LCV MARKETPLACE

Whilst the footfall seemed healthy enough at most of the open auction sales we attended during October, the quality of stock remained much the same as the previous month with no appreciable change in the model mix, age profile and condition of auction entries. It’s perhaps not surprising then that bidding was slow at times and, at most sales, a bit like the England Rugby team, many buyers took an early bath.

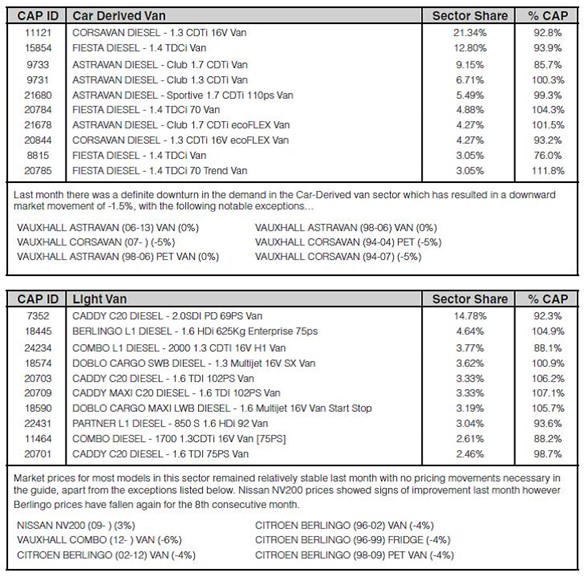

Speaking of defeats, last month the word took on an a whole new meaning for the motor industry and we received many enquiries from motoring journalists, auctioneers and buyers as well as vehicle manufacturers themselves all asking the same question – “do we expect the guide values of Volkswagen Commercial Vehicles to fall”. Whilst some buyers might see this as an opportunity to acquire VW LCVs at lower prices in the short term, with the possible exception of Crafter and Amarok, prices have remained firm.

According to the research data we have gathered over the past month Caddy and Transporter panel vans values are unchanged, however, we have had to review Amarok model walk-up relationships and Crafter panel vans have gone down by 5%. There can be little doubt that this has been a massive blow to their reputation and even VW themselves appear to be saying that it will take at least three years to repair the damage that has been done to the brand. It remains to be seen if this filters down to the used LCV market.

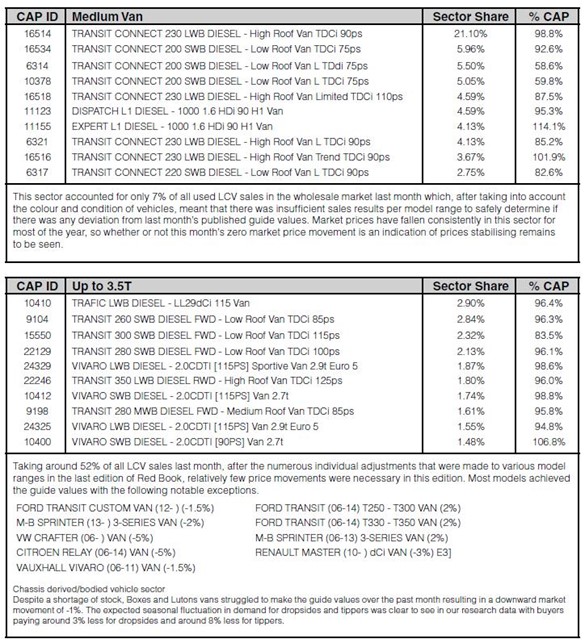

Unless it is a direct result of the so-called ‘dieselgate’ scandal, the weakening of Crafter values this month remains an enigma in this sector. Whilst car-derived vans and light vans were often seen struggling to reach reserve prices, bidding was much stronger on large panel vans in the 2.8t – 3.5t sector with many achieving well above the guide prices irrespective of condition. Time after time we witnessed vehicles with extensive body panel damage selling above CAP Average and even CAP Clean guide values. With the Christmas shopping furore fast approaching this of course is to be expected and is a reflection of the usual seasonal fluctuation in demand for parcel delivery vans. Over the next month or so we are anticipating prices of large panel vans, lutons and boxes to soar as demand increases from the home delivery market segment. This is a double edged sword because it comes at a time when supply is likely to be limited as parcel delivery companies and van rental companies hold onto existing vehicles.

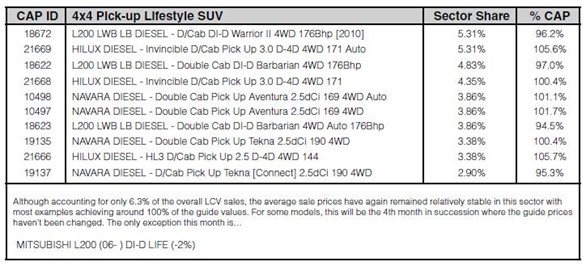

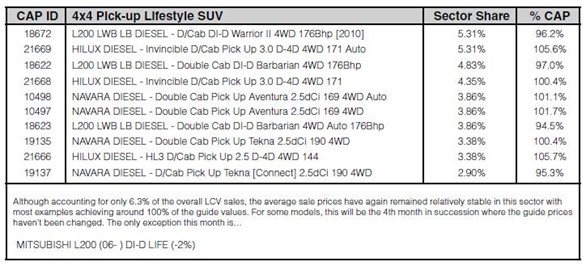

The demand for 4X4 Lifestyle pick-ups showed signs of improvement last month which again is something we often see at this time of the year. Whilst we are not suggesting that someone would go out and buy a 4x4 pick-up just because of the threat of some snow for a week or so, as winter approaches there is a definite increase in demand in this sector as dealers tailor their stock profile to take advantage of any potential increase in retail demand.

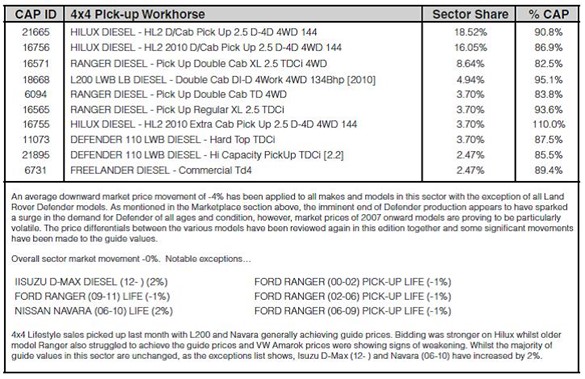

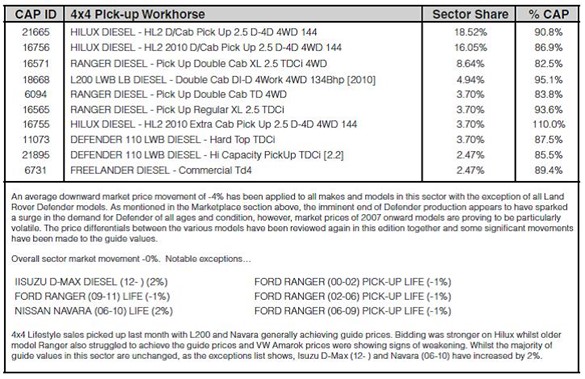

The 4X4 Pick-up Workhorse sector continues to lag behind in terms of supply and the quality of stock with market prices falling significantly last month, however, one very noticeable exception was Land Rover Defender. Whilst there is some talk of production being extended into the fi rst quarter of 2016, the end of the Land Rover Defender era is imminent after a continuous production run that’s lasted over 67 years. With the likelihood that all the new vehicles in the pipeline have already been allocated to its franchised dealer network, and most likely pre-sold, the demand for used stock is set to continue. This month we have again revised the values of Defender from the 2007 plate onwards, however, with such a wide regional variation in advertised retail prices and with wholesale market prices fluctuating wildly, guide values are likely to remain unstable for some time.

In this edition we have made some significant reductions in the used values of new shape Ford Transit Minibus to reflect the latest discounted new vehicle prices which are currently being advertised nationally. We have also increased the values of new shape VAT qualifying Ford Transit 8-11 Seat Buses to more accurately reflect their worth in relation to older models in the marketplace.

From a retail demand perspective, the comments we were picking up last month about demand slowing down have all but ceased and we are now hearing far more upbeat snippets from traders and dealers we’ve been speaking to.

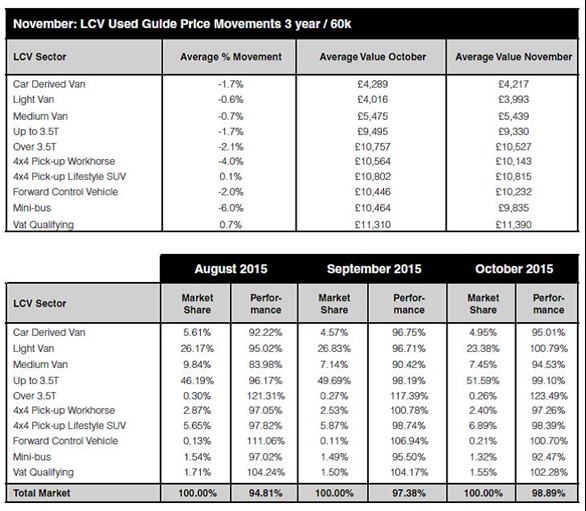

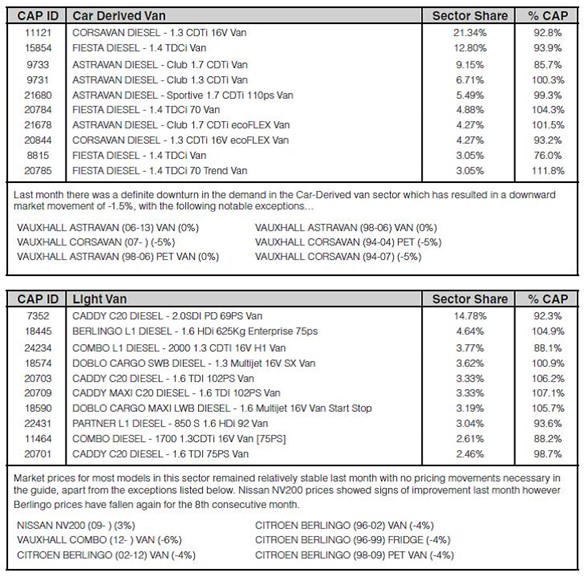

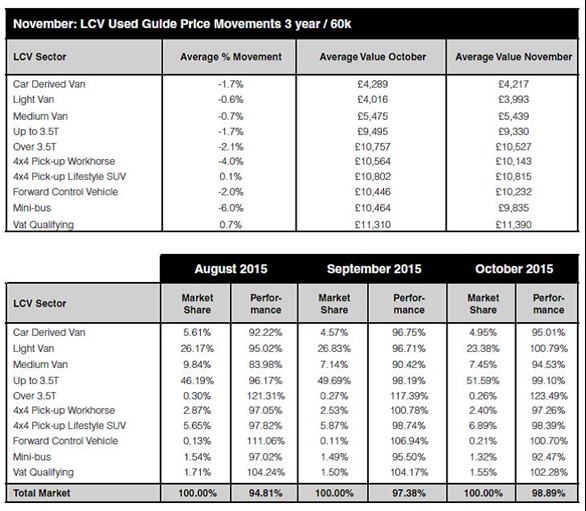

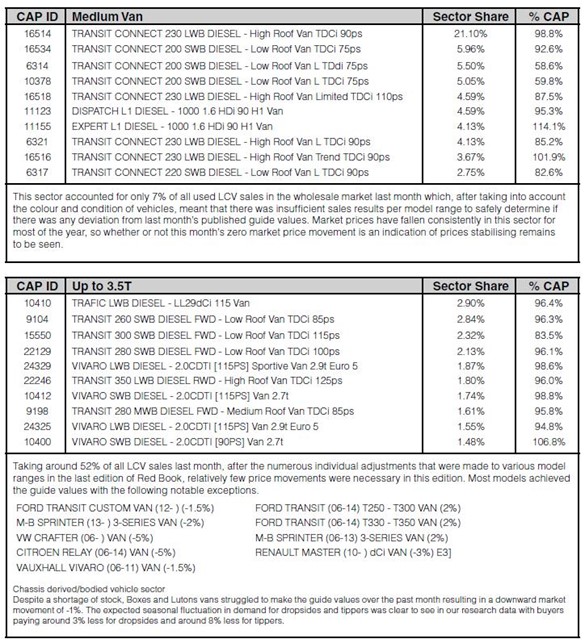

The top 10 models in the sector tables below are intended to give you a clearer view of what’s driving the market. It should be noted that that the Sector Share is based on actual sales and not the availability of these models in the marketplace. The %CAP performance values are also based on actual sales.

Since our guide values reflect the market prices of basic vans in plain white as they appear in the vehicle manufacturer’s price lists, some of guide price movements you might see in this edition may not correlate directly with the sales performances shown in the tables which include vehicles in all colours and specifications.

In some of these tables you may also notice the same model description appearing more than once, however, the CAP Identity numbers will always be unique. Generally the lower CAP Identity numbers signify older models and higher ones are newer models; further details can be found by looking up the model/CAP Id number in the prices section of the guide.

MOTORHOMES MARKETPLACE

There are so many different ways to buy and sell anything online these days as the internet as become of age and Motorhomes are no exception. As well as the likes of eBay and Gumtree there are specialist sites which specifically target potential motorhome buyers and sellers such as Motorhomes-mobi which charge a flat fee for advertising on their site.

Anyone who knows anything about Motorhomes though would always advocate physically seeing a vehicle in the fl esh before parting with any hard-earned cash. However, the internet provides potential buyers with the means to sift through hundreds of used motorhome advertisements without even getting out of their armchairs.

The internet also provides us with countless reviews on specific models, buyer’s guides as well blogs and advice from motorhome owners willing to share their own experiences to help others with their purchasing decision. Let’s face it, buying a motorhome for most of us is likely to be one of the most expensive purchases we will ever make so it’s important to both you as well as your customers that they get it right.

Unfortunately though because Motorhomes are so expensive and highly desirable it makes them an ideal target for thieves. Often seen parked on the driveways during the daytime when everyone has gone to work or school, it is little wonder that motorhome theft has become a big problem in the UK.

To tackle this problem the UK motorhome Industry and HPI, a sister company to CAP Automotive and part of the Solera group, joined forces to create MINDER, a vehicle security and asset registration system to help protect against theft and fraud. This service, although aimed specifi cally at the trade provides peace of mind for both buyers and sellers alike.

Similar to the HPI Check, HPI Minder is a well-established trade information service that checks the vehicle’s registration mark (VRM) or VIN against the HPI registers to make sure that the vehicle isn’t registered on fi nance, stolen or written off in the UK by an insurance company. It also checks the motorhome against the unique HPI Minder register. This is where specifi c data is held from Motorhome manufacturers about their conversion. These details are then linked with the correct vehicle data received from the DVLA. A MINDER check will give you the normal HPI check detail, which relates to the base vehicle as registered at the DVLA, but then adds in the unique MINDER details which confi rm the motorhome conversion details. For example, you will not just be looking at a ‘Fiat Ducato’ as with other vehicle history checks, but at a ‘Fiat Ducato converted to a Swift Rio 320’.

To use Minder, simply sign up as an HPI user by calling 0845 3007507 and ask for the service to be added to your account. You will then have the option to run an HPI Minder check from the HPI website.

Registration of new motorhomes on MINDER is free for OEM’s and authorised importers so there is no reason not to do it! Manufacturers or importers who would like to protect their motorhomes or use our trade MINDER Check service should contact MINDER on 01722 435478 or email minder.uk@hpi.co.uk for further information.