In line with expectations and seasonality

With only weeks until we enter 2016, and the consumers begin to focus on other distractions – it comes as no surprise for many that activity and consumer demand saw an easing since last month. Many have indicated, however, that the demand continued for a little longer than anticipated and gave them a slighter healthier result than budgeted for – there are, as always, those that have it better or worse than others.

A key point this month is that although throughout October and November we have experienced an increase in vehicles to choose from, they aren’t necessarily in the models or specifications which are in demand and more importantly, in the right condition. With the increased choice, comes the ability to be selective and therefore, by default, we see a decline in values.

As new car registration experiences some pressure in the growth it’s being seeing, many new car franchise dealers are now entering into - in some cases uncomfortable - discussions around their targets for 2016 and many will be questioning how long the growth can continue and the supporting incentives helping to drive the demand.

With regards consumer trends, the Consumer Rights Act has had varying degrees of acceptance, from those who have fully embraced it, to those that seem to be experiencing the odd challenge from consumers, taking up potentially valuable time.

It is reasonable to surmise that whilst the over retail market has experienced some pressure, and as a result a decline in November, this is what some may say is ‘customary’ for the time of the year as consumers turn their attentions to what’s going to be under the tree and Christmas parties. However, reports are that many are working hard and seeing some positive results for their efforts.

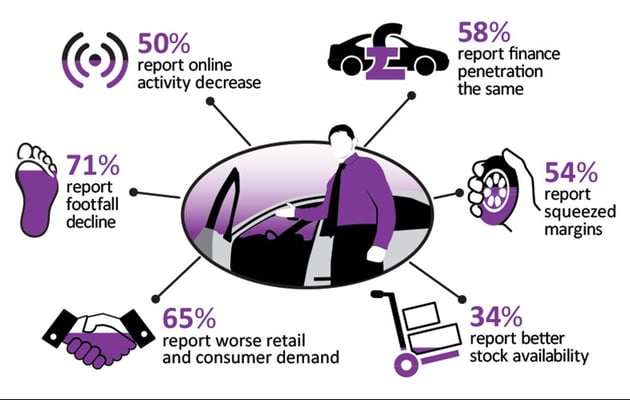

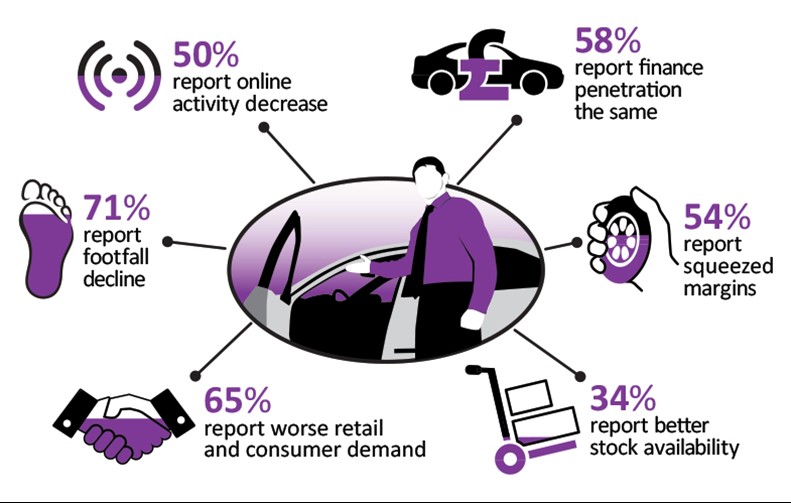

The headline results...

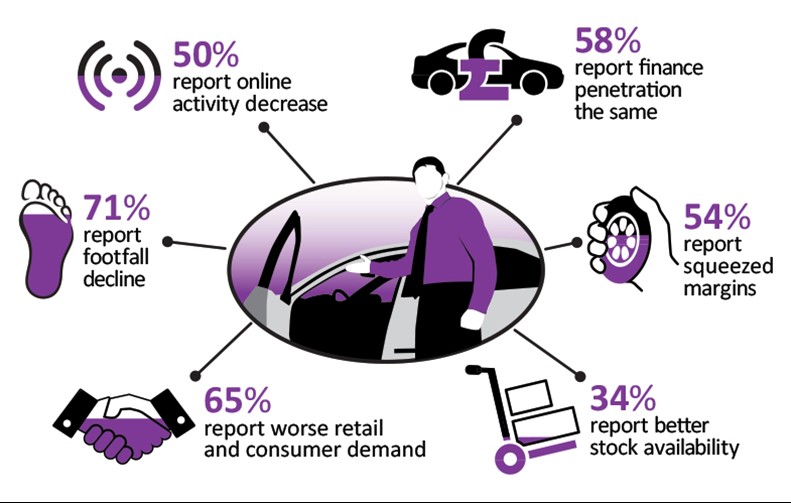

o As many may have projected, activity at this time of the year experienced a slowdown, with over 70% of those responding indicating that physical footfall had declined since last month - this is the highest percentage we’ve observed in 2015, with only 8% citing an improvement.

o Online activity wasn’t too dissimilar to the physical activity; however, not to the same degree, with half stating it has declined. This, however, is a lesser percentage than the previous month's results and a fifth of those responding specified they experienced an increase from October.

o The percentage of respondents signifying that margins are under pressure again returns to those seen in June and July, with 54% stating that margins have been squeezed compared to October. The number which said they had seen less pressure on margins in November compared to October was only 4%, the lowest we’ve seen throughout 2015.

o As you would anticipate in the final quarter of a year, the majority are seeing either an increase or little change since last month in stock availability; however, this raises the question, whether it is the desirable stock in the right condition and as dealers begin to focus on January, how long will this excess remain?

o As we continue to monitor finance penetration, this month sees a slight increase in those indicating that it’s declined since October at 26%, with the majority of 58% saying they’ve seen little variation.

o Again this month, similar to October, over half of those responding felt that the current trade values are too high, with the majority of the remainder agreeing they are reflective of the today's market. Throughout 2015, those stating that the values were too low only managed double digits in the first quarter of the year.

o As both the physical footfall and online this month has proven, the dealer network has felt an easing again this month. The highest year-to-date, 65% of those responding said that retail/consumer demand had worsened since October and those experiencing an improvement only just managed double figures.

o As Volkswagen diesel prices and demand remained topical throughout the month, we surveyed the network to gauge overall opinion on purchasing desirability and pricing. As the results indicate, the majority of buyers who purchase the product have continued to do so in November, and not paying any less than you would expect for the final months of the year.