year occurred at Protruck, not only did it produce a good attendance but plenty of sales too. The first of a number of vehicles from the failed wholesaler and distributer Palmer and Harvey appeared at this sale and all sold but with plenty more in the pipeline it will be interesting to see if values will be adversely affected over the coming month or so.

Subsequent auctions have been reasonably busy with plenty of fresh stock available. Some exporters have also made occasional appearances at auctions and the stock they are looking to buy at present is generally the same stock as the domestic buyers are looking to procure leading to some competitive bidding.

Manufacturers continue to record healthy sales, not necessarily volume wise but in terms of value. Falling stocks of two or three year old rigid vehicles remain a problem and many vehicles are still staying out beyond their return dates, but this appears to be something that is being addressed to ensure maximum return from those that do return.

Independent retailers also continue to see good sales results but they too are having difficulty sourcing vehicles suitable for immediate retail and therefore offer additional services such as vehicle conversions to increase revenue. Traders report that whilst incoming enquiries are currently less numerous, they are often for vehicles they don’t have in stock and some are active in seeking suitable vehicles to match enquiries. General sentiment currently is quite upbeat but some are happy to just keep ticking over until the second quarter, when buyers seem to appear as the weather starts to improve.

Records from our auction visits indicate that the average number of auction entries increased significantly last month by over 20%. Despite this the number of on-the-day sales of trucks fell slightly by just 0.5% in relation to total entries whilst trailer sales dropped by over 4%. This is based on nine auction visits and a total of 1342 viewed lots. As we always point out these are ‘hammer sales’ on-the-day and converted provisional sales are not included. One auction reports that the conversion rate of provisional sales was around the 70% mark.

This month’s research indicates that:

- Up to 7.5t – A slight reduction in values for all but Euro 6 vehicles.

- 5t to 12t – A slight reduction in values for all but Euro 6 vehicles.

- 13t to 18t – A slight reduction in values for most but not for Euro 6 vehicles.

- Multi-wheel rigids – A slight reduction in values for most but not for Euro 6 vehicles.

- Tractor units – A slight reduction in some 4x2 and 6x2 values for all but Euro 6 vehicles. Although some Euro 5 values have increased slightly especially for Renault Premium values which have shown positive moves of late. 6x4 values have also shown an increase.

- Trailers – On the whole values have remained stable but with some increases, mainly for curtains, platforms and fridges.

- Finally, this month we have added a number of 18t Euro 6 vehicles.

7.5t to 12t Vehicles

Fridges are plentiful and dependent on specification some are finding new homes but with so many to choose from buyers are being selective with their purchases.

The number of 7.5t boxes seems to be abating and although there are still plenty in the marketplace more could appear following any January de-fleets. A good selection of DAF’s and batches of 2012 Mercedes-Benz 816’s are currently being seen.

Tippers, while still selling, have seen values weaken a little, but this is to be expected at this time of year and it follows a period where plenty have been available. Late boxes and curtains are few and far between and generally sell well when they appear.

Beavertails and other specialist vehicles always attract attention and subject to condition usually sell with ease. Dropsides still remain popular but as ever in this sector mileage and condition are paramount and anything with low mileage will sell much more easily than higher mileage examples.

13t to 18t Vehicles

There are plenty of 13t and 18t fridges available on a variety of chassis and from several sources of which the aforementioned Palmer and Harvey fleet provided a good selection of 2011 day cab DAF FA LF55.220 Fridge boxes.

Tidy 18t boxes, curtains and dropsides, especially with sleeper cabs, are selling but anything below standard is being shunned. A plentiful supply of fresh five and six year old Mercedes-Benz Axor 1824 day cab boxes are giving buyers a good choice to select from.

Tippers are still popular as are skip loaders with extendable arms and anything non-standard or with a crane fitted which continue to attract additional interest although extra interest does not necessarily result in a sale on the day. One such skip loader was an unusual 12 plate Isuzu Forward F180.300 with Hyva equipment.

Late 18t vehicles have been very much in demand recently and they have been achieving unrealistic values at times. However, as a few more Euro 6 examples start to appear in the open market values are beginning to become more realistic but it will be some time before they fully stabilise to any kind of normality.

Multi-wheelers

The number of 6x4 and 8x4 tippers has slowed a little, possibly due to the time of year, but those that do appear still attract interest, especially so when cranes and grabs are fitted.

Hook-loaders and skips continue to sell but price usually reflects condition rather than mileage. Draw-bar outfits and car carrier rigs, whilst not so plentiful, are struggling to find buyers. One drawbar rig at an auction recently was a 10 plate DAF FA CF85.410 day cab fridge box with a considerably older Gray and Adams tandem drawbar fridge box trailer which mustered a bid of just below £8,000.

Refuse trucks remain a problem and most are struggling to find new homes and often attract bids which still do not reflect their true value.

Boxes continue to remain scarce in comparison to curtains and fridges whilst dropsides continue to appear in good numbers often carrying cranes and it is often condition and mileage rather than age which leads to a successful outcome.

Specialist vehicles continue to create most interest and a 2003 52 plate Space cab DAF FAS CF75.310 flat with a PM Series 36024 crane and just under 900,000 km hit the right spot and sold for £12,000. A similar 03 plate day cab example with a PK 24500 crane and 304,000 km sold for £10,600.

Other vehicles of interest include a selection on cement mixers of varying age and specifications all of which struggled and a couple of DAF FAT CF75.310 Vac Tankers which continued to attract little attention.

An unusual vehicle was a 2004 Hino FY sleeper cab cheesewedge with a PM series 47P crane which did attract bids but it failed to sell on the day.

Heavy recovery vehicles are few and far between and a recent auction entry was a 03 plate DAF FTS XF95.480 with all the right equipment and ready to work. It had almost 900,000 kilometres but was in a very tidy condition, as most vehicles of this type tend to be. It failed to sell on the day despite a best offer of £29,500

Tractor Units

There are few positives to report here as anyone with a Euro 5 6x2 tractor unit for sale will verify that obtaining maximum sales revenue is becoming increasingly difficult unless it is of a high specification and with plenty of horsepower. Vehicles which are sold with warranties or full service histories always sell more easily, and at higher values, but the current auction stocks of run of the mill units are high and that it’s difficult to see a quick solution to the problem.

Euro 5 models are currently not seen as export friendly unlike their predecessors. With little export activity with Euro 5 vehicles at present they are struggling to sell in pace with fresh stock becoming available.

Late model DAF and Iveco’s remain relatively scarce compared to other marques and despite previous declarations that the large quantity of Renault Premiums in the market are declining, further batches have appeared, although slightly newer in year and the good news is that they have started to achieve slightly better values at auction. The most numerous examples currently are 2012 and 2013 Renault Premiums 460’s with Privilege cabs.

There is a good selection of most other marques available so for anyone looking to purchase a tractor unit to put to work perhaps now is the time to do so as there are some good deals to be had. Small numbers of Euro 6 examples have been through the auctions, mainly from finance companies, and whilst bids have been higher than like for like Euro 5’s many have failed to sell on the day, possibly due to the vendor’s high expectations and unrealistic reserve values.

4x2 examples are less numerous and are often a little older and current stock tends to consist of mainly DAF and Scania models. However, sales of these vehicles are no better than that for 6x2’s.

One of the small number of Euro 6 vehicles to appear at auction was a 15 plate 6x2 Volvo FM 460 Globetrotter with only 193,000 kilometres believed to be from an operator retiring from the business. It provoked plenty of interest but failed to sell on the day.

Trailers

There has been little change in the market as the trailer sector continues to be steady and so far there has not been an influx of fresh trailers which often occurs post-Christmas

Most of the available trailers remain over ten years of age, often well over, so what little stock of newer trailers there is provokes good interest and often results in a sale.

Good quality tri-axle curtains along with flats have performed well recently, an example of this being a tidy 2012 curtain, unlettered and ready for immediate work which proved a popular lot and sold easily at auction.

Tippers and low-loaders continue to attract attention and often, but not always sell, as and when they appear especially if they can be put straight to work.

Senior Editor

+44 (0) 113 360 7211

steven.botfield@cap-hpi.com