Looking for a Vehicle Valuation or HPI Check?

Although auction entries increased significantly during October when compared to September, supply still appeared to be lagging well behind demand during the first part of the month and the early indications were that market prices were likely to soar. However, as the month progressed and we continued our field research, the sale catalogues did get thicker but we couldn’t help but notice huge variations in the number of entries in different parts of the country. Based on the notion that a big sale draws a big crowd, if we didn’t know any better, we could be excused for thinking that vendors were favouring some auction venues over others.

Analysis of the auction sale catalogues revealed that October auction entries were up by 18.5%. The average age of vehicles remained the same at 60 months (MTD) whilst the average recorded mileage decreased slightly from 73,470 to 73,283 (MTD).

|

Auction Catalogue Entries |

|||||||||||||

|

Oct-16 |

Nov-16 |

Dec-16 |

Jan-17 |

Feb-17 |

Mar-17 |

Apr-17 |

May-17 |

Jun-17 |

Jul- |

Aug-17 |

Sep- |

Oct-17 |

|

|

Auction Entries % Var |

-3% |

8% |

-42% |

72% |

0% |

9% |

-28% |

7% |

-2% |

5% |

-2% |

-24.50% |

18.5% |

|

Average age (Months) |

64 |

64 |

63 |

60 |

59 |

60 |

62 |

59 |

59 |

57 |

61 |

59 |

60 |

|

Average Mileage |

77766 |

77485 |

77217 |

75619 |

74127 |

73214 |

74310 |

72879 |

72264 |

74050 |

73821 |

72201 |

73283 |

The condition of entries is always going to be a mixed bag, however, the general feeling across our team was that there were noticeably more vehicles around that we would classify as ‘Clean’ and ready to retail last month. Clearly though there still weren’t enough to satisfy demand which put upward pressure on the prices of the most desirable lots.

At some of the sales where the entries were lower than we would normally expect, yet again we witnessed many examples of professional buyers paying well above the guide prices for vehicles that were exhibiting significant amounts of damage, particularly in the medium and large van sectors. Presumably, with more time available in between lots, bidding steadily inched-up in as buyers responded to the tenacious chanting of the auctioneers.

Ironically, at some of the auctions we attended which had higher attendance levels and more vehicles on sale, arguably the opposite was true. Bidding was brisk and there was a sense that auctioneers were working at a heightened pace to get through the lots in each section of the sale. The atmosphere was certainly more highly charged, and there was that definite buzz in the air that regular auction-goers talk about, but generally hammer prices hovered around the guide values and discerning buyers were clearly not prepared to pay over the odds for damaged vehicles.

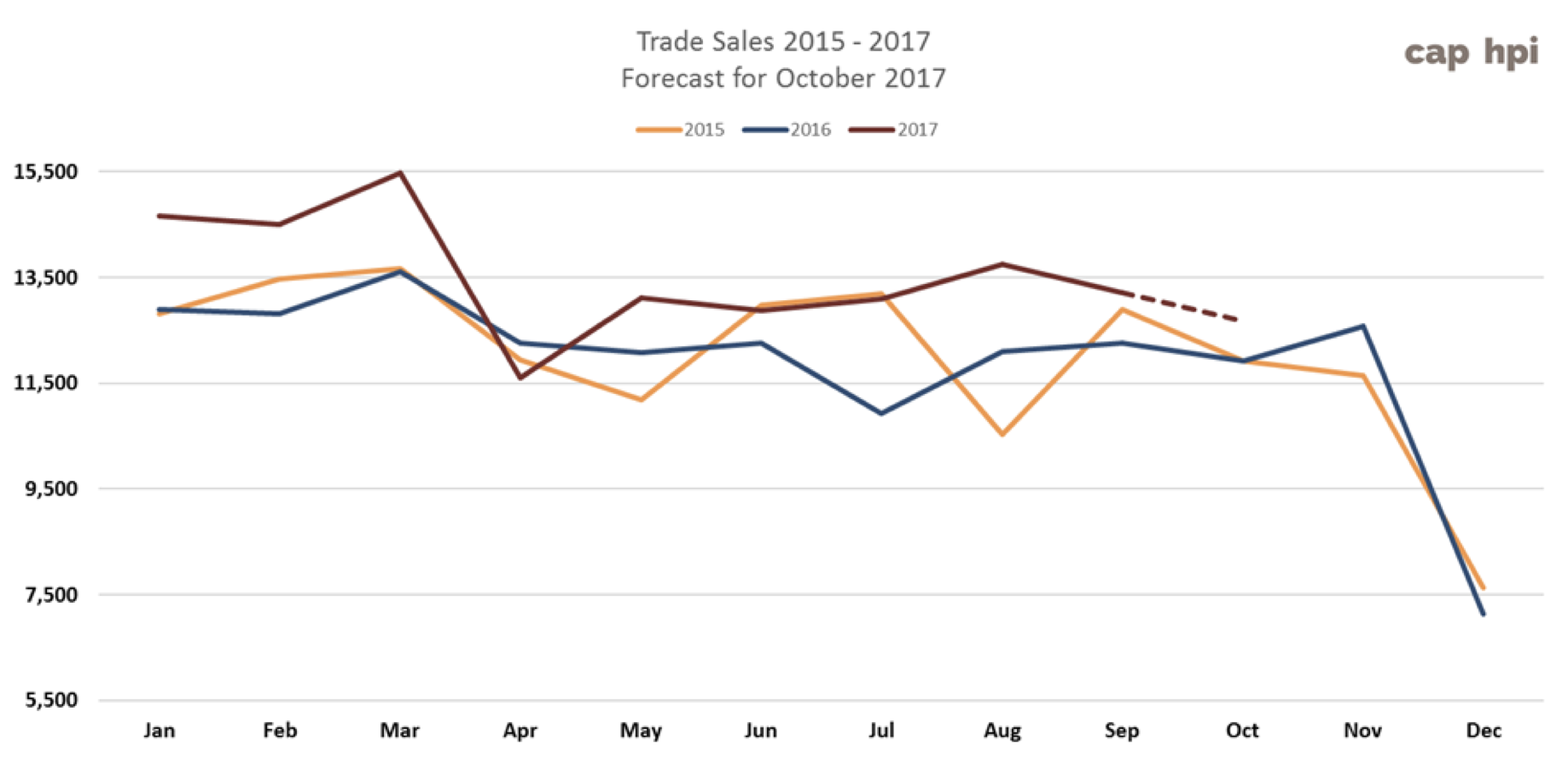

Actual sales at auctions were well above last month’s forecast and it’s looking like November is set to continue in the same vein which is pretty much in line with the trend we have seen over the previous two years.

From the comments we’ve picked up the general feelings in the trade is that there is a serious shortage of used stock around with little mention of any let-up in used LCV retail demand.

Looking back at the historical sales on new LCVs over the past three years, as we’ve mentioned several times this year in this editorial, there ought to be more stock returning to the used market but it simply isn’t coming back quick enough. Since a large proportion of LCVs remarketed through auctions comes from the vehicle leasing sector, this suggests that either operators are unwilling to sign new leasing contracts due to continuing economic and political uncertainty, or, the market is feeling the effects of the shift away from the traditional 3 year lease model to longer terms.

Our view is that the shift towards longer leases may be having some effect but, as we teeter on the edge of a Brexit-induced recession with who knows what that is going to entail, beleaguered business bosses are looking for ways to limit risk and reduce operating costs. Re-negotiating a new contract on an existing vehicle when the lease agreement is coming to an end is one way of dramatically reducing leasing costs since a new agreement would be based on what the vehicle is worth when the original lease ends.

Whatever the causes are, the effects on the new LCV market are that, between January and September, registrations were down by 3.1% year on year. To put that into perspective, that’s around 9,050 less new LCVs registered so far in 2017 than in 2016. With October-December registrations still to come, potentially that could add at least another 2,600 to the deficit.

The vehicle manufacturer’s production lines, which have been steadily gaining momentum since the last recession, inevitably take their time in to slow down. Meanwhile their sales teams still have their targets to achieve and have to resort to ever more aggressive price-led marketing initiatives. With many manufacturers already offering large discounts off new products, even heftier discounts are likely to become more widespread if new LCV registrations continue to fall squeezing used LCV dealer profit margins even further.

|

August 2017 |

September 2017 |

October 2017 |

||||

|

LCV Sector |

Market Share |

Performance |

Market Share |

Performance |

Market Share |

Performance |

|

City Van |

5.24% |

98.28% |

5.42% |

98.01% |

4.74% |

99.95% |

|

Small Van |

28.10% |

98.31% |

28.72% |

98.02% |

28.92% |

98.28% |

|

Medium Van |

26.50% |

100.25% |

25.12% |

100.03% |

24.31% |

101.82% |

|

Large Van |

18.83% |

99.08% |

20.07% |

100.44% |

18.44% |

101.05% |

|

Over 3.5T |

0.19% |

108.23% |

0.18% |

106.92% |

0.18% |

102.89% |

|

4x4 Pick-up Workhorse |

1.67% |

99.21% |

1.85% |

97.24% |

1.75% |

99.57% |

|

4x4 Pick-up Lifestyle SUV |

11.11% |

98.60% |

9.78% |

100.40% |

12.84% |

99.50% |

|

Forward Control Vehicle |

0.16% |

100.71% |

0.05% |

96.13% |

0.08% |

101.25% |

|

Chassis - Derived |

5.01% |

97.96% |

5.71% |

97.83% |

6.33% |

98.68% |

|

Mini-bus |

1.13% |

97.25% |

1.44% |

96.73% |

0.90% |

97.45% |

|

Vat Qualifying |

1.99% |

99.05% |

1.62% |

99.30% |

1.41% |

99.47% |

|

Total Market |

100.00% |

99.02% |

100.00% |

99.23% |

100.00% |

99.95% |

Based on the research data gathered last month, average market prices remained relatively stable across all sectors as did the sector market share. From our own observations at auctions, as you might expect at this time of year, demand for medium and large panels vans was particularly strong which is reflected in the above average performance of both sectors. Also worthy of note is the 4x4 Lifestyle sector. Although buyers seemed to be blowing hot and cold at times and sector prices have weakened slightly, demand was showing signs of increasing.

|

November: LCV Used Guide Price Movements 3 year / 60k |

||

|

LCV Sector |

Average % Movement |

Average £ Movement |

|

City Van |

-0.50% |

-£16 |

|

Small Van |

-0.78% |

-£35 |

|

Medium Van |

1.73% |

£168 |

|

Large Van |

0.36% |

£29 |

|

Over 3.5T |

-0.37% |

-£38 |

|

4x4 Pick-up Workhorse |

-1.11% |

-£137 |

|

4x4 Pick-up Lifestyle SUV |

-0.79% |

-£86 |

|

Forward Control Vehicle |

-0.04% |

-£4 |

|

Chassis - Derived |

-0.83% |

-£76 |

|

Mini-bus |

0.67% |

£66 |

|

Vat Qualifying |

-0.77% |

-£84 |

This table shows how much the market prices have moved in each sector in this edition of Red Book. Based on feedback from some of our subscribers we have modified the table so it now shows just the average movement both as a monetary value and as a percentage.

It clearly shows how the increased demand and, to some extent, the limited supply of Medium and Large panel vans has impacted on market prices.

The Top 10 Models in each sector tables below are intended to give you a clearer picture of the models that are driving the prices in the used LCV Market. It should be noted that that the Sector Share is based on actual sales and not the availability of these models in the marketplace. The %cap performance values are also based on actual sales.

Since our guide values reflect the market prices of basic vans in plain white as they appear in the vehicle manufacturer’s price lists, some of guide price movements you might see in this edition may not correlate directly with the sales performances shown in the tables which include vehicles in all colours and specifications.

|

CAPId |

City Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||

|

24229 |

BIPPER DIESEL - 1.3 HDi 75 S [SLD] [non Start/Stop] |

6.84% |

92.4% |

95.0% |

||||||||||

|

24231 |

BIPPER DIESEL - 1.3 HDi 75 S Plus Pack [SLD] [non Start/Stop] |

6.13% |

86.0% |

97.1% |

||||||||||

|

26324 |

FIESTA DIESEL - 1.5 TDCi Van |

6.13% |

108.5% |

103.1% |

||||||||||

|

24217 |

NEMO DIESEL - 1.3 HDi Enterprise [non Start/Stop] |

5.66% |

97.1% |

101.1% |

||||||||||

|

11121 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

4.48% |

92.5% |

98.8% |

||||||||||

|

24216 |

NEMO DIESEL - 1.3 HDi LX [non Start/Stop] |

3.77% |

94.9% |

96.3% |

||||||||||

|

26326 |

FIESTA DIESEL - 1.6 TDCi ECOnetic Van |

3.77% |

100.0% |

104.3% |

||||||||||

|

20357 |

BIPPER DIESEL - 1.3 HDi 75 SE EGC |

3.54% |

143.9% |

111.4% |

||||||||||

|

21678 |

ASTRAVAN DIESEL - Club 1.7 CDTi ecoFLEX Van |

2.59% |

104.0% |

110.8% |

||||||||||

|

9733 |

ASTRAVAN DIESEL - Club 1.7 CDTi Van |

2.59% |

97.1% |

101.9% |

||||||||||

|

With sector market share of 4.74% sales volumes were down by just over 0.5% last month whilst overall sales performance against the guide values improved by just under 2%. After taking into account colour and the condition on average market prices appeared to have stabilised therefore the majority of values in this edition remain unchanged with the following exceptions…

|

||||||||||||||

|

CAPId |

Small Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||

|

20709 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Van |

11.42% |

96.9% |

104.4% |

||

|

18445 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg Enterprise 75ps |

10.39% |

100.5% |

98.3% |

||

|

22432 |

PARTNER L1 DIESEL - 850 S 1.6 HDi 92 Van [SLD] |

4.27% |

101.0% |

101.1% |

||

|

16514 |

TRANSIT CONNECT 230 LWB DIESEL - High Roof Van TDCi 90ps |

2.63% |

95.7% |

96.8% |

||

|

26689 |

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 115ps Limited Van |

2.33% |

101.4% |

99.4% |

||

|

25176 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Highline Van |

2.28% |

106.8% |

103.4% |

||

|

18446 |

BERLINGO L1 DIESEL - 1.6 HDi 850Kg Enterprise 90ps |

2.20% |

102.0% |

94.2% |

||

|

26672 |

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 75ps Van |

2.16% |

89.8% |

89.8% |

||

|

28266 |

CADDY C20 DIESEL - 1.6 TDI 102PS Startline Van |

2.16% |

97.8% |

98.8% |

||

|

30768 |

NV200 DIESEL - 1.5 dCi Acenta Van |

1.85% |

106.5% |

103.1% |

||

|

Running at 28.92% of all LCVs sold in October, the sector market share for Small Vans remained much the same as September as did the overall price performance at 98.28%. After taking into account colour and condition the market prices of most models appeared to be relatively stable. Consequently, the guide values for all models in this sector remain the same as last month with the exception of the new shape TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 75ps Van. The trade didn’t appear to have any appetite for this model at the October guide price. Whilst they were available in reasonable numbers it certainly wasn’t a case of the market being over-supplied. The vast majority of this great looking van were in very good condition but just didn’t seem excite the trade buyers for reasons which, so far, we haven’t been able to fathom. We have no option but to reflect current market sentiment for this model which is why we have dropped the values by 5% in this edition. We will be keeping a close eye on its future performance.

|

||||||

|

CAPId |

Medium Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||||||||||||||

|

24636 |

TRANSPORTER T28 SWB DIESEL - 2.0 TDI BlueMotion Tech 84PS Van |

6.91% |

114.1% |

113.0% |

||||||||||||||||||||||

|

25441 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

4.28% |

100.5% |

99.4% |

||||||||||||||||||||||

|

10435 |

VIVARO LWB DIESEL - 2.0CDTI [115PS] Van 2.9t |

3.58% |

95.4% |

100.1% |

||||||||||||||||||||||

|

25446 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

2.98% |

101.6% |

100.1% |

||||||||||||||||||||||

|

18442 |

DISPATCH L1 DIESEL - 1000 1.6 HDi 90 H1 Van Enterprise |

2.78% |

100.5% |

99.2% |

||||||||||||||||||||||

|

25437 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

2.59% |

99.5% |

99.2% |

||||||||||||||||||||||

|

25450 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

2.04% |

101.1% |

102.3% |

||||||||||||||||||||||

|

24325 |

VIVARO LWB DIESEL - 2.0CDTI [115PS] Van 2.9t Euro 5 |

1.99% |

97.3% |

101.1% |

||||||||||||||||||||||

|

25475 |

TRANSIT CUSTOM 290 L2 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

1.99% |

98.6% |

100.2% |

||||||||||||||||||||||

|

25440 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Trend Van |

1.69% |

99.0% |

99.0% |

||||||||||||||||||||||

|

Accounting for around a quarter of all used LCVs last month with a sale price performance of 102.82%, market prices strengthened by improvement almost 2% last month. However as always there were some winners and losers that we were able to identify from our research. Overall the sector market prices remained level so a large proportion of the guide prices for this sector are unchanged in this edition with some notable exceptions listed below.

Also worthy of note were a large number of ex-utility Vivaro all of which had internal racking, roof rack/pipe holder and hand-washing facility which were selling well above the guide values. The same could be said of a large number of 84 PS Transporters from a large media and telecommunications company - again with roof racks and internal racking that were being snapped up by the trade for well above the guide prices.

|

||||||||||||||||||||||||||

|

CAPId |

Large Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||||||||

|

9158 |

TRANSIT 280 SWB DIESEL FWD - Medium Roof Van TDCi 85ps |

5.27% |

99.2% |

100.7% |

||||||||||

|

26863 |

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van |

4.85% |

101.0% |

101.7% |

||||||||||

|

30637 |

TRANSIT 350 L3 DIESEL RWD - 2.2 TDCi 125ps H3 Van |

2.94% |

95.6% |

97.7% |

||||||||||

|

9104 |

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

2.46% |

92.9% |

96.1% |

||||||||||

|

22129 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 100ps |

2.40% |

105.1% |

103.9% |

||||||||||

|

9551 |

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van |

2.40% |

109.0% |

101.2% |

||||||||||

|

9155 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

2.34% |

111.1% |

98.4% |

||||||||||

|

22130 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van ECOnetic TDCi 100ps |

1.86% |

102.2% |

100.2% |

||||||||||

|

33533 |

MASTER LWB DIESEL FWD - LM35dCi 125 Business Medium Roof Van |

1.86% |

100.3% |

100.1% |

||||||||||

|

22118 |

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 100ps |

1.80% |

97.6% |

101.3% |

||||||||||

|

The Large Van market share of total LCV sales returned to near normal levels last month at 18.44% whilst average sales performance was up by just over 1% against the guide. However, for the majority of models in this sector market prices remained level with the over performance attributed to the model ranges listed below.

|

||||||||||||||

CAPId

4x4 Pick-up Lifestyle SUV

Sector Share

%CAP

%CAP All Colours Condition Adjusted

18622

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD 176Bhp

6.56%

99.1%

99.6%

22418

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 4WD

4.89%

98.8%

98.8%

19135

NAVARA DIESEL - Double Cab Pick Up Tekna 2.5dCi 190 4WD

4.89%

100.3%

99.3%

18672

L200 LWB LB DIESEL - D/Cab DI-D Warrior II 4WD 176Bhp [2010]

3.89%

100.5%

97.3%

35285

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD Auto

3.56%

102.5%

102.5%

21668

HILUX DIESEL - Invincible D/Cab Pick Up 3.0 D-4D 4WD 171

3.56%

96.3%

97.9%

35284

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD

3.33%

102.3%

102.3%

22419

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 4WD Auto

3.33%

100.5%

98.8%

19137

NAVARA DIESEL - D/Cab Pick Up Tekna [Connect] 2.5dCi 190 4WD

3.22%

102.1%

98.8%

35282

L200 DIESEL - Double Cab DI-D 178 Warrior 4WD

3.11%

101.9%

101.9%

Sales of Lifestyle Pick-ups were up by just over 3% last month whilst the average price performance against the guide was down by just under 1%. A downward market movement of -1% has been applied to most models in this sector with the following notable exceptions. The guide values for these haven’t changed in this edition with the exception of Great Wall Pick-ups. Whilst they are not seen that often at auctions there were reasonable number sold last month but they failed to reach the guide values by a wide mark.

FORD RANGER (15- ) PICK-UP LIFE (0%)

MITSUBISHI L200 (01-02) PET PICK-UP LIFE (0%)

GREAT WALL (11- ) (-5%)

MITSUBISHI L200 (01-07) TD/TD 113 LIFE (0%)

ISUZU D-MAX DIESEL (17- ) (0%)

NISSAN NAVARA (10-16) LIFE (0%)

MITSUBISHI L200 (15- ) DI-D LIFE (0%)

TOYOTA HILUX (01-10) PICK-UP LIFE (0%)

NISSAN NAVARA E6 (16- ) LIFE (0%)

FORD RANGER (02-06) PICK-UP LIFE (0%)

TOYOTA HILUX E6 (16- ) LIFE (0%)

FORD RANGER (06-09) PICK-UP LIFE (0%)

VW AMAROK (16- ) LIFE (0%)

NISSAN NAVARA (03-05) LIFE (0%)

FORD RANGER (11-16) PICK-UP LIFE (0%)

NISSAN NAVARA (05-07) LIFE (0%)

NISSAN NP300 NAVARA (16-16) LIFE (0%)

NISSAN NAVARA (06-10) LIFE (0%)

TOYOTA HILUX (10-16) D-4D LIFE (0%)

TOYOTA HILUX (93-01) PICK-UP LIFE (0%)

FORD RANGER (09-11) LIFE (0%)

HGV MARKETPLACE

CAPId

4x4 Pick-up Workhorse

Sector Share

%CAP

%CAP All Colours Condition Adjusted

21665

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 144

12.24%

98.4%

99.9%

26500

NAVARA DIESEL - Double Cab Pick Up Visia 2.5dCi 144 4WD

7.48%

99.0%

99.0%

30784

HILUX DIESEL - Active D/Cab Pick Up 2.5 D-4D 4WD 144

6.12%

93.8%

93.8%

21676

DISCOVERY DIESEL - Commercial Sd V6 [255] Auto

3.40%

108.1%

108.1%

18668

L200 LWB LB DIESEL - Double Cab DI-D 4Work 4WD 134Bhp [2010]

3.40%

100.5%

100.5%

11064

DEFENDER 90 SWB DIESEL - Hard Top TDCi

2.72%

118.8%

100.9%

24963

D-MAX DIESEL - 2.5TD Double Cab 4x4

2.72%

98.0%

98.0%

11073

DEFENDER 110 LWB DIESEL - Hard Top TDCi

2.72%

97.8%

89.1%

22413

RANGER DIESEL - Pick Up Double Cab XL 2.2 TDCi 150 4WD

2.04%

75.6%

100.2%

21663

HILUX DIESEL - HL2 Pick Up 2.5 D-4D 4WD 144

2.04%

95.4%

95.4%

Sales of 4x4 Workhorse Pick-ups accounted for less than 2% of the total used LCV market last month, however, month on month sales performance improved significantly at sector level with average values achieving just 0.5% below the guide values. With limited hard research data to go on the information we pick up from attending auctions is crucial to our price review process. The guide values for most model ranges in this sector remain the same as last month with the following notable exceptions…

LAND ROVER (11-16) DEFENDER 90 110 130 TDCi (-1%)

NISSAN NAVARA (13-16) PICK UP (-1%)

LAND ROVER DISCOVERY (09- ) (2%)

LAND ROVER (98-06) DEFENDER 110 Td5 (-1%)

LAND ROVER (07-11) DEFENDER 90 110 130 TDCi (-1%)

LAND ROVER (98-06) DEFENDER 130 Td5 (-1%)

LAND ROVER DISCOVERY (07-09) (-3%)

LAND ROVER (98-07) DEFENDER 90 Td5 (-1%)

NISSAN NP300 NAVARA (16-16) PICK-UP (-1%)

LAND ROVER (98-99) DEFENDER 90 PET (-1%)

LAND ROVER (05-07) DEFENDER 110 Td5 (-1%)

NISSAN NAVARA (02-05) WORK (-1%)

LAND ROVER (06-07) DEFENDER Td5 130 (-1%)

NISSAN NAVARA (05-08) WORK (-1%)

LAND ROVER DISCOVERY (93-05) Tdi Td5 (-1%)

Auction stocks remain lower than at this time last year but buyers continue to attend most auctions in numbers. However, there remains a problem at a couple of auctions where after lunchtime people drift away and by the end of the auction sometimes only a handful of buyers remain.

Over the last few weeks there has been plenty of fresh stock available which creates interest at the initial sale, but once vehicles start reappearing in subsequent sales interest weakens markedly. Such vehicles continue to be an ongoing problem for both vendors and auctions because selling something which nobody wants or at a reserve value that is too high is difficult to manage for any period of time, so something has to give.

Once such vehicles were bread and butter for export, but the absence of many exporters from the auction circuit and with domestic buyers being more cautious in their purchasing one wonders where this stock will eventually end up.

UK based exporters report that exporting at present is becoming more difficult. Some traditional export markets are being targeted by Chinese manufacturers offering new vehicles with cheap finance and those that do want used vehicles are being more selective and are looking for newer vehicles.

Poor fuel quality in some areas of the world preclude the use of newer used European vehicles without some re-engineering which costs money. Also, the fact that trucks can no longer be easily repaired at the roadside requires a workshop and parts infrastructure which is lacking in many countries, hence the desirability of cheap new Asian trucks and finance.

Euro 6 rigids remain scarce and are highly sought after where the demand is outstripping supply and on the odd occasion such vehicles appear for sale they are snapped up.

Some dealer’s report that it is quiet at present with few incoming enquiries, one pointing out that the traditionally quiet summer holiday period has continued and business has yet to pick up. Conversely several traders confirmed that they are reasonably busy with some having potential orders which could be fulfilled if only they could find the right vehicle at the right price.

Manufacturer sales remain buoyant with Euro 6 vehicles selling particularly well. One manufacturer reports that better management of vehicle returns is being used to maximise the potential revenues for used Euro 6 vehicles. By talking to their customers well in advance of when a vehicle is due to terminate there is less chance of the customer requesting an extension. Any extension which are agreed are now strictly judged on a commercial basis and when agreed they will only be for a maximum of three months. This is a win-win situation at present because returning vehicles can be pre-sold and the existing customers are committing to a new vehicle.

Records from our auction visits indicate that the average number of auction entries fell again last month by over 9%. The number of on-the-day sales of trucks increased slightly in relation to total entries and trailer sales increased by a little over 6%. This is based on nine auction visits and a total of 923 viewed lots. As we always point out these are ‘hammer sales’ on-the-day and converted provisional sales are not included. One auction reports that the conversion rate of provisional sales remains at last month’s level of around 60%.

This month’s research indicates that:

- Up to 7.5t – Values have remained steady.

- 5t to 12t – With the exception of Euro 6 variants Values have fallen on boxes, curtains and fridges but dropside and tippers have seen values increase.

- 13t to 18t – Excepting boxes and curtains where there has been a slight fall in values the value of other derivatives remain stable.

- Multi-wheel rigids – Three axle vehicles have seen values decrease a little whilst the values of eight wheelers has remained steady.

- Tractor units – Pre Euro 5 4x2 values have fallen but Euro 5 values have been stable. 6x2’s values have seen a bit of a renaissance recently with values increasing for some Euro 5 and pre Euro 5 models.

- Trailers – With the exception of platforms which continue to go from strength to strength values have remained steady.

7.5t to 12t Vehicles

Plenty more Euro 5 7.5t boxes have flowed into the market which are predominantly 2012 and 2013 DAF’s. Most are selling but values remain under pressure. Older boxes are also plentiful and buyers continue to have a wide choice to select from.

Most examples in this sector currently on offer are over seven years old and only the best examples are selling. Dropsides and tippers have appeared on the auction circuit and whilst some are new enough and tidy enough to provoke strong interest, mileage plays a big factor in prices paid and on the whole both have been strong performers of late.

Curtains are far fewer than boxes and often sell well when they appear but they too are subject to the aforementioned caveats in order to realise best value.

Car transporters always provoke good interest, especially when end users are present. Numerous 12t Renault Midlum 220 crew cab tilt and slide vehicles proved popular as did a selection of 7.5t and 10t day cab double deck examples from a respected lease company.

A couple of 12t DAF FA LF180 left hand drive Johnston dual sweep sweepers with low mileage also proved popular lots and both sold easily on the day.

A tidy 11 plate Mitsubishi Canter 7C18 beavertail with manual gearbox with only 32,600 warranted kilometres and a long MOT was a popular auction lot and whilst bidding was brisk it failed to reach its reserve value.

13t to 18t Vehicles

A good number 18t boxes and curtains, mainly DAF’s, have appeared at auction recently and values are starting to be affected. Once again most were new enough to provoke strong bidding especially on the low mileage examples which played a big factor in prices paid. Most of the vehicles sold on the day but it was those with high mileages which failed to sell, however, the provisional bids would probably have been good enough to have secured their sale.

Ten year old 13t Mercedes Benz fridges from a wholesale food distribution company continue to appear in numbers and sales have progressed steadily despite their generally poor specification and condition. That said, the worst examples are beginning to struggle in enticing buyers.

Several DAF LF chassis cabs from a bottle gas company have appeared at several different auctions and they proved popular lots, as did anything non-standard, and late dropsides fitted with cranes which usually attract additional interest.

Despite it being the buying season for gritters, there are few signs of any additional interest at present but this may change at the outset of the first cold snap. Refuse trucks are selling but only if the price is right and tippers and skip loaders remain popular but this may change as we progress into winter and any needing remedial work sees their desirability decrease.

Glass carriers are not commonly seen and usually attract little interest, however a pair of 08 plate Volvo FL280 day cab glass carrier boxes provoked good interest and both sold easily.

Multi-wheelers

With a few exceptions the run of the mill three axle derivatives are not selling so easily unless they are late registered or have low kilometres. Boxes continue to be remain relatively scarce when compared to curtains and fridges which are in good supply but are of varying age and quality. Platforms are also readily available, some carrying cranes but again age and condition do not necessarily play in their favour. With the exception of tippers four-axle variants are less common and continue to maintain buyer interest.

The cement mixers mentioned last month have reappeared and they are still struggling to attract sufficient interest for them to sell. Refuse trucks of varying combinations have been available to purchase and sold examples include a selection of 2009 59 plate Dennis Elite 2629 6x4 crew cab twin pack RCV’s from a London Borough which achieved around £4,000 each.

A 14 plate EU6 Iveco Stralis 360 6x2 day curtain with 144,000 km’s prompted strong bidding but it failed to meet the reserve value, however the fact that it failed to reappear at a subsequent sale suggests a deal was struck post sale.

Car carriers have been mentioned in previous editorials and one example currently circulating at auction is a 06 plate Scania P420 sleeper 6x2 with a Transporter Engineering trailer. This low mileage example for its age struggled to achieve bids of £6000 even with a long MOT.

An unusual drawbar rig which sold recently was a 09 plate Volvo FL280 drawbar jet vac tanker complete with a tandem axle 2200 gallon tanker trailer which sold for £47,500. Tankers, dependent on their application and specification, can either attract strong bids or muster little interest. Either way hoses, reels and all the necessary paperwork is required in order to obtain the best result.

Tractor Units

More Euro 5 6x2 examples continue to flow into an already saturated market and there is a good selection of most marques and specifications, to choose from. A smattering of Euro 6 examples have appeared, all Mercedes Benz, and good money was been bid but most have failed to sell, possibly as the vendor has high expectations.

Vehicles aged four to six years old are plentiful at present and they often struggle to sell but those that do are showing signs of increasing values, whether it is the time of year and Christmas orders require fulfilling will become apparent in the New year, but for now there is a bit of a renaissance happening with 6x2’s values.

Older examples, mainly over ten years old, are less numerous and often sport a manual gearbox are also having more success in finding new homes.

4x2 variants are far less numerous than 6x2 examples and often sell a little quicker but condition, mileage, specification and quite often the badge on the front grille, influence to the eventual outcome.

6x4 tractor units remain scarce and often sell with little difficulty as they appear.

Trailers

The number of trailers available remains in decline and with an increase in on-the-day auction sales things are reasonably steady in the trailer market and values have remained steady with the exception of platfoms which are doing particularly well at present, possibly due to their scarcity. This time of the year is usually when ready to roll box and curtain trailers are in most demand when they are purchased to supplement an operator’s short-term additional requirements in the pre-Christmas period.

Good quality newer trailers, irrespective of body type are attracting reasonable offers but the age and condition of many trailers currently available is not conducive to further use and they are unlikely to find buyers quickly.

Tippers of all types generally provoke interest and fridges have been a little more popular recently and as already mentioned platforms remain particularly popular, especially extendable ones or those fitted with twist-locks.

Skeletals, either locked or extenders, which were so plentiful not so long ago continue to struggle a little and double deck curtain trailers are proving more popular at auction than double deck boxes which are often bespoke to the original operator.

Senior Editor

+44 (0) 113 360 7211

steven.botfield@cap-hpi.com