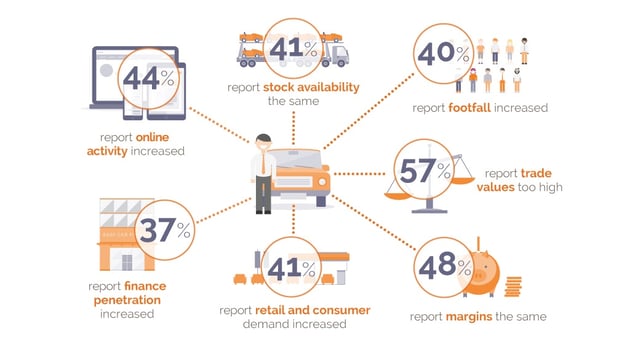

cap hpi reports that February 2017 has seen a 5% decline in the number of dealers reporting an increase in footfall compared to 12 months ago with 40% for this year compared with 45% last year. Dealers indicating that footfall had declined rose from 18% in 2016 to 29% in 2017 and the remaining third (31%) indicated little or no change.

Online activity performed similarly to the physical footfall for the second month in succession, although those dealers reporting an increase in activity into February were lower than this period in 2016 (44% for 2017 against 53% in February 2016). As was also seen in January, those citing a decline had risen from 16% to 27% in 2017.

The respondents reporting compression in retained margins jumped significantly from 18% in February 2016 to 39% this year, whilst those indicating an improvement since last month dropped by over half from 28% to 13%. The remaining half of dealers (48%) reported experiencing little or no change since January.

22% reported improved stock availability since last month, over double the 10% reported last year. Almost identical to February 2016, over a third (37%) said stock availability worsened since January with the remaining 41% noting little change.

Sentiment from dealers on finance penetration has seen a big shift with 37% of dealers highlighting an increase compared to just 21% in 2016. 18% indicated penetration has declined since January - a drop of 10% on last year.

Philip Nothard, consumer and retail specialist at cap hpi, said: “Consumer demand is the area that has seen, potentially the largest change compared to February 2016. With 31% of dealers indicating a worsening coming into February from January compared to 18% in 2016. Whereas, those citing an improvement remained similar at 41% compared to 45% and those who identified it being about the same reduced from 38% to 28% in February 2017. Overall, the market for the first two months of 2017 seems relatively stable which should continue as we approach the end of the first quarter.”

Derren manages the valuation process for current used car values at cap hpi, which includes managing a team of 6 Car Valuations Editors who analyse around 170,000 individual sold trade records each month from a wide variety of industry sources, plus 700,000 retail adverts that are reviewed daily. Derren and the team also engage in market insight discussions with various auctions, leasing and rental and remarketing companies and vehicle manufacturers throughout the month as well as offering consultancy on the new and used car market.

07436 817 383

Derren.Martin@cap-hpi.com