Looking for a Vehicle Valuation or HPI Check?

In last month’s editorial we suggested that LCV sales might buck the traditional seasonal trend in August as it did last year and boy didn’t that turn out to be true? Auction attendance levels were noticeably higher than the previous month and, as you’d expect during a holiday period, there were far more retail buyers around with many of them prepared to ‘have a go’ in the hope of bagging a bargain. Professional buyers were out in earnest too and clearly on a mission to acquire stock dispelling any suggestion that retail demand was waning. There was a distinct buzz in the air at many of the sales we attended, particularly during the first hour or so.

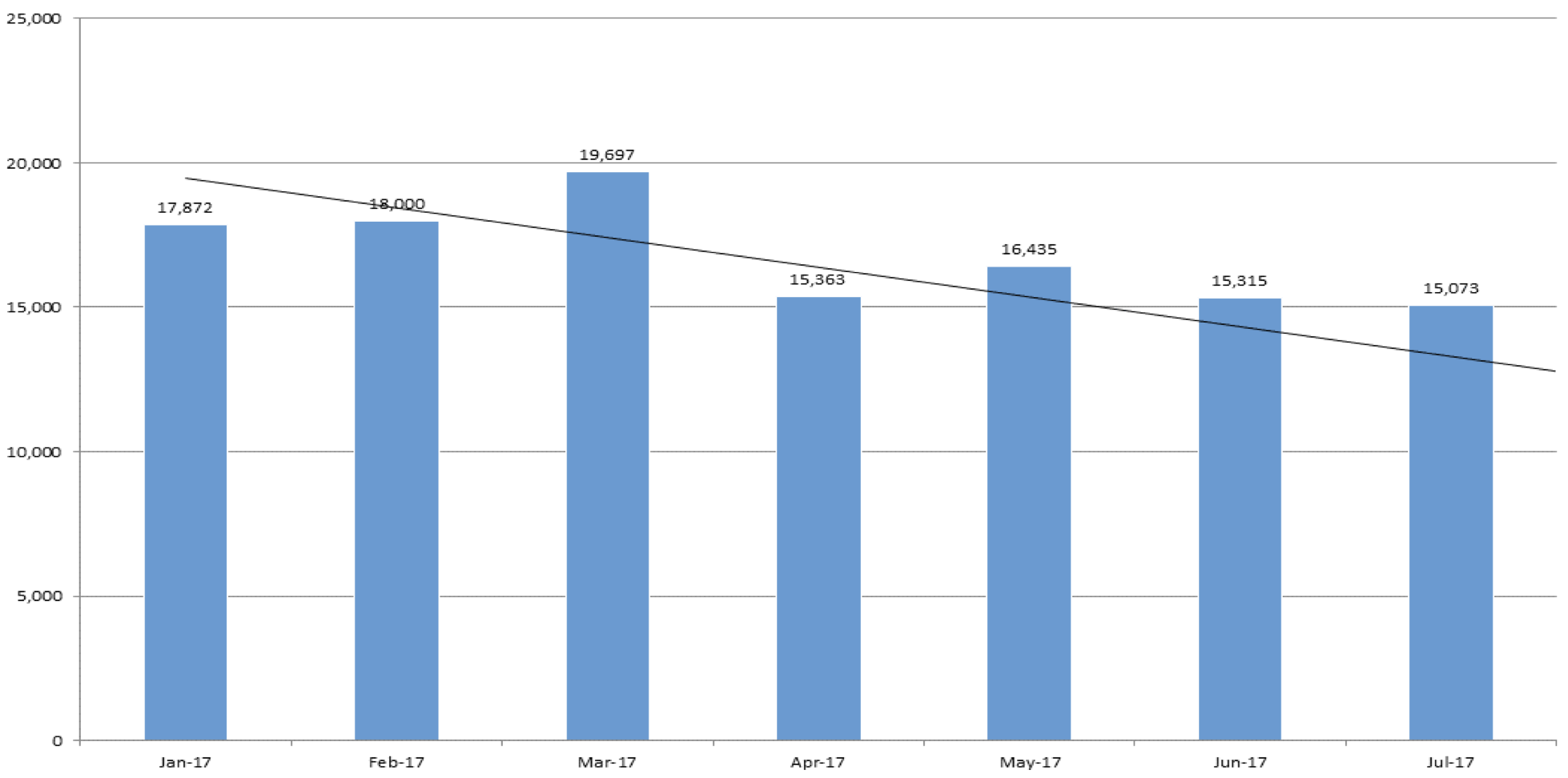

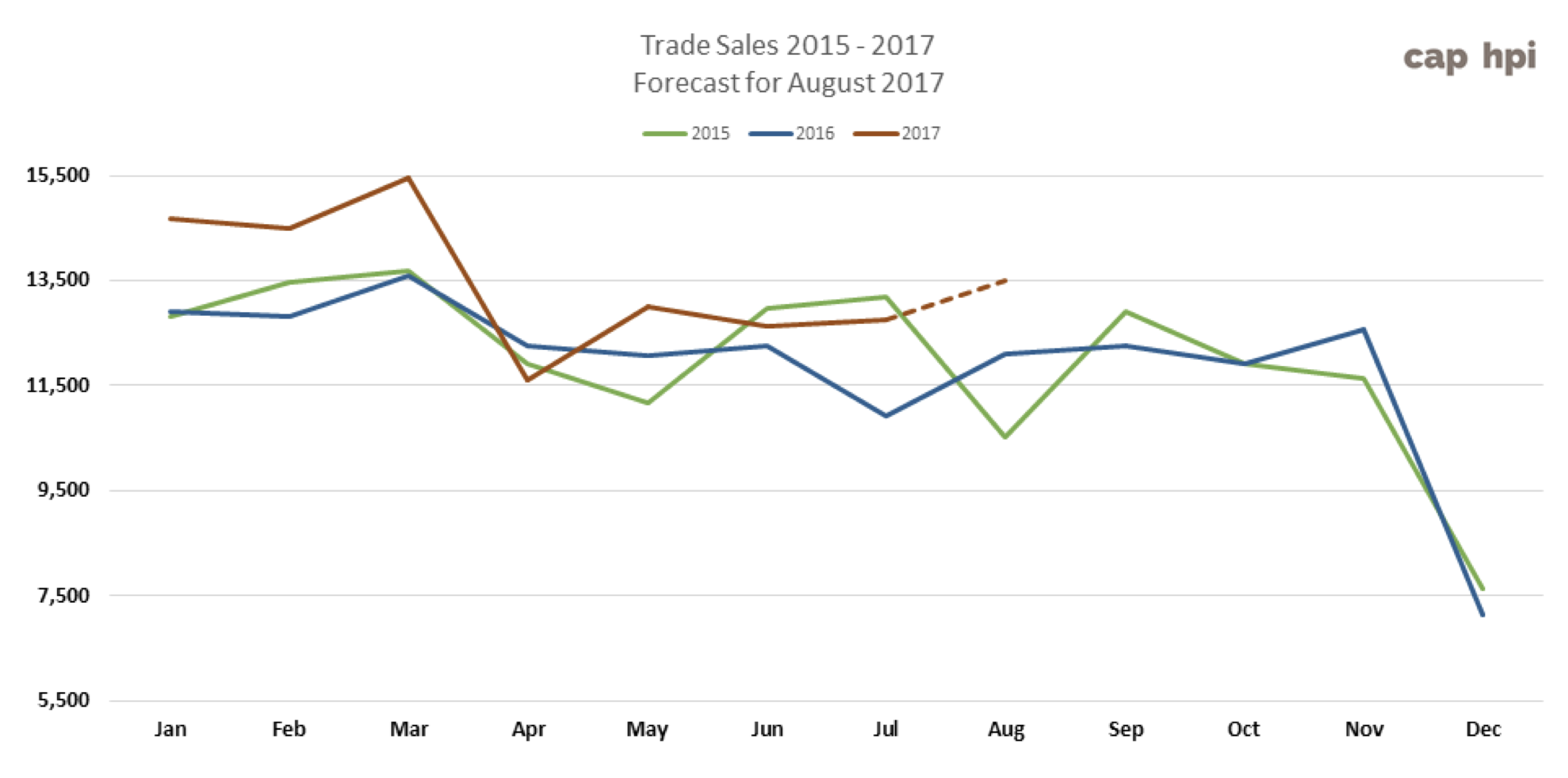

As the chart below clearly shows, sales volumes increased modestly between June and July then increases significantly during August.

Fortunately this upturn in demand was met with a plentiful supply of stock albeit sale entries were down slightly. That can only be good news for the vendors as it suggests that, overall, conversion rates must have been up and some of those vans that had been around the block a few times finally found homes.

It has to be said that not all of the stock we witnessed going though was in the best of condition. According to the independent inspections we carry out during our auction visits, the overall quality of stock was down last month. Understandably, it’s not always economically viable to overspend on sales preparation especially when it comes accident damage where panels need replacing or extensive paintwork is required. However, we did feel that price performance could have been improved on some lots we saw which had relatively minor issues and didn’t seem to have had any sale preparation at all. Livery ghosting was evident on many vehicles presented for sale and it now seems so widespread it’s almost as if it’s become the norm.

2017 Auction Catalogue Entries

Analysis of the auction sale catalogues reveals that August auction entries were down by 1.8%. The average age of vehicles increased from 57 months to 61 months and the average recorded mileage decreased from 74,050 to 73,821. Year on year the average age of vehicles entered at open auction has decreased from 64 months to 61 months whilst the average mileage has decreased by 5273.

Used LCV Auction Catalogues Stock Trend

Aug-16

Sep-16

Oct-16

Nov-16

Dec-16

Jan-17

Feb-17

Mar-17

Apr-17

May-17

Jun-17

Jul-17

Aug-17

Auction Entries % Var

4%

-9%

-3%

8%

-42%

72%

0%

9%

-28%

7%

-2%

5%

-2%

Average age (Months)

64

65

64

64

63

60

59

60

62

59

59

57

61

Average Mileage

79094

78884

77766

77485

77217

75619

74127

73214

74310

72879

72264

74050

73821

|

June 2017 |

July 2017 |

August 2017 |

||||

|

LCV Sector |

Market Share |

Performance |

Market Share |

Performance |

Market Share |

Performance |

|

City Van |

4.71% |

98.54% |

4.53% |

99.60% |

5.24% |

98.28% |

|

Small Van |

26.09% |

98.67% |

28.17% |

98.52% |

28.10% |

98.31% |

|

Medium Van |

26.46% |

99.21% |

27.16% |

99.67% |

26.50% |

100.25% |

|

Large Van |

21.03% |

97.70% |

21.09% |

98.63% |

18.83% |

99.08% |

|

Over 3.5T |

0.19% |

106.28% |

0.05% |

108.11% |

0.19% |

108.23% |

|

4x4 Pick-up Workhorse |

1.96% |

97.39% |

1.58% |

100.16% |

1.67% |

99.21% |

|

4x4 Pick-up Lifestyle SUV |

11.11% |

98.09% |

9.90% |

97.86% |

11.11% |

98.60% |

|

Forward Control Vehicle |

0.05% |

92.64% |

0.09% |

98.39% |

0.16% |

100.71% |

|

Chassis - Derived |

5.10% |

97.37% |

4.32% |

98.83% |

5.01% |

97.96% |

|

Mini-bus |

1.40% |

97.16% |

1.48% |

97.58% |

1.13% |

97.25% |

|

Vat Qualifying |

1.85% |

97.96% |

1.61% |

99.17% |

1.99% |

99.05% |

|

Total Market |

100.00% |

98.42% |

100.00% |

98.88% |

100.00% |

99.02% |

On average market prices for all LCV sectors fell short of the guide prices by only 0.7% whilst vehicles in white were down by around 2%. In terms of average price performance there was very little variation across the sectors with only the over 3.5t Sector and Forward Control standing out as over-performing and Electrically Powered under-performing considerably.

Whilst electric vehicles have been appearing at auction in increasing numbers over the past few months it’s clear that retail demand in the used market is limited. So far this year only 37 Nissan NV E200 have sold at auction and they have achieved on average 68% of the average guide price. Consequently we have made some significant downward price movements in the Electrically Powered sector in this edition.

|

September: LCV Used Guide Price Movements 3 year / 60k |

|||

|

LCV Sector |

Average % Movement |

Average Value August |

Average Value September |

|

City Van |

0.0% |

£4,315 |

£4,316 |

|

Small Van |

-0.9% |

£4,380 |

£4,342 |

|

Medium Van |

-2.0% |

£9,840 |

£9,646 |

|

Large Van |

-0.8% |

£7,791 |

£7,731 |

|

Over 3.5T |

-0.5% |

£9,861 |

£9,808 |

|

4x4 Pick-up Workhorse |

2.1% |

£11,988 |

£12,249 |

|

4x4 Pick-up Lifestyle SUV |

-0.9% |

£10,398 |

£10,309 |

|

Forward Control Vehicle |

-0.5% |

£9,982 |

£9,929 |

|

Chassis - Derived |

-0.8% |

£8,949 |

£8,874 |

|

Mini-bus |

-0.8% |

£9,665 |

£9,588 |

|

Vat Qualifying |

-0.8% |

£10,772 |

£10,689 |

In case you missed last month’s Red Book LCV Editorial it’s worth mentioning again that we have made some changes to the naming of our LCV sectors. Panel Vans are now split into Large Van, Medium Van, Small Van and City Van sectors. This change was necessary in order to improve the way we analyse the LCV market in our database, particularly in relation to auction sales results. We believe these minor changes will lead to a greater understanding of how each sector of the market is performing and improve the accuracy of the guide. This is an internal change only and does not affect any of our valuation products in any way.

The Top 10 Models in each sector tables below are intended to give you a clearer picture of the models that are driving the prices in the used LCV Market. It should be noted that that the Sector Share is based on actual sales and not the availability of these models in the marketplace. The %cap performance values are also based on actual sales.

Since our guide values reflect the market prices of basic vans in plain white as they appear in the vehicle manufacturer’s price lists, some of guide price movements you might see in this edition may not correlate directly with the sales performances shown in the tables which include vehicles in all colours and specifications.

Please note the changes that have been made to sector names. The reasons for making these changes are explained in the main body of the editorial above.

|

CAPId |

City Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||

|

24217 |

NEMO DIESEL - 1.3 HDi Enterprise [non Start/Stop] |

6.55% |

98.4% |

99.7% |

||||||||

|

24231 |

BIPPER DIESEL - 1.3 HDi 75 S Plus Pack [SLD] [non Start/Stop] |

6.36% |

106.3% |

89.6% |

||||||||

|

24228 |

BIPPER DIESEL - 1.3 HDi 75 S [non Start/Stop] |

6.18% |

105.1% |

91.1% |

||||||||

|

26324 |

FIESTA DIESEL - 1.5 TDCi Van |

5.09% |

117.4% |

101.5% |

||||||||

|

26326 |

FIESTA DIESEL - 1.6 TDCi ECOnetic Van |

4.36% |

102.7% |

100.9% |

||||||||

|

21886 |

CORSAVAN DIESEL - 1.3 CDTi 16V 95ps ecoFLEX Van [Start/Stop] |

4.18% |

90.1% |

93.5% |

||||||||

|

20845 |

CORSAVAN DIESEL - 1.3 CDTi 16V ecoFLEX Van [Start/Stop] |

4.00% |

90.8% |

96.5% |

||||||||

|

21678 |

ASTRAVAN DIESEL - Club 1.7 CDTi ecoFLEX Van |

3.64% |

92.7% |

105.3% |

||||||||

|

11121 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

3.45% |

87.3% |

92.7% |

||||||||

|

20846 |

CORSAVAN DIESEL - 1.3 CDTi 16V 95ps Sportive Van |

3.09% |

100.8% |

97.1% |

||||||||

|

With a 5.24% share of all LCVs sold at auction last month and with a price performance of 98.28% City Van sector prices were down by around 0.7% last month. Overall prices have remained relatively stable in this sector so the guide prices for most models are unchanged this month with the following notable exceptions…

|

||||||||||||

|

CAPId |

Small Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||||||||

|

18445 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg Enterprise 75ps |

12.72% |

97.7% |

95.8% |

||||||||||||||||||||

|

20709 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Van |

6.44% |

106.2% |

103.9% |

||||||||||||||||||||

|

22432 |

PARTNER L1 DIESEL - 850 S 1.6 HDi 92 Van [SLD] |

4.63% |

127.4% |

92.1% |

||||||||||||||||||||

|

18446 |

BERLINGO L1 DIESEL - 1.6 HDi 850Kg Enterprise 90ps |

2.79% |

96.0% |

95.0% |

||||||||||||||||||||

|

11464 |

COMBO DIESEL - 1700 1.3CDTi 16V Van [75PS] |

2.75% |

64.7% |

100.5% |

||||||||||||||||||||

|

26630 |

KANGOO DIESEL - ML19dCi 75 eco2 Van |

2.67% |

92.9% |

94.3% |

||||||||||||||||||||

|

15182 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg LX 75ps |

2.51% |

100.4% |

98.9% |

||||||||||||||||||||

|

16514 |

TRANSIT CONNECT 230 LWB DIESEL - High Roof Van TDCi 90ps |

2.35% |

103.0% |

103.9% |

||||||||||||||||||||

|

28266 |

CADDY C20 DIESEL - 1.6 TDI 102PS Startline Van |

2.28% |

103.8% |

98.5% |

||||||||||||||||||||

|

22438 |

PARTNER L1 DIESEL - 850 1.6 HDi 92 Professional Van |

2.20% |

94.6% |

94.8% |

||||||||||||||||||||

|

With a 28.10% market share of all LCVs sold last month average sales prices remained strong at 98.31% of the guide prices. After taking into account colour and condition a 1% downward market movement has been applied to this sector with the following notable exceptions…

|

||||||||||||||||||||||||

|

CAPId |

Medium Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||||||||||||||||||

|

25446 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

4.13% |

99.8% |

99.6% |

||||||||||||||||||||||||||||||

|

24303 |

VIVARO SWB DIESEL - 2.0CDTI [90PS] ecoFLEX Van 2.7t Euro 5 |

3.49% |

104.3% |

104.6% |

||||||||||||||||||||||||||||||

|

24325 |

VIVARO LWB DIESEL - 2.0CDTI [115PS] Van 2.9t Euro 5 |

3.45% |

97.2% |

97.2% |

||||||||||||||||||||||||||||||

|

25441 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

3.32% |

99.5% |

97.6% |

||||||||||||||||||||||||||||||

|

18442 |

DISPATCH L1 DIESEL - 1000 1.6 HDi 90 H1 Van Enterprise |

3.19% |

97.4% |

96.2% |

||||||||||||||||||||||||||||||

|

25437 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

2.38% |

99.1% |

97.3% |

||||||||||||||||||||||||||||||

|

24329 |

VIVARO LWB DIESEL - 2.0CDTI [115PS] Sportive Van 2.9t Euro 5 |

2.21% |

99.5% |

101.2% |

||||||||||||||||||||||||||||||

|

24636 |

TRANSPORTER T28 SWB DIESEL - 2.0 TDI BlueMotion Tech 84PS Van |

2.13% |

119.4% |

113.5% |

||||||||||||||||||||||||||||||

|

25471 |

TRANSIT CUSTOM 290 L2 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

1.92% |

92.9% |

94.5% |

||||||||||||||||||||||||||||||

|

10412 |

VIVARO SWB DIESEL - 2.0CDTI [115PS] Van 2.7t |

1.79% |

92.1% |

95.1% |

||||||||||||||||||||||||||||||

|

Accounting for around 26.5% of all LCVs sold last month average market prices remained strong with a price performance of 100.25%. After taking into account colour and condition a downward market movement of 1% has been applied to this sector with the following notable exceptions.

|

||||||||||||||||||||||||||||||||||

|

CAPId |

Large Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||||||||||||||||||||||||||

|

26863 |

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van |

4.72% |

96.0% |

99.3% |

||||||||||||||||||||||||||||||||||||||

|

22129 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 100ps |

4.47% |

104.9% |

102.7% |

||||||||||||||||||||||||||||||||||||||

|

30637 |

TRANSIT 350 L3 DIESEL RWD - 2.2 TDCi 125ps H3 Van |

4.16% |

93.4% |

94.0% |

||||||||||||||||||||||||||||||||||||||

|

9104 |

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

3.91% |

82.9% |

96.3% |

||||||||||||||||||||||||||||||||||||||

|

9158 |

TRANSIT 280 SWB DIESEL FWD - Medium Roof Van TDCi 85ps |

2.64% |

102.6% |

105.2% |

||||||||||||||||||||||||||||||||||||||

|

18682 |

MOVANO 35 L3 DIESEL FWD - 2.3 CDTI H2 Van 100ps |

2.64% |

91.7% |

92.6% |

||||||||||||||||||||||||||||||||||||||

|

9166 |

TRANSIT 300 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

2.59% |

88.6% |

95.6% |

||||||||||||||||||||||||||||||||||||||

|

9155 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

2.39% |

89.4% |

99.3% |

||||||||||||||||||||||||||||||||||||||

|

31217 |

RELAY 35 L3 DIESEL - 2.2 HDi H2 Van 130ps Enterprise |

1.93% |

105.6% |

101.5% |

||||||||||||||||||||||||||||||||||||||

|

9541 |

SPRINTER 313CDI MEDIUM DIESEL - 3.5t High Roof Van |

1.88% |

94.4% |

96.1% |

||||||||||||||||||||||||||||||||||||||

|

With an 18.83% market share of all LCVs sold last month average sales prices remained strong at 99.08% of the guide prices. After taking into account colour and condition a 1% downward market movement has been applied to this sector with the following notable exceptions.

|

||||||||||||||||||||||||||||||||||||||||||

|

CAPId |

4x4 Pick-up Lifestyle SUV |

Sector Share |

%CAP |

%CAP All Colours Condition Adjusted |

||||||

|

19135 |

NAVARA DIESEL - Double Cab Pick Up Tekna 2.5dCi 190 4WD |

5.22% |

102.8% |

99.6% |

||||||

|

19137 |

NAVARA DIESEL - D/Cab Pick Up Tekna [Connect] 2.5dCi 190 4WD |

4.89% |

95.8% |

95.8% |

||||||

|

18622 |

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD 176Bhp |

4.44% |

102.2% |

99.8% |

||||||

|

22415 |

RANGER DIESEL - Pick Up Double Cab Limited 2.2 TDCi 150 4WD |

4.11% |

98.7% |

97.9% |

||||||

|

21668 |

HILUX DIESEL - Invincible D/Cab Pick Up 3.0 D-4D 4WD 171 |

3.56% |

98.4% |

96.7% |

||||||

|

34128 |

L200 LWB SPECIAL EDITIONS - Double Cab DI-D Challenger 4WD |

3.56% |

97.0% |

97.0% |

||||||

|

18623 |

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD Auto 176Bhp |

3.00% |

101.7% |

99.1% |

||||||

|

22418 |

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 4WD |

3.00% |

103.1% |

103.1% |

||||||

|

18672 |

L200 LWB LB DIESEL - D/Cab DI-D Warrior II 4WD 176Bhp [2010] |

2.67% |

98.7% |

94.3% |

||||||

|

19134 |

NAVARA DIESEL - Double Cab Pick Up Acenta 2.5dCi 190 4WD |

2.67% |

101.3% |

97.1% |

||||||

|

With an 11.11% share of all LCVs sold and an overall price performance of 98.60% there has been a marginal increase in the number of vehicles sold in this sector last month together with an increase in performance against the guide. Prices appear to have stabilised at the moment so the guide prices for most model ranges remain the same this month with the following notable exceptions…

|

||||||||||

|

CAPId |

4x4 Pick-up Workhorse |

Sector Share |

%CAP |

%CAP All Colours Condition Adjusted |

||||||||||||||

|

26500 |

NAVARA DIESEL - Double Cab Pick Up Visia 2.5dCi 144 4WD |

8.82% |

97.5% |

101.5% |

||||||||||||||

|

18668 |

L200 LWB LB DIESEL - Double Cab DI-D 4Work 4WD 134Bhp [2010] |

8.24% |

95.1% |

101.7% |

||||||||||||||

|

11073 |

DEFENDER 110 LWB DIESEL - Hard Top TDCi |

6.47% |

86.4% |

92.7% |

||||||||||||||

|

21665 |

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 144 |

5.88% |

96.0% |

105.2% |

||||||||||||||

|

16756 |

HILUX DIESEL - HL2 2010 D/Cab Pick Up 2.5 D-4D 4WD 144 |

5.29% |

96.2% |

96.2% |

||||||||||||||

|

16571 |

RANGER DIESEL - Pick Up Double Cab XL 2.5 TDCi 4WD |

5.29% |

77.3% |

93.8% |

||||||||||||||

|

30784 |

HILUX DIESEL - Active D/Cab Pick Up 2.5 D-4D 4WD 144 |

4.12% |

85.3% |

88.3% |

||||||||||||||

|

22413 |

RANGER DIESEL - Pick Up Double Cab XL 2.2 TDCi 150 4WD |

4.12% |

91.7% |

91.7% |

||||||||||||||

|

11045 |

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 120 |

3.53% |

100.0% |

100.0% |

||||||||||||||

|

18664 |

L200 LWB DIESEL - Pick Up DI-D 4Work 4WD 134Bhp [2010] |

2.35% |

87.9% |

102.1% |

||||||||||||||

|

With a sector market share of 1.67% and price performance of 99.21% the guide values for most ranges remain the same this month with the following notable exceptions…

|

||||||||||||||||||

HGV MARKETPLACE

Despite it being the height of the holiday season auction attendances have been well attended in most cases and sales activity has continued to be steady, with one of the auctions we attended over 65% of all the HGV entries sold on the day.

Vehicles and trailers are still appearing at recurring sales, as a result there remains a lot of older stock in auction catalogues and with the export market currently subdued, this stock is likely to be around for the near future.

Euro 6 rigid vehicles remain scarce and those that do appear create considerable interest, especially low mileage examples.

Dealers report that they are a little quiet at present but some do have enquiries especially for Euro 6 rigids, high specification 6x2 tractor units and flat trailers with twist-locks which are readily saleable at present.

Manufacturer sales remain pretty buoyant and they continue to return good revenues. The demand for Euro 6 vehicles is accelerating at the expense of Euro 5’s, which are having to be managed more carefully, particularly tractor units.

Records from our auction visits indicate that the average number of auction entries increased last month by a little over 16%, making up for the previous months decrease. The number of on-the-day sales of trucks fell by over 3% in relation to total entries and trailer sales also decreased by 2.5%. This is based on eight auction visits and a total of 1271 viewed lots. As we always point out these are ‘hammer sales’ on-the-day and converted provisional sales are not included. One auction reports that the conversion rate of provisional sales remains stable at around 70%.

This month’s research indicates that:

- Up to 7.5t – Values have fallen across the board with Euro 5 vehicles affected more so than older versions.

- 7.5t to 12t – Up to and including Euro 5 fridges and tippers have fared reasonably well, closely followed by curtains. Other variants have seen values fall, particularly boxes and more so for Euro 5 versions. Euro 6 vehicles have seen values increase.

- 13t to 18t – With the exception of some fridges, tippers and skip loaders most values have fallen again.

- Multi-wheel rigids - Values have fallen across the board.

- Tractor units – 4x2 and 6x2 values have fallen with a few exceptions. 6x2 DAF CF’s, Renault Premium, Scania and Volvos values have remained stable and high specification Scania’s and Volvo’s have actually seen a small increase in values recently.

- Trailers - Values have again fallen across the board with the exception of platforms which have sold well recently.

- This month sees a general decrease in values to account for the new 67 plate.

- Finally, the publication of further Euro 6 tractor unit values and other Euro 6 values are being worked on and will follow imminently.

7.5t to 12t Vehicles

Large volumes of four and five year old white Euro 5 boxes have been available for sale in the last few weeks, mainly DAF, Iveco and Mercedes-Benz. Due to the numbers available values have fallen across all of these types of vehicles. Price fluctuations like this usually filter down to older vehicles, particularly Euro 4, but on this occasion whilst values of such vehicles have fallen they have been affected less so than their Euro 5 peers. Dropsides have been similarly affected although volumes remain low.

Fridges and tippers performed reasonably well last month, and the curtains that we saw sold returned healthy results.

Evidence suggests that Euro 6 vehicles are seeing values increase and competition to purchase them is getting ever tougher. One buyer advised that he has pre-purchased several 7.5t vehicles unseen from a truck rental company in order to ensure the price and availability remained steady. Another advised that offers made to operators and initially accepted for Euro 6 vehicles have been exceeded by other dealers desperate for stock and some sellers are currently holding out for better deals.

A considerable selection of 7.5t and 10t double deck car transporters of varying ages and mileages, but all in tidy condition, proved popular auction lots with almost all selling on the day. Vehicles such as these always provoke strong interest and usually draws in additional buyers, including end users who often tender higher bids.

13t to 18t Vehicles

Plenty of Euro 4 13t and 18t fridges from a food distribution company have appeared recently and whilst most of them were around ten years of age they all sold as they appeared, despite most having unpopular fridge units. Values were nothing special but the fact that they were predominantly Mercedes-Benz and in reasonable condition made them good export prospects.

Older stock still remains out of sorts with the current demand for late Euro 5 and Euro 6 vehicles. The result is that much of the older stock remains unsold whilst the thirst for late registered vehicles cannot be satisfied. When late vehicles do appear they command top dollar.

Several car transporters were presented for sale but were met with varied interest but they failed to achieve their true value.

Several more left hand drive dual-sweep sweepers have appeared and were all well received. Most sold with only the older untidy examples, which may require expensive reparation being shunned.

Tippers, gritter/ploughs and any type of vehicle carrying a crane remain popular but only if mileage and condition met expectations. Anything outside these parameters is finding it tough to find a new home.

Refuse vehicles have proved a little more popular recently, but only those with the right chassis and body combinations that could be put straight to work. 4x2 refuse vehicles are actually attracting more interest at the moment than multi-axle examples.

Skip Loaders are often popular lots, particularly tidy examples. One which provoked plenty of bidding activity, eventually selling to an end user, was an 11 plate Mercedes-Benz Axor 1824 with Hyva equipment and 252,000 warranted kilometres

Multi-wheelers

Across the board values have fallen, including tippers which have seen interest dwindle a little recently. With the expected lifespan of multi-wheelers being greater than two axle vehicles many vehicles in auction have had more than one owner

and those which are direct entries from the original operator attract more interest, irrespective of vehicle type and are generally in better condition.

A Livestock carrier along with several plant carriers have appeared in sales recently all proving popular lots. Livestock carriers are rarely seen at auction and always attract a good selection of buyers into the saleroom.

A couple of fresh fuel tankers proved less popular and will probably be kicking around for several months, adding to the sprinkling of similar vehicles which have been around for some time.

Refuse trucks continue to struggle to find new homes and some bids submitted account for them being cut up and scrapped.

A couple of 2008 DAF FAX CF85.360 8x2 brick and block carriers with centre cranes and brick grabs failed to provoke sufficient interest as often occurs with such specialist vehicles. If someone has a use for them and they will sell easily, but if not they can be difficult to move on. This pair mustered bids around £10,000, but on another day the outcome could be much different.

One 8x4 tipper that did hit the right note was a 2014 63 plate DAF FAD CF85.360 sporting an Epsilon crane with only 91,000 warranted kilometres. A couple of buyers had a bit of a duel and it eventually sold for further work in a rental fleet. Ironic, as the vendor was a rental fleet.

To show how fickle the market can be a similar 2012 62 plate MAN TGS 35.400 in a clean condition but without a crane and with only 105,000 kilometres failed to produce a realistic offer.

Tractor Units

As reported last month there are a few chinks of light at the end of the tunnel for Euro 5 values, whilst values of all 4x2 examples have fallen.

Euro 5 6x2 DAF CF’s have performed a little better of late, much better than that of their sister XF’s which are more numerous, and although there are still lots of Renault Premiums around prices have stabilised and almost all that were offered for sale found buyers.

Euro 5 6x2 Scania’s and Volvo’s have seen prices remain steady with high specification examples such as Scania R type Toplines and Volvo FH Globetrotters actually increasing in value.

The latest version of the Mercedes-Benz Actros 2545 have been numerous at auction and Euro 5 examples are struggling to produce credible interest, with the previous Euro 5 incarnation finding it easier to find buyers. Similar aged Volvo FH460 Globetrotters have also been readily available but these have fared much better.

All things considered Euro 5 6x2 tractor units are still plentiful and with a few exceptions it continues to be a buyer’s market.

Trailers

Trailer sales have continued to struggle recently. Whilst sales are occurring values continue to decline with the exception of flat trailers that have seen increased interest and subsequent sales values.

The number of trailers available has reduced dramatically in recent months and choice available is not as wide as three months ago. Most stock remains over ten years of age, some of which are no longer fit for further use, but anything under ten and in reasonable condition is met with increased interest and is selling easier than in recent times.

Boxes, fridges, tippers and skeletals have not been registering bids sufficient to produce sales but curtains have been selling readily but at reduced values.

However, it is still specialist trailers that always produce most interest, and a trio of low-loader one with multi-axles did just that when they appeared at auction and all sold.

Senior Editor

+44 (0) 113 360 7211

steven.botfield@cap-hpi.com