The second new-plate registration month of the year, and the final quarter of 2015, often brings a change in the market. And if this survey had been carried out within the first ten days of October the outcome would have looked very different.

This is not necessarily a negative view of the market, far from it. Some have commented that it was like someone had switched the tap off mid-month. But the data suggests a similar trend to last year.

In a month, following September, where around 460k cars were registered, but not necessarily sold, consumers start to think about the half-term holidays and what’s going to be requested in the Father Christmas letters this year.

In a post new-plate month, we expect both the physical and online activity to show signs of easing, along with the consumer demand, coupled with an increase in available stock volumes, this can only add pressure to both values and margins. To the majority of the network these trends hold few surprises and many would have budgeted for it.

As both the result itself and more importantly, the sentiment supporting the choice; the question surrounding new car registrations for 2016 exceeding 2015 raises many issues on the topic of transparency and sustainability in the UK market for continual growth.

On a positive note, the sentiment within the network sees the current market as a lull, and focus will soon turn on the January 2016, with an eye on sourcing quality stock to attract consumers.

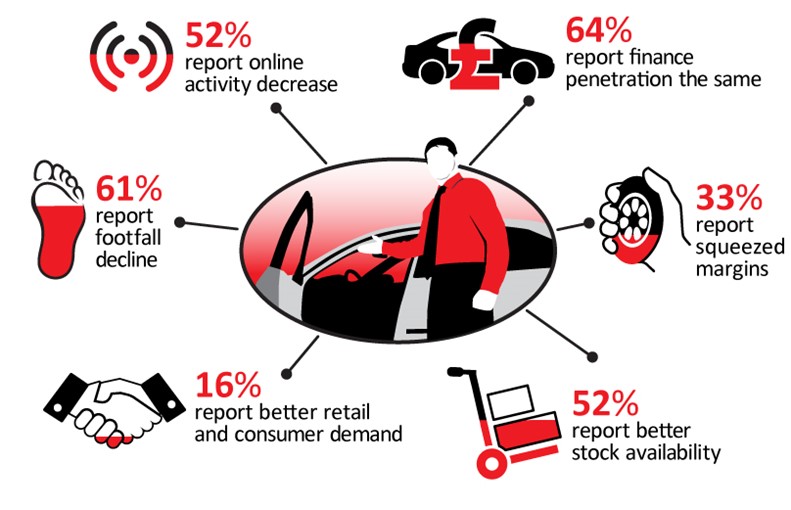

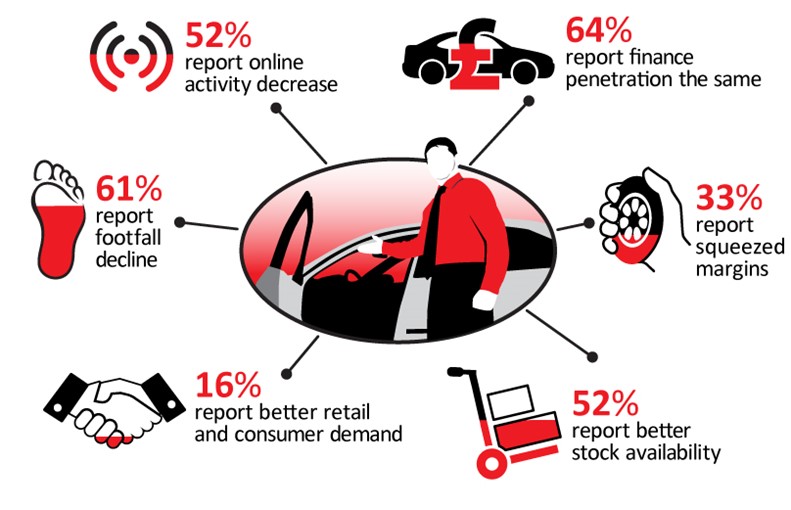

At a glance...

o This month saw the highest number of respondents indicating a decline in physical footfall we’ve observed in 2015, at 61%, a significant contrast to the 40% who specified an increase in September.

o Online activity saw a major reversal from September, with only 19% indicating an increase, against 46% in September, and the opposite for those seeing a decline – 19% in September and 52% in October.

o Margins continue under pressure again, seeing a repeat on September, with 33% indicating they’re squeezed. However, we see a positive change, as 19% indicate an improvement – the highest since March this year.

o As you would anticipate, following a high-volume registration month, 52% of those responding, indicated that stock availability has improved. Interestingly, a quarter felt that it had worsened. This could be caused by the sector of the market they operate in, as the sub 3K vehicles, in the right condition, with the correct provenance are a challenge to locate.

o This month saw little change to finance penetration, with 64% saying it remained level from last month. Those indicating an increase on the previous month reduced. However, this is in a month following a new plate month where a great deal of focus would have been placed on manufacturer finance campaigns.

o Over half of those, responding felt that the current trade values are too high, with the majority of the remainder agreeing, they are reflective of the today's market. As you would expect, in the final quarter of the year, those that felt values were too low are in the minority.

o As both footfall and online illustrated, the dealer network has felt an easing this month. Slightly over half felt that the retail/consumer demand has worsened since last month and a third seeing no change.

o With the month-on-month growth we’ve experienced with new car registrations, it’s interesting to see that 46% of those questioned believe that 2016 new-car sales could exceed 2015. This question, as you would expect, generated a few comments surrounding transparency of reporting, continual growth, and the impact on the used car market.

October results in full