Looking for a Vehicle Valuation or HPI Check?

Last month was yet another exceptionally strong month for used LCV sales with high demand across all sectors. Some auctions we attended were busier than others but much of this seemed to be down to the number of lots on sale. With LCV auctions on nearly every day each month there is plenty of choice and, as always, the larger sales draw in the biggest number of buyers.

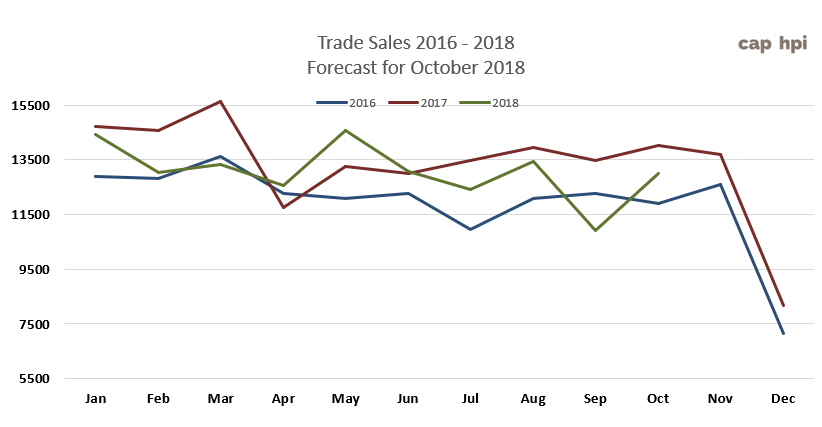

Whilst we would normally expect higher used LCV sales volumes during October and November, the rate of increase we saw last month appears to be particularly high. According to our latest Trade Sales Forecast, if demand continues to increase at the same rate, Quarter 4 sales seem set to outstrip those seen in 2017.

Having said that, from our observations at auctions, there were some signs that stock shortages might be on the way as we witnessed many examples of professional buyers paying well above the guide prices for vehicles that were exhibiting significant amounts of damage, particularly in the medium and large van sectors.

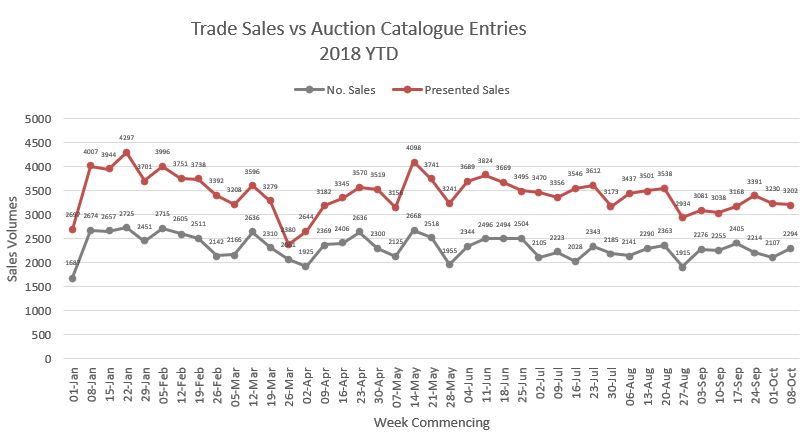

The notion that there may be a supply problem looming is borne out by the chart below which combines trade sales with auction catalogue entries. Although it’s only marginal at this time it does clearly show that the number of vehicles presented for sale has been falling since the middle of September whilst actual sales have been steadily increasing.

If demand continues at the current rate with no significant increase in the supply of used LCV stock this can only add to the upward pressure on market prices we are already seeing.

Supply Trend: Auction Catalogue Entries

|

Nov-17 |

Dec-17 |

Jan-18 |

Feb-18 |

Mar-18 |

Apr-18 |

May-18 |

Jun-18 |

Jul-18 |

Aug-18 |

Sep-18 |

Oct-18 |

|

|

Auction Entries % Var |

5% |

-1% |

2% |

6% |

-16% |

-9% |

25% |

-3% |

3.60% |

0% |

-14% |

8% |

|

Re-Entries |

28.70% |

34.17% |

19.90% |

24.25% |

21.74% |

19.00% |

22.96% |

27.65% |

31.18% |

30.37% |

24.52% |

24.51% |

|

New Entries |

71.30% |

65.83% |

80.10% |

75.75% |

78.26% |

81.00% |

77.04% |

72.35% |

68.82% |

69.63% |

75.48% |

75.49% |

|

Average age (Months) |

61 |

58 |

59 |

60 |

61 |

64 |

63 |

61 |

60 |

61 |

61 |

60 |

|

Average Mileage |

76,195 |

72,451 |

72,318 |

74,589 |

75,676 |

76,127 |

75,780 |

74,631 |

76,993 |

76,087 |

74,994 |

75,074 |

October was a slightly longer month in terms of the number of auction sale days calendar which to some extent explains the 8% month on month increase in supply. However, the daily average auction entries remained much the same as the previous month at most sales as did the number of auction re-entries at 24.51%. The average age of stock was down slightly at 60 months whilst the average mileage was up marginally at 75,074.

Looking at previous supply trends it’s highly unlikely that we will see any significant increase in auction entries throughout November.

Sales Performance by Sector

|

August 2018 |

September 2018 |

October 2018 |

||||

|

LCV Sector |

Market Share |

Performance |

Market Share |

Performance |

Market Share |

Performance |

|

City Van |

4.38% |

100.52% |

4.02% |

98.76% |

3.77% |

99.61% |

|

Small Van |

23.72% |

99.81% |

22.29% |

101.11% |

24.40% |

100.98% |

|

Medium Van |

31.20% |

99.82% |

30.84% |

99.55% |

28.53% |

100.13% |

|

Large Van |

17.49% |

98.60% |

19.30% |

99.22% |

18.05% |

98.47% |

|

Over 3.5T |

0.26% |

102.58% |

0.27% |

100.59% |

0.20% |

106.51% |

|

4x4 Pick-up Workhorse |

2.33% |

96.19% |

2.84% |

98.05% |

3.07% |

100.06% |

|

4x4 Pick-up Lifestyle SUV |

13.33% |

99.35% |

12.08% |

100.47% |

12.85% |

100.54% |

|

Forward Control Vehicle |

0.22% |

98.45% |

0.15% |

96.87% |

0.21% |

98.27% |

|

Chassis - Derived |

5.43% |

99.12% |

5.78% |

99.03% |

6.80% |

98.76% |

|

Mini-bus |

0.49% |

105.54% |

0.79% |

103.80% |

0.34% |

105.41% |

|

Vat Qualifying |

1.12% |

99.69% |

1.47% |

103.12% |

1.52% |

99.27% |

|

Total Market |

100.00% |

99.48% |

100.00% |

99.92% |

100.00% |

99.98% |

|

November: LCV Used Guide Price Movements 3 year / 60k |

||

|

LCV Sector |

Average % Movement |

Average £ Movement |

|

City Van |

-0.2% |

-£8 |

|

Small Van |

0.1% |

£4 |

|

Medium Van |

2.2% |

£236 |

|

Large Van |

-0.7% |

-£67 |

|

Over 3.5T |

2.0% |

£226 |

|

4x4 Pick-up Workhorse |

0.6% |

£73 |

|

4x4 Pick-up Lifestyle SUV |

0.8% |

£93 |

|

Forward Control Vehicle |

-0.3% |

-£30 |

|

Chassis - Derived |

-0.2% |

-£17 |

|

Mini-bus |

2.9% |

£333 |

|

Vat Qualifying |

1.5% |

£189 |

Updated - Vehicle Colour/Price Guide

Whilst auction catalogue entries always specify colour, it’s the guide values of White vans that you will see printed in the auction catalogues.

Every month in this editorial we remind our subscribers that the published guide values in the LCV section of Red Book are for standard vehicles in plain white as they appear in the vehicle manufacturer’s price lists.

It’s widely accepted within the remarketing industry that age, mileage and condition aren’t the only factors that can affect how much a used vehicle is worth, colour is extremely important too. Whilst traditionally there have been fewer standard colours to choose from when buying a commercial vehicle, over recent years that’s changed as vehicle manufacturers have responded to a growing demand for vehicles in a much greater range of colours. Some manufacturer’s will also supply vehicles in factory-painted in corporate colours to fulfil certain large fleet orders adding even more colours into the mix of vehicles which eventually come back into the used LCV market.

Whilst white remains the colour choice for most new LCV buyers, increasingly we are seeing more and more vans in other colours entering the used market. The chart below is intended as a guide to illustrate how more or less in percentage terms you would expect to pay for a vehicle in any of the colours listed. For example, if you were bidding on a Silver van in the City Van sector you can expect to pay on average 1.80% more than you’d pay for the same van in White. The values shown in this table are based on actual trade sales of vehicles at open auctions and that at any given time the market values of vehicles are dependent on many other factors such as supply volume and condition.

|

Colours |

City Van |

Small Van |

Medium Van |

Large Van |

4x4 Workhorse |

4x4 Lifestyle |

Mini-bus |

VAT Qualifying |

|

White |

cap Average |

cap Average |

cap Average |

cap Average |

cap Average |

cap Average |

cap Average |

cap Average |

|

Silver |

1.80% |

3.32% |

2.64% |

4.53% |

1.18% |

1.04% |

-1.07% |

1.73% |

|

Blue |

-0.54% |

0.01% |

2.29% |

0.29% |

1.06% |

0.87% |

-1.75% |

1.39% |

|

Black |

3.68% |

4.56% |

3.69% |

3.57% |

2.19% |

0.84% |

4.00% |

|

|

Grey |

4.65% |

5.30% |

4.15% |

3.52% |

2.20% |

1.23% |

4.42% |

|

|

Red |

0.78% |

-0.51% |

1.81% |

-1.58% |

0.96% |

0.07% |

1.90% |

|

|

Yellow |

-3.69% |

-3.90% |

-6.37% |

-7.74% |

||||

|

Green |

-1.50% |

-3.05% |

-2.98% |

-2.31% |

1.56% |

0.16% |

4.68% |

|

|

Orange |

-1.14% |

5.88% |

1.11% |

1.18% |

||||

|

Brown |

1.33% |

1.59% |

-1.26% |

Top 10 models driving the used LCV Market

The Top 10 tables below give you a clear picture of the makes and models in the main LCV sectors that are driving prices in the used LCV Market. Arranged in order of their respective share of total sector sales, the percentage CAP performance is based on actual recorded sales at open auctions.

Since our guide values reflect the market prices of basic vans in plain white as they appear in the vehicle manufacturer’s price lists, some of guide price movements you might see in this edition may not correlate directly with the sales performances shown in the tables since these include vehicles in all colours and specifications.

|

CAPId |

City Van |

Sector Share |

%CAP |

%CAP White Only Condition Adjusted |

||||

|

26324 |

FIESTA DIESEL - 1.5 TDCi Van |

11.63% |

108.6% |

99.5% |

||||

|

24216 |

NEMO DIESEL - 1.3 HDi LX [non Start/Stop] |

4.94% |

87.3% |

99.5% |

||||

|

26290 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van [Start/Stop] |

4.94% |

107.7% |

104.4% |

||||

|

11121 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

4.36% |

102.0% |

104.8% |

||||

|

24217 |

NEMO DIESEL - 1.3 HDi Enterprise [non Start/Stop] |

3.78% |

98.8% |

102.6% |

||||

|

26326 |

FIESTA DIESEL - 1.6 TDCi ECOnetic Van |

3.49% |

96.1% |

100.3% |

||||

|

14411 |

FIORINO CARGO DIESEL - 1.3 16V Multijet Van |

3.49% |

91.6% |

94.3% |

||||

|

34481 |

FIESTA DIESEL - 1.5 TDCi Sport Van |

2.62% |

110.4% |

111.4% |

||||

|

30869 |

TRANSIT COURIER DIESEL - 1.5 TDCi Van |

2.62% |

89.0% |

89.0% |

||||

|

26289 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

2.62% |

92.7% |

97.9% |

||||

|

Although the City Van sector achieved on average 99.6% of the average guide price, after factoring in colour and condition most of the guide values in this sector have moved own by 1% which includes an allowance for age depreciation of each plate. However due to exceptionally strong performances there are some notable exceptions.

|

||||||||

CAPId

Small Van

Sector Share

%CAP

%CAP White Only Condition Adjusted

18445

BERLINGO L1 DIESEL - 1.6 HDi 625Kg Enterprise 75ps

10.21%

103.3%

104.4%

24234

COMBO L1 DIESEL - 2000 1.3 CDTI 16V H1 Van

2.83%

100.6%

99.8%

15182

BERLINGO L1 DIESEL - 1.6 HDi 625Kg LX 75ps

2.77%

111.0%

96.8%

28276

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Startline Van

2.60%

102.3%

99.4%

26695

TRANSIT CONNECT 240 L2 DIESEL - 1.6 TDCi 115ps Limited Van

2.25%

110.0%

102.2%

26672

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 75ps Van

2.13%

95.7%

96.6%

38471

BERLINGO L1 DIESEL - 1.6 BlueHDi 625Kg Enterprise 75ps

2.08%

104.0%

103.4%

26689

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 115ps Limited Van

1.90%

106.3%

104.5%

38515

PARTNER L1 DIESEL - 850 1.6 BlueHDi 100 Professional Van [non SS]

1.90%

96.7%

97.0%

20709

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Van

1.79%

115.5%

105.0%

Exceptionally strong demand for Small Vans was evident last month most models achieving around 100% of book. The guide prices of the following ranges remain unchanged in this edition whilst all others have gone down by 1% to allow for colour, condition and age depreciation of each plate.

CITROEN BERLINGO (16- ) VAN (0%)

CITROEN BERLINGO (08- ) VAN (0%)

FIAT DOBLO CARGO E6 (16- ) DROP (0%)

FIAT DOBLO (10- ) COMBI VAN (0%)

FIAT DOBLO CARGO E6 (16- ) VAN (0%)

FIAT DOBLO CARGO (10- ) PET VAN (0%)

FORD CONNECT (13- ) T200-T240 VAN (0%)

FIAT DOBLO CARGO (10- ) VAN (0%)

M-B CITAN (13- ) VAN (0%)

FIAT DOBLO CARGO (11- ) DROP (0%)

NISSAN NV200 (09- ) VAN (0%)

RENAULT KANGOO (13-17) VAN (0%)

RENAULT KANGOO E6 (16- ) VAN (0%)

VAUXHALL COMBO (12-17) VAN (0%)

VAUXHALL COMBO E6 (18- ) VAN (0%)

VAUXHALL COMBO E6 (16- ) VAN (0%)

VW CADDY E6 (16- ) VAN (0%)

VW CADDY (15-17) VAN (0%)

CAPId

Medium Van

Sector Share

%CAP

%CAP White Only Condition Adjusted

25441

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van

4.80%

97.6%

98.0%

25437

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van

2.90%

97.6%

97.2%

31669

VIVARO L2 DIESEL - 2900 1.6CDTI 115PS Sportive H1 Van

2.85%

101.0%

99.9%

25440

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Trend Van

2.60%

117.3%

96.6%

25446

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van

2.35%

100.7%

99.3%

31668

VIVARO L2 DIESEL - 2900 1.6CDTI 115PS H1 Van

2.30%

94.8%

96.1%

25475

TRANSIT CUSTOM 290 L2 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van

1.95%

99.1%

100.1%

25450

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van

1.90%

99.5%

98.8%

18442

DISPATCH L1 DIESEL - 1000 1.6 HDi 90 H1 Van Enterprise

1.75%

101.9%

102.4%

35807

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.0 TDCi 105ps Low Roof Van

1.70%

98.5%

98.8%

Most of the guide values in this sector have gone down by 1% in this edition with the following exceptions. The most notable of these are VW Transporter which have gone up by 3%.

CITROEN DISPATCH E6 (16- ) VAN (0%)

PEUGEOT EXPERT (07-16) VAN (0%)

PEUGEOT EXPERT E6 (16- ) VAN (0%)

VW T6 TRANSPORTER (15-16) VAN (3%)

TOYOTA PROACE E6 (16- ) VAN (0%)

VW T5 TRANSPORTER (03-14) FRIDGE (3%)

VW T6 TRANSPORTER E6 (16- ) VAN (3%)

VW T5 TRANSPORTER (10-15) VAN (3%)

VW T6 TRANSPORTER PETROL (16- ) VAN (3%)

VW T4 TRANSPORTER (96-04) VAN (3%)

CITROEN DISPATCH (07-16) VAN (0%)

VW T5 TRANSPORTER (03-10) VAN (3%)

CAPId

Large Van

Sector Share

%CAP

%CAP White Only Condition Adjusted

26863

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van

4.93%

85.6%

96.8%

30637

TRANSIT 350 L3 DIESEL RWD - 2.2 TDCi 125ps H3 Van

4.05%

92.8%

95.1%

21705

CRAFTER CR35 LWB DIESEL - 2.0 TDI 136PS High Roof Van

2.63%

101.1%

101.8%

9155

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 85ps

1.89%

97.4%

99.5%

33533

MASTER LWB DIESEL FWD - LM35dCi 125 Business Medium Roof Van

1.82%

102.0%

102.0%

9551

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van

1.69%

97.7%

89.9%

31707

BOXER 335 L3 DIESEL - 2.2 HDi H2 Professional Van 130ps

1.69%

98.3%

101.9%

9104

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 85ps

1.69%

97.2%

100.5%

31217

RELAY 35 L3 DIESEL - 2.2 HDi H2 Van 130ps Enterprise

1.55%

90.8%

95.7%

27306

SPRINTER 313CDI MEDIUM DIESEL - 3.5t High Roof Van

1.49%

94.5%

96.0%

Most models in the large van sector have gone down by 1% in this edition with the following notable exceptions.

FORD TRANSIT E6 (16- ) T290 - T350 VAN (-3%)

FORD TRANSIT (06-14) T330 - T350 VAN (-3%)

FIAT DUCATO (14- ) VAN (0%)

FORD TRANSIT (00-06) T260 T280 T300 VAN (-3%)

FORD TRANSIT (14-17) T290 - T350 VAN (-3%)

FORD TRANSIT (00-06) T330 T350 T350EL VAN (-3%)

FORD TRANSIT (06-12) T250 - T350 PET VAN (-3%)

FORD TRANSIT (01-06) PET VAN (-3%)

FORD TRANSIT (06-14) T250 - T300 VAN (0%)

CAPId

4x4 Pick-up Lifestyle SUV

Sector Share

%CAP

%CAP All Colours Condition Adjusted

18622

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD 176Bhp

4.65%

110.0%

102.7%

35284

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD

3.97%

99.9%

99.9%

25079

AMAROK A32 DIESEL - D/Cab Pick Up Highline 2.0 BiTDI 180 BMT 4MTN Auto

3.74%

106.7%

105.4%

35282

L200 DIESEL - Double Cab DI-D 178 Warrior 4WD

3.74%

97.2%

97.2%

19137

NAVARA DIESEL - D/Cab Pick Up Tekna [Connect] 2.5dCi 190 4WD

3.74%

98.3%

98.5%

19135

NAVARA DIESEL - Double Cab Pick Up Tekna 2.5dCi 190 4WD

3.74%

110.4%

100.9%

35006

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 200 Auto

3.29%

100.5%

100.5%

22415

RANGER DIESEL - Pick Up Double Cab Limited 2.2 TDCi 150 4WD

3.17%

107.7%

103.0%

35285

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD Auto

3.06%

100.6%

100.6%

35005

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 200

2.61%

100.5%

103.6%

Increasing trade demand for 4x4 Lifestyle Pick-up has led to a gradual strengthening of prices over recent weeks. However, a downward price of 1% has been necessary to many of the ranges in this edition to allow for condition and age depreciation of the plates. The following model ranges have had individual price adjustments or remain unchanged.

FIAT FULLBACK (16- ) LIFE (0%)

MITSUBISHI L200 (06-16) DI-D LIFE (0%)

FORD RANGER (15- ) PICK-UP LIFE (2%)

NISSAN NP300 NAVARA (16-16) LIFE (0%)

GREAT WALL (11- ) (-4%)

SSANGYONG KORANDO (13-16) (-2%)

ISUZU D-MAX DIESEL (17- ) (0%)

SSANGYONG KORANDO SPORT (12-17) (-2%)

MERCEDES-BENZ X CLASS DIESEL (2017- ) (0%)

SSANGYONG MUSSO E6 (16- ) (-2%)

MITSUBISHI L200 (15- ) DI-D LIFE (0%)

TOYOTA HILUX (10-16) D-4D LIFE (2%)

NISSAN NAVARA E6 (16- ) LIFE (0%)

VW AMAROK (11-17) LIFE (2%)

SSANGYONG KORANDO E6 (16- ) (-2%)

FORD RANGER (09-11) LIFE (2%)

SSANGYONG KORANDO SPORT E6 (16-17) (-2%)

ISUZU RODEO (03-07) LIFE (0%)

SSANGYONG MUSSO E6 (18- ) (-2%)

MITSUBISHI L200 (01-07) TD/TD 113 LIFE (-2%)

TOYOTA HILUX E6 (16- ) LIFE (2%)

NISSAN NAVARA (10-16) LIFE (0%)

VAUXHALL VXR8 MALOO (16- ) (-5%)

TOYOTA HILUX (01-10) PICK-UP LIFE (2%)

VW AMAROK (16- ) LIFE (2%)

FORD RANGER (02-06) PICK-UP LIFE (-2%)

FORD RANGER (11-16) PICK-UP LIFE (2%)

FORD RANGER (06-09) PICK-UP LIFE (2%)

ISUZU D-MAX DIESEL (12-18) (0%)

NISSAN NAVARA (03-05) LIFE (-2%)

ISUZU RODEO (07-12) LIFE (0%)

NISSAN NAVARA (05-07) LIFE (0%)

MAZDA BT50 (08-10) LIFE (8%)

NISSAN NAVARA (06-10) LIFE (0%)

CAPId

4x4 Pick-up Workhorse

Sector Share

%CAP

%CAP All Colours Condition Adjusted

22413

RANGER DIESEL - Pick Up Double Cab XL 2.2 TDCi 150 4WD

9.62%

98.7%

99.5%

30784

HILUX DIESEL - Active D/Cab Pick Up 2.5 D-4D 4WD 144

8.65%

95.2%

95.2%

21665

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 144

8.17%

105.9%

103.1%

35425

NP300 NAVARA DIESEL - Double Cab Pick Up Visia 2.3dCi 160 4WD

7.21%

89.9%

91.7%

16756

HILUX DIESEL - HL2 2010 D/Cab Pick Up 2.5 D-4D 4WD 144

4.81%

104.6%

98.2%

29907

DISCOVERY DIESEL - XS Commercial Sd V6 Auto

3.85%

101.2%

101.2%

34428

DISCOVERY DIESEL - SE Commercial Sd V6 Auto

3.85%

99.5%

99.5%

11073

DEFENDER 110 LWB DIESEL - Hard Top TDCi

3.85%

97.1%

93.1%

38351

HILUX DIESEL - Active D/Cab Pick Up 2.4 D-4D

3.85%

93.7%

93.7%

24963

D-MAX DIESEL - 2.5TD Double Cab 4x4

3.37%

101.4%

101.4%

With an overall sales performance of just over 100% it was another strong month for 4x4 Workhorse Pick-ups, however, whilst most model ranges have had only a 1% downward price adjustment to allow for condition and age depreciation of the plates, we have taken the opportunity to realign the values of some models which have been under-performing consistently. These exceptions are listed below.

FORD RANGER (15- ) CHASSIS PICK-UP WORK (0%)

LAND ROVER DISCOVERY (07-09) (0%)

ISUZU D-MAX DIESEL (17- ) (0%)

LAND ROVER DISCOVERY (09- ) (0%)

LAND ROVER (11-16) DEFENDER 90 110 130 TDCi (2%)

MITSUBISHI L200 (06-10) DI-D WORK (0%)

LAND ROVER DISCOVERY (18 - ) Euro 6 (0%)

MITSUBISHI L200 (10-16) DI-D WORK (-5%)

MITSUBISHI ASX DIESEL (11-14) (-5%)

MITSUBISHI SHOGUN (00-16) (2%)

MITSUBISHI L200 (15- ) DI-D WORK (0%)

NISSAN NP300 NAVARA (16-16) PICK-UP (-3%)

MITSUBISHI OUTLANDER (07- ) WORK (-5%)

TOYOTA HILUX (10-16) D-4D WORK (0%)

MITSUBISHI OUTLANDER (14- ) WORK HYBRID EV (-5%)

FORD RANGER (09-11) CHASSIS (0%)

MITSUBISHI SHOGUN (14- ) (2%)

FORD RANGER (09-11) PICK-UP WORK (0%)

NISSAN NAVARA E6 (16- ) PICK-UP (0%)

FORD RANGER (09-11) TIP (0%)

TOYOTA HILUX E6 (16- ) WORK (-5%)

LAND ROVER (05-07) DEFENDER 110 Td5 (0%)

FORD RANGER (11-16) CHASSIS WORK (0%)

LAND ROVER (06-07) DEFENDER Td5 130 (0%)

FORD RANGER (11-16) PICK-UP WORK (0%)

LAND ROVER DISCOVERY (93-05) Tdi Td5 (0%)

ISUZU D-MAX DIESEL (12-18) (0%)

NISSAN NAVARA (13-16) PICK UP (0%)

ISUZU RODEO (08-12) WORK (0%)

TOYOTA HILUX (07-10) D-4D WORK (0%)

LAND ROVER (07-11) DEFENDER 90 110 130 TDCi (0%)

The following tables are the same models as in the Top 10 above and show the current and historic values we have published in Red Book. These values are mainly for 3 year old vehicles at 60,000 miles except where it is stated otherwise in the right hand columns.

Whilst the individual performances vary the average year on year performances of each sector are…

City Van +5.7%

Small Van +4.9%

Medium Van -2.3%

Large Van +10.3%

4x4 Pick-up Work -1.6%

4x4 Pick-up Lifestyle +3%

|

CAPId |

City Van |

2018 |

2017 |

Age/Miles |

Change |

|

26324 |

FIESTA DIESEL - 1.5 TDCi Van |

£4,025 |

£3,700 |

3yr/60K |

£325 |

|

24216 |

NEMO DIESEL - 1.3 HDi LX [non Start/Stop] |

£3,200 |

£3,075 |

3yr/60K |

£125 |

|

26290 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van [Start/Stop] |

£2,200 |

£2,200 |

4yr/80K |

£0 |

|

11121 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

£1,425 |

£1,450 |

8yr/80K |

-£25 |

|

24217 |

NEMO DIESEL - 1.3 HDi Enterprise [non Start/Stop] |

£3,525 |

£3,375 |

3yr/60K |

£150 |

|

26326 |

FIESTA DIESEL - 1.6 TDCi ECOnetic Van |

£4,025 |

£3,700 |

3yr/60K |

£325 |

|

14411 |

FIORINO CARGO DIESEL - 1.3 16V Multijet Van |

£3,050 |

£2,850 |

3yr/60K |

£200 |

|

34481 |

FIESTA DIESEL - 1.5 TDCi Sport Van |

£8,875 |

£8,225 |

1yr/20K |

£650 |

|

30869 |

TRANSIT COURIER DIESEL - 1.5 TDCi Van |

£4,725 |

£4,475 |

3yr/60K |

£250 |

|

26289 |

CORSAVAN DIESEL - 1.3 CDTi 16V Van |

£2,200 |

£2,200 |

4yr/80K |

£0 |

|

CAPId |

Small Van |

2018 |

2017 |

Age/Miles |

Change |

|

18445 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg Enterprise 75ps |

£4,600 |

£4,275 |

3yr/60K |

£325 |

|

24234 |

COMBO L1 DIESEL - 2000 1.3 CDTI 16V H1 Van |

£3,350 |

£3,150 |

3yr/60K |

£200 |

|

15182 |

BERLINGO L1 DIESEL - 1.6 HDi 625Kg LX 75ps |

£4,425 |

£4,125 |

3yr/60K |

£300 |

|

28276 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Startline Van |

£5,900 |

£5,500 |

3yr/60K |

£400 |

|

26695 |

TRANSIT CONNECT 240 L2 DIESEL - 1.6 TDCi 115ps Limited Van |

£7,675 |

£7,800 |

3yr/60K |

-£125 |

|

26672 |

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 75ps Van |

£5,925 |

£5,575 |

3yr/60K |

£350 |

|

38471 |

BERLINGO L1 DIESEL - 1.6 BlueHDi 625Kg Enterprise 75ps |

£7,625 |

£7,350 |

1yr/20K |

£275 |

|

26689 |

TRANSIT CONNECT 200 L1 DIESEL - 1.6 TDCi 115ps Limited Van |

£7,075 |

£7,225 |

3yr/60K |

-£150 |

|

38515 |

PARTNER L1 DIESEL - 850 1.6 BlueHDi 100 Professional Van [non SS] |

£8,050 |

£8,750 |

1yr/20K |

-£700 |

|

20709 |

CADDY MAXI C20 DIESEL - 1.6 TDI 102PS Van |

£5,800 |

£3,875 |

5yr/80K |

£1,925 |

|

CAPId |

Medium Van |

2018 |

2017 |

Age/Miles |

Change |

|

25441 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

£9,275 |

£9,700 |

3yr/60K |

-£425 |

|

25437 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

£7,450 |

£7,775 |

3yr/60K |

-£325 |

|

31669 |

VIVARO L2 DIESEL - 2900 1.6CDTI 115PS Sportive H1 Van |

£7,450 |

£7,400 |

3yr/60K |

£50 |

|

25440 |

TRANSIT CUSTOM 270 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Trend Van |

£8,050 |

£8,400 |

3yr/60K |

-£350 |

|

25446 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 100ps Low Roof Van |

£7,400 |

£7,550 |

3yr/60K |

-£150 |

|

31668 |

VIVARO L2 DIESEL - 2900 1.6CDTI 115PS H1 Van |

£6,725 |

£6,900 |

3yr/60K |

-£175 |

|

25475 |

TRANSIT CUSTOM 290 L2 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

£9,500 |

£9,900 |

3yr/60K |

-£400 |

|

25450 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.2 TDCi 125ps Low Roof Limited Van |

£9,300 |

£9,700 |

3yr/60K |

-£400 |

|

18442 |

DISPATCH L1 DIESEL - 1000 1.6 HDi 90 H1 Van Enterprise |

£5,500 |

£5,300 |

3yr/60K |

£200 |

|

35807 |

TRANSIT CUSTOM 290 L1 DIESEL FWD - 2.0 TDCi 105ps Low Roof Van |

£11,100 |

£11,050 |

1yr/20K |

£50 |

|

CAPId |

Large Van |

2018 |

2017 |

Age/Miles |

Change |

|

26863 |

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van |

£10,900 |

£9,525 |

3yr/60K |

£1,375 |

|

30637 |

TRANSIT 350 L3 DIESEL RWD - 2.2 TDCi 125ps H3 Van |

£8,700 |

£8,250 |

3yr/60K |

£450 |

|

21705 |

CRAFTER CR35 LWB DIESEL - 2.0 TDI 136PS High Roof Van |

£9,650 |

£8,350 |

3yr/60K |

£1,300 |

|

9155 |

TRANSIT 280 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

£4,675 |

£4,600 |

4yr/80K |

£75 |

|

33533 |

MASTER LWB DIESEL FWD - LM35dCi 125 Business Medium Roof Van |

£7,375 |

£6,900 |

3yr/60K |

£475 |

|

9551 |

SPRINTER 313CDI LONG DIESEL - 3.5t High Roof Van |

£6,175 |

£5,450 |

5yr/100K |

£725 |

|

31707 |

BOXER 335 L3 DIESEL - 2.2 HDi H2 Professional Van 130ps |

£7,825 |

£6,875 |

3yr/60K |

£950 |

|

9104 |

TRANSIT 260 SWB DIESEL FWD - Low Roof Van TDCi 85ps |

£3,275 |

£3,250 |

3yr/60K |

£25 |

|

31217 |

RELAY 35 L3 DIESEL - 2.2 HDi H2 Van 130ps Enterprise |

£7,575 |

£7,125 |

3yr/60K |

£450 |

|

27306 |

SPRINTER 313CDI MEDIUM DIESEL - 3.5t High Roof Van |

£10,500 |

£9,150 |

3yr/60K |

£1,350 |

|

CAPId |

4x4 Pick-up Workhorse |

2018 |

2017 |

Age/Miles |

Change |

|

22413 |

RANGER DIESEL - Pick Up Double Cab XL 2.2 TDCi 150 4WD |

£9,550 |

£9,975 |

3yr/60K |

-£425 |

|

30784 |

HILUX DIESEL - Active D/Cab Pick Up 2.5 D-4D 4WD 144 |

£8,850 |

£9,300 |

3yr/60K |

-£450 |

|

21665 |

HILUX DIESEL - HL2 D/Cab Pick Up 2.5 D-4D 4WD 144 |

£7,225 |

£7,350 |

5yr/80K |

-£125 |

|

35425 |

NP300 NAVARA DIESEL - Double Cab Pick Up Visia 2.3dCi 160 4WD |

£13,250 |

£12,400 |

18mth/20K |

£850 |

|

16756 |

HILUX DIESEL - HL2 2010 D/Cab Pick Up 2.5 D-4D 4WD 144 |

£8,250 |

£8,350 |

3yr/60K |

-£100 |

|

29907 |

DISCOVERY DIESEL - XS Commercial Sd V6 Auto |

£21,100 |

£21,800 |

3yr/60K |

-£700 |

|

34428 |

DISCOVERY DIESEL - SE Commercial Sd V6 Auto |

£27,500 |

£28,450 |

2yr/40K |

-£950 |

|

11073 |

DEFENDER 110 LWB DIESEL - Hard Top TDCi |

£9,050 |

£8,375 |

7yr/100K |

£675 |

|

38351 |

HILUX DIESEL - Active D/Cab Pick Up 2.4 D-4D |

£13,500 |

£14,200 |

3yr/60K |

-£700 |

|

24963 |

D-MAX DIESEL - 2.5TD Double Cab 4x4 |

£10,350 |

£10,550 |

3yr/60K |

-£200 |

|

CAPId |

4x4 Pick-up Lifestyle SUV |

2018 |

2017 |

Age/Miles |

Change |

|

18622 |

L200 LWB LB DIESEL - Double Cab DI-D Barbarian 4WD 176Bhp |

£10,950 |

£10,200 |

3yr/60K |

£750 |

|

35284 |

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD |

£14,450 |

£14,200 |

2yr/40K |

£250 |

|

25079 |

AMAROK A32 DIESEL - D/Cab Pick Up Highline 2.0 BiTDI 180 BMT 4MTN Auto |

£14,550 |

£14,250 |

3yr/60K |

£300 |

|

35282 |

L200 DIESEL - Double Cab DI-D 178 Warrior 4WD |

£14,400 |

£14,150 |

2yr/40K |

£250 |

|

19137 |

NAVARA DIESEL - D/Cab Pick Up Tekna [Connect] 2.5dCi 190 4WD |

£10,400 |

£9,900 |

3yr/60K |

£500 |

|

19135 |

NAVARA DIESEL - Double Cab Pick Up Tekna 2.5dCi 190 4WD |

£10,300 |

£9,650 |

3yr/60K |

£650 |

|

35006 |

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 200 Auto |

£16,900 |

£15,950 |

2yr/40K |

£950 |

|

22415 |

RANGER DIESEL - Pick Up Double Cab Limited 2.2 TDCi 150 4WD |

£11,500 |

£11,850 |

3yr/60K |

-£350 |

|

35285 |

L200 DIESEL - Double Cab DI-D 178 Barbarian 4WD Auto |

£15,050 |

£14,800 |

3yr/60K |

£250 |

|

35005 |

RANGER DIESEL - Pick Up Double Cab Wildtrak 3.2 TDCi 200 |

£15,750 |

£15,400 |

3yr/60K |

£350 |

HGV MARKETPLACE

The market remains fairly buoyant at present despite the number of vehicles available having fallen. Some auctions are busier than others and this varies week to week and from auction to auction. It’s all down to the desirability of the goods on offer. An example of this being one auction house achieved sales conversion of over 62% of the total HGV entries at one sale but at the following sale that had fallen to below 20%.

Over the last month there has once again been plenty of new stock on offer which initially creates buyer interest but if the fresh vehicles fail to sell and subsequently start reappearing in following sales interest decreases substantially. The best chance of obtaining optimum value is at the maiden sale.

Vehicles which continue to reappear at auctions present a continuing challenge for both the vendor and the auction house because attempting to sell something which is neither desirable or buyers simply do not want to purchase at a reserve value which is unlikely to result in a sale is difficult to manage for a sustained period of time.

Dealers report that business is nothing spectacular at the moment, just steady, and whilst agreeing a Brexit deal is currently the hottest topic in town, not one trader has seen any effect of it yet and exporters have been a little more active of late. It remains to be seen what effect Brexit will have on trade but nobody has suggested it will be good, with many who export clenching their teeth in the hope that any effect is minimal.

Auction internet sales seem to be on the increase and whilst previous editorials touch on the pros and cons of such sales it has had an effect on some dealers who were previously tech dinosaurs. They once suggested that the internet was unnecessary and undesirable but most have now relented and the internet has become the exact opposite, now being an absolute requirement to exist and survive in today’s market place, one dealer saying that ‘it has turned the job inside out’.

Larger independent dealers are finding it a little easier to source late registered vehicles but some continue to purchase vehicles direct from manufacturers to fulfil orders. Manufacturers themselves report sales remaining buoyant with Euro 6 vehicles continuing to sell well. One manufacturer advised that the implementation of tighter management controls of vehicle returns has been successful in enabling it to maximise revenues for used Euro 6 vehicles, however they also admit that Euro 5 sales are becoming more challenging.

Records from our auction visits indicate that the average number of auction entries has reduced substantially, by around 50%, but the number of on-the-day sales of trucks increased by almost 4% in relation to total entries. Trailer sales also increased by nearly 11% last month.

This is based on nine auction visits and a total of 1020 viewed lots and as we always say, these are ‘hammer sales’ on-the-day and converted provisional sales are not included. One auction reports that the conversion rate of provisional sales has fallen to around 50%.

This month’s research indicates that:

- Up to 7.5t - Values have generally fallen a little across the board.

- 5t to 12t – Values of pre-Euro 5 vehicles have fallen whilst Euro 5 values have also drifted, some more than others dependent on manufacturer and body style.

On the whole Euro 6 values have increased slightly, although there are a few examples where values have remained the same and a singular vehicle where values have fallen.

- 13t to 18t – Values of most pre-Euro 5 vehicles have remained stable although fridges have seen a fall in value, possibly due to the large number of such vehicles currently available in the market. Euro 5 values have decreased a little with fridges again bearing the brunt of any falls. However, values of skips and tippers have remained steady.

Euro 6 values are a mixed bag with some makes and body derivatives seeing values increase and at the same time others are suffering from values drifting downwards. It is all dependent on make, body type and current availability.

- Multi-wheel rigids – Pre-Euro 5 6x2 and 6x4 values remain steady and Euro 5 values for similar vehicles have increased for most types with the exception of some hook-loaders, skips and tippers where the general trend is an increase in value but some values have gone down.

Eight-wheelers values have remained steady across the board.

- Tractor units – Pre-Euro 5 4x2 values have decreased a little and in the main Euro 5 values have either remained stable or have increased slightly depending on manufacturer. Euro 6 4x2 values remain steady.

There has been slight increase to the values of some pre-Euro 5 6x2 examples dependent on manufacturer and Euro 5 6x2 values have generally increased a little, although some values remain the same with just a couple having decreased.

Euro 6 values have generally stayed the same but there are a couple of slight increases and one particular model which is currently available in quantity has seen values fall a little.

6x4 and multi-axle tractor unit values have increased across all Euro emissions.

- Trailers – Values of most trailers have increased with curtains and fridges being the main beneficiary.

7.5t to 12t Vehicles

A fair selection of low mileage 7.5t Euro 6 boxes and curtains appeared at auction recently, including a relatively rare Iveco Eurocargo 75E16S curtain with sleeper cab. All provoked strong interest with mileage and condition making them desirable lots and whilst most sold on the day some failed to find new homes and have since been seen circling the auctions without a satisfactory outcome.

Fridge boxes are plentiful and falling values reflect this as buyers have a huge choice to select from. The tidiest examples on desirable chassis are easily finding buyers but the rest are just adding to the numbers already in circulation. That said a tidy 15 plate Mitsubishi Fuso Canter 7C15 with 198,000 kilometres failed to muster any real interest at auction and it continues to seek a new owner.

Older vehicles are starting to find buyers but values are nothing to shout about. Euro 5 examples are selling much more easily than previously, but as always in order to achieve best value they must have low mileage and be in good condition. High mileage, untidy or damaged examples are struggling to find buyers and some will no doubt be around for a while unless vendors reduce their expectations and apply realistic reserve values. Now is the time to do so in the run up to Christmas because failure to sell in the next few weeks will mean they have little chance of selling any time soon as post-Christmas de-fleets will see more vehicles coming into the market thus making them even more difficult to sell.

The ex-Palmer and Harvey 7.5t Isuzu and Mitsubishi Canter boxes continue to appear in auctions but both quantity and interest has dramatically decreased together with their values.

Auction sales include a tidy 2008 58 plate Iveco Eurocargo 75E16K Econ gritter with 51,000 kilometres which sold for £8,500 and a tidy 08 plate Isuzu NQR 70 day cab double deck car transporter with a manual gearbox and 374,000 kilometres which achieved £7,500

13t to 18t Vehicles

Tippers, skip Loaders and often recovery vehicles generally sell reasonably easily but Euro 3 and Euro 4 examples have found it tough going recently. With little export activity and being in an untidy and unkempt condition it all conspires to add to their struggles.

The large stocks of older vehicles available is at odds with current demand which favours newer vehicles. The consequence being that much of the older stock survives unsold whilst the craving for late registered vehicles at reasonable prices remains unsatisfied.

Boxes and curtains are attracting some attention, especially Euro 5 examples at present, but those with short or low bodies are much less of a prospect as they have restricted use in comparison to standard bodied examples. Several short bodied dropsides and curtains on Iveco Eurocargo 180E25 chassis currently doing the auctions bear testament to this.

Fridges continue to struggle a little due to several factors, mainly quantity available, because of the quality of the vehicles available is below expected standards and further service will not be possible without considerable rectification and finally fridge and body specifications are not to most vendors taste. Frigoblok fridge units married to Lecapitaine bodies is proving a little too difficult for buyers to be captivated.

13 tonne DAF FA LF55.180 day cab bread van boxes have been doing the rounds in numbers for a few months now. The latest examples from Peter Kay’s favourite bakery being 08 plates with over 500,000 kilometres which are making around £1,700 - £1,800 each.

A pair of unusual 11 plate 15 tonne day cab DAF FA LF55.220 cement mixers with sub 100,000 kilometres hit the right spot at auction both selling easily. The better of the pair for £11,000 and unusual being 15 tonne cement mixers.

A 2008 58 plate 15 tonne DAF FA LF55.220 left hand drive Johnston twin sweep sweeper with 125,000 kilometres appeared at the same sale as the cement mixers and achieved a provisional offer of £34,250. At a different auction a 12 plate 15 tonne DA FA LF55.220 carrying a 2008 Johnson VT650 sweeper and with 86,000 kilometres sold for £36,000.

A trio of 16 plate DAF LF220 day cab curtains all with tail lifts and averaging around 100,000 kilometres drew strong interest and prompted equally strong bidding with all three readily finding new owners.

Multi-wheelers

Multi-axle rigid vehicles remain popular and unlike other sectors age and condition appears less important providing that the vehicle has a good MOT and it is ready to go to work. If it is the right specification and has the right equipment to do the job, it likely to find a buyer.

While many vehicles continue to do the rounds there has been instances where older examples have held their own and Euro 5 variants have performed reasonably well recently with sales values looking promising for most variants.

The craving for tippers, especially those carrying grabs remains, but only at the right price. The days when tippers commanded premium sales values appear to be over. 8x4 examples are much more common than tri-axle variants where examples are less numerous so often attract increased interest.

A good number of Euro 5 fridges remain available, some suffering from the same problems as their smaller peers. More cement mixers of varying age, condition and chassis have again appeared at auction and once again have struggled to attract sufficient interest for them to sell.

Whilst refuse trucks are not the most desirable offerings and often fail to muster bids reflecting true value one example which sold quickly was a 2011 61 plate crew cab Dennis Elite W2630 6x4 with Phoenix twin pack body and Terberg bin lifts. Tidy condition and only 104,000 kilometres aided its sale for £13,250

An odd vehicle to appear at auction was a 2016 66 plate Euro 6 Iveco Stralis AT440S46T/FP 6x2 sleeper cab car carrier front end with Hunwick equipment and only 59,000 kilometres. The vehicle failed to muster any great interest, possibly due to its specialised nature and lack of trailer, so it failed to sell.

Like buses odd vehicles often appear in pairs. The second example being a 2014 64 plate day cab Renault C430 8x4 Armcon volumetric cement mixer with 84,000 kilometres which came with its own cement filling station which necessitated collection from a Guildford postcode. The lot reached a provisional bid of £109,500. A similar 2010 manufactured Volvo FM 420 day cab volumetric cement mixer with 530,000 kilometres achieved a bid of £36,000 at the same auction.

Tractor Units

Little change from last month as more Euro 6 6x2 mid-lift examples continue to appear and their values begin to settle down. By contrast Euro 5 examples generally continue to thrive with increased interest and good sales values.

Pre-Euro 5 4x2 examples have started to suffer a little whilst Euro 5 examples are mirroring 6x2 Euro 5 vehicles and 6x4 and other multi-axle variants continue to be rare but are strong sellers.

A batch of twenty 2013 63 plate Big Space Mercedes-Benz Actros 2542’s with around 800,000 kilometres appeared at the same sale. All sold on the day but at values below expectations.

A trio of 2008 ex-MOD 4x2 sleeper cab DAF FT CT85.360 with manual gearboxes made and favourable impression when offered for sale. Despite being on MOD plates and requiring re-registering to 57 plates they were in tidy condition and had between 36,000 and 74,000 warranted kilometres. All three sold very well after some hectic bidding.

A pair of relatively scarce 2012 61 plate 6x2 Renault Premium 460 Privilege sleepers with rear lift axles proved popular lots and both sold easily for more than equivalent mid-lifts would have achieved. Rear lifts are far less common than mid-lifts and often sell better due to rarity and increased desirability.

Trailers

Not only have trailer sales increased in relation to total entries but values have increased slightly, especially for trailers under ten years of age and for older examples which are ready to work.

The number of trailers available has reduced considerably in recent months so the choice available is not as wide as it was three months ago, but more importantly the quality of those available has improved. Most stock remains over ten years of age, with some being no longer fit for further use.

Curtain and Fridges have performed well of late, but so too, to a slightly lesser degree have most variants.

However, as always, it is specialist trailers that always produce most interest, and a brace of low-loaders one with multi-axles and a trio of plant carriers did exactly that when they appeared at auction.

red book editor - light commercial vehicles & motorhomes

+44 (0) 7841 156 963

ken.brown@cap-hpi.com