Looking for a Vehicle Valuation or HPI Check?

New Car Sales

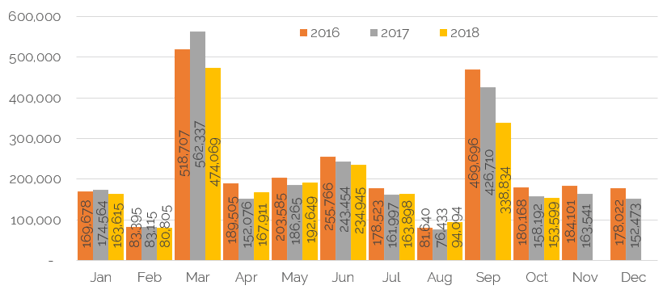

According to figures produced by the SMMT, 153,599 cars were registered in October 2018, compared to 158,192 in the same month last year, a reduction of 2.9%. Year-to-date, 2,064,419 cars had been registered, a reduction of 7.2% over the same period last year, as WLTP (Worldwide Harmonized Light Vehicle Test Procedure) continued to cause delays in the flow of vehicles into new car market. Early signs are that November will be similarly affected. Looking at the 3-months from August to October, this being the timeframe most affected by WLTP, some large manufacturers such as Audi, Nissan and Volkswagen saw volumes reduced by 44%, 37% and 28% respectively, year-on-year, for this period.

Source: SMMT

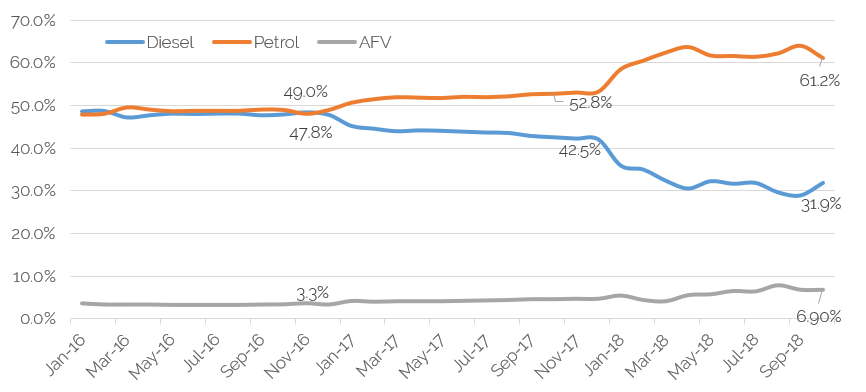

Diesel cars continue to be in the minority for new car registrations, continuing a trend in place since January 2017, led by anti-diesel press sentiment and not helped by government legislation. In October, they accounted for 31.9% of registrations, whereas in the same month two years ago they were 47.8%. Petrol cars have taken up most of this slack, with 61.2% being of that propulsion type. Alternatively-fuelled cars accounted for 6.9% of the market in October.

Source: SMMT

Interestingly, although availability was obviously an issue for some, sales to daily rental companies, one of the least profitable channels for car manufacturers, saw an increase in October, by more than 1,200 units. With these businesses keen to refresh their fleets, it will be intriguing to see if this leads to an increase in defleets over the coming weeks. Overall, a healthy used market is likely to be well placed to absorb these short-cycle cars into the market, particularly as over the first 10-months of 2018, rental registrations remain down year-on-year, by a significant 27,000 units – a deliberate ploy to protect profitability by some manufacturers. An interesting dynamic in this area though is that not all manufacturers have reduced their volumes; remarketing of used cars will be key for those that have increased their activity. According to figures from the SMMT, Vauxhall were particularly active in the month of October and BMW, Land Rover and Mini have been increasing volumes throughout 2018.

Used Car Retail Activity

Used car retail demand dropped away slightly in November, but this is a normal occurrence for the time of year, with many consumers turning more than one eye towards the festive season and putting on hold any “big ticket” purchases, unless it is out of necessity.

What is also clear, however, is that the drop off was not acute as it has been in previous years at this time; many used car outlets remained upbeat for the season. Those more dynamic businesses offering competitive price points, price matching, and low deposit and low monthly payments continued to attract buyers.

The business model for others, and perhaps a more traditional one employed by many franchise dealers in particular, is to hold prices for now and wait for post-Christmas, when consumer demand increases and sales campaigns begin in earnest. Holding prices for now can allow more attractive discounts to be advertised when the time comes.

Cap hpi’s daily-produced retail values reflect real-time advertised prices in the used car market, with statistical, empirical analysis of the data received from a number of the key volume sources, with whom we have agreements in place.

Used Car Remarketing Activity

The trade-to-trade remarketing arena in November could best be described as steady. Volumes have remained on the relatively low side, again for the time of year, mainly due to the reduction in new car registrations led by WLTP meaning less part-exchanges or fleet returns.

However, despite some buying for stock in preparation for January, or late December, supply did slightly outweigh demand, making it more of a buyer’s market than it has been for most of the year.

There was a marked change apparent in the results of the cap hpi auction survey, compared to the previous month. As can be seen by the charts below, when responding to the question on demand in October, the auctions were unanimous in that demand had not reduced and almost two-thirds reported increased trade desire to buy. Move forward a month and only a small minority (13%) reported increased demand, and whilst two-thirds saw things as steady, 20% stated that demand had dropped away.

How does your current overall demand compare to last month?

As would be expected with demand slipping, conversion rates also suffered, according to the auctions. In October, 62% confirmed that conversion rates were on the increase and no one reported that they had slipped. In November, there was an even 3-way split between those reporting increases, decreases and parity. Maybe the first signs of the traditional seasonal drop-off, but with not all affected at the time of the survey, towards the end of November.

How does your conversion rates compare to last month?

As a result of both of these key dynamics, 40% of respondents in November stated that prices had fallen – in October only a minority of 8% had stated this.

Used Cars – Trade Values

Cap hpi’s black book live trade values, the industry renowned clean, average and below condition-adjusted figures, are calculated from daily feeds of data from a large variety of trade sources. In conjunction with the retail advertised data received, this allows us to reflect, real-time, both trade and retail prices, allowing any business dealing in used cars to buy and sell based off real life data, whilst also maintaining a reasonable margin. Valuations Editors review this data to ensure complete accuracy and attention to detail.

During November, it is normal that these values drop, generally due to wholesale stock levels remaining high following new-plate, new car activity generating part-exchanges. Over the last 5-years, values in November (leading to December’s monthly figures for those that do not take the live product) dropped by an average of 2.3% at the 3-year age point. This time around, the reduction has been just 1.5%. So, whilst the market has weakened with the season, comparable to other years it has remained relatively healthy, due to lower supply and reasonable demand.

However, the devil is always in the detail, as no broad-brush market movements are made within our figures.

SUVs were an interesting case in point in November. They started the month outperforming the market, but buyer demand drifted away and prices weakened as the month progressed, ending up only slightly better than the average drop. However, with seasonal factors coming into play, larger 4x4s only dropped by 0.9%, whereas small and medium examples, more of a lifestyle choice, dropped by 1.4% and 1.5% respectively. Some examples of models where demand particularly failed to match supply, and prices fell by a significant 3% or more, were the BMW X3 diesel, Renault Captur petrol, Hyundai Kona petrol, Jaguar E-PACE diesel and Vauxhall Crossland X, both petrol and diesel. Even in a relatively strong market, supply and demand need to be well matched or prices will drop.

The traditional sectors of the market – city car, supermini, lower and upper medium – all dropped by close to the average, with upper medium marginally the worst affected (down 1.6%). Current models such as the BMW 3-Series, Jaguar XE, Mercedes-Benz C-Class and Vauxhall Insignia Grand Sport all saw values reduce by more than the average on both their petrol and diesel variants.

MPVs continue to outperform the market, mainly due to lower supply in the used market and steady demand. The new car fashion for SUVs over MPVs obviously impacts the used car market eventually, but buyers still requiring a good-sized family car with plenty of boot space have been prepared to pay reasonable money. Models such as the Volkswagen Touran and Caddy Life, Fiat Doblo, Peugeot 5008 and Ford S-Max all outperformed the market during November, with some values rising.

As is normal during the final quarter of the year, consumers have not been queuing up to purchase convertibles or coupe cabriolets. November tends to be the low point for prices of these and the average reduction of 3.2% came as no surprise. Very few models escaped value reductions.

One sector that did see strength was the electric vehicle market. With consumer acceptance of electric cars increasing, and the number of miles one can drive between charges far better than it was in the past, smaller electric cars in particular are more in vogue than ever. In many cases, this is as a second or even third car within a family, for those shorter commutes or leisure journeys. In particular, the Nissan Leaf, Peugeot iOn and Renault Zoe models continued to appreciate in value. However, electric cars with a higher price-point, such as the Tesla Model X, were not subject to the same demand, and prices dropped.

Overall, petrol and diesel car values behaved similarly to each other in November, continuing the trend that the used car buyer is less concerned by fuel-type than the new car buyer, who tends to be led more by fiscal reasons.

Also, in November, our used car valuations included McLaren models for the first time. Due to increased customer demand, we now produce fully researched trade and retail values for the most popular McLaren models.

What Next?

This section of the overview could almost be a “copy and paste” from last month.

New car supply is unlikely to dramatically increase in the last month of the year, with WLTP supply constraints evident for some manufacturers for the next few months at least. It will be interesting, however, to see if those that are in a position to do so, chase volume and market share which could lead to another strong month for rental registrations as well as increased pre-registration activity.

Used car supply will almost certainly stay steady. Consumer demand will continue to fall, although some trade buyers will be active in December, stocking up for the New Year.

Cap hpi expect values to drop in December, but not by dramatic amounts. Over the last 5-years the average has been -1.5% moving into January, with last year being just -1.1%. It would be reasonable to expect something broadly similar this time around.

Looking slightly further ahead, the first quarter of 2019 will be an interesting one. Will values increase by as much as they have done in this quarter in the past? They are already at a high level, but demand is also strong. Will WLTP volume constraints and fleet extensions come to an end, meaning more part-exchanges and fleet returns in the used market? A healthy start to the year is likely, and prices will likely stay high.

What is clear is that any price movements will be very manufacturer and model specific, meaning an eye on the detail, as reflected in black book live, is essential for vendors and buyers alike.

Finally, we would like to wish all of our customers and contacts a happy and safe Christmas period! Thank you for your feedback throughout the year so far.

black book December 18 - Average Value Movements

|

|

1 YR/10K |

3 YR/60K |

5 YR/80K |

|

City Car |

(1.3%) |

(1.4%) |

(1.4%) |

|

Supermini |

(1.8%) |

(1.5%) |

(1.3%) |

|

Lower Medium |

(1.3%) |

(1.5%) |

(1.3%) |

|

Upper Medium |

(1.5%) |

(1.6%) |

(1.7%) |

|

Executive |

(1.8%) |

(2.0%) |

(0.9%) |

|

Large Executive |

(1.6%) |

(2.2%) |

(1.6%) |

|

MPV |

(0.9%) |

(0.8%) |

(0.7%) |

|

SUV |

(1.4%) |

(1.3%) |

(1.3%) |

|

Electric |

(0.1%) |

0.1% |

0.4% |

|

Convertible |

(2.4%) |

(3.2%) |

(3.2%) |

|

Coupe Cabriolet |

(3.9%) |

(3.8%) |

(3.5%) |

|

Sports |

(0.8%) |

(0.6%) |

(0.7%) |

|

Luxury Executive |

(0.2%) |

(0.1%) |

(0.7%) |

|

Supercar |

(1.3%) |

(1.3%) |

(0.9%) |

|

Overall Avg Book Movement |

(1.5%) |

(1.5%) |

(1.4%) |

( ) Denotes negative percentages

Notable Movers 1yr 20k

Generation Name

MIN £

MAX £

Avg £

AUDI S8 (12-18)

400

2,400

1,400

FORD FIESTA (08-17) DIESEL

-175

-75

-136

LAND ROVER RANGE ROVER EVOQUE (11- ) DIESEL

-1,100

-650

-838

MERC A CLASS (12-18) DIESEL

-400

-250

-339

MERC C CLASS (14- ) DIESEL

-500

-300

-395

NISSAN LEAF (10-18)

300

550

431

NISSAN QASHQAI (13-18) DIESEL

-700

-100

-342

PEUGEOT 5008 (10-17) DIESEL

100

150

125

PORSCHE MACAN (14- )

700

1,200

960

SKODA OCTAVIA (13- ) DIESEL

-200

-100

-133

Notable Movers 3yr 60k

Generation Name

MIN £

MAX £

Avg £

AUDI A1 (10- )

-350

-75

-228

BMW 3 SERIES (12- ) DIESEL

-350

-175

-261

LAND ROVER RANGE ROVER EVOQUE (11- ) DIESEL

-750

-450

-573

MERC A CLASS (12-18) DIESEL

-300

-200

-240

MERC S CLASS (13- ) DIESEL

700

1,100

933

NISSAN JUKE (10- )

-300

-75

-200

RENAULT CAPTUR (13- ) DIESEL

-275

-200

-234

RENAULT ZOE (13- ) ELECTRIC

125

125

125

VAUXHALL MOKKA (12- )

-175

-125

-155

VOLKSWAGEN GOLF (14-16) HYBRID

150

150

150

Derren manages the valuation process for current used car values at cap hpi, which includes managing a team of 6 Car Valuations Editors who analyse around 170,000 individual sold trade records each month from a wide variety of industry sources, plus 700,000 retail adverts that are reviewed daily. Derren and the team also engage in market insight discussions with various auctions, leasing and rental and remarketing companies and vehicle manufacturers throughout the month as well as offering consultancy on the new and used car market. 07436 817 383 Derren.Martin@cap-hpi.com