cap hpi undertakes a monthly survey of UK dealers, which provides a valuable reflection of dealer sentiment.

cap hpi has reported the strength of the market through the first quarter of this year. We are seeing this bull market reflected in new registrations, used demand and dealer sentiment.

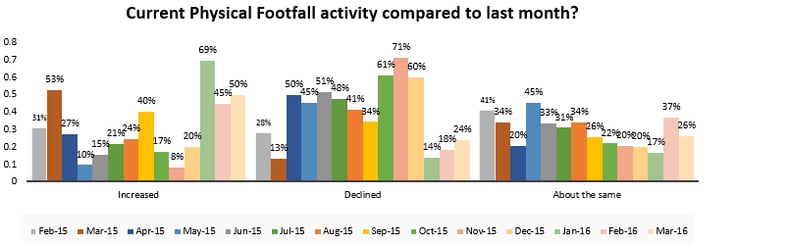

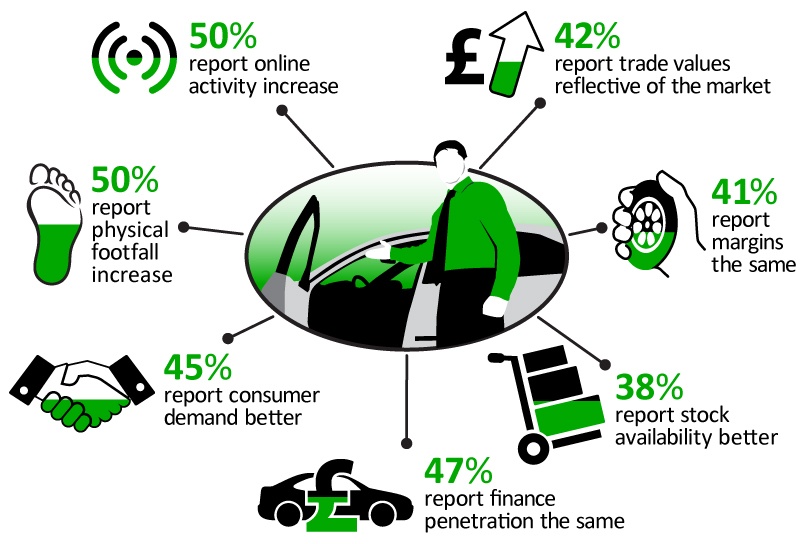

- In this month’s report half of those responding reported an increase in physical footfall since last month, and almost one third cited a worsening, while the remainder reported no change.

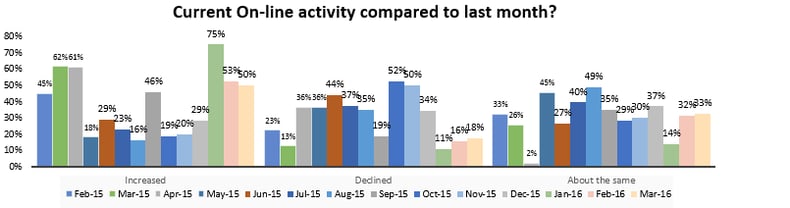

- Online activity reflected footfall, with half reporting it had increased, compared to 62% in 2015, and a third experiencing little or no change in activity since last month.

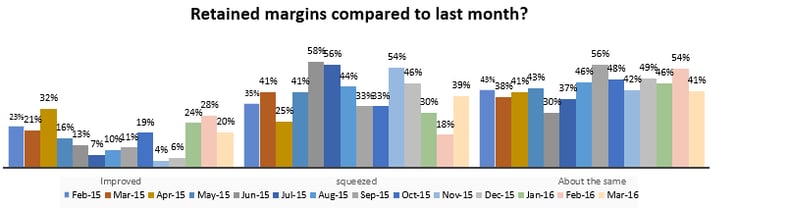

- Almost 40% of those surveyed said retained margins had reduced from the previous month, with a similar number stating parity. 20% did advise that margins had increased however, but this number was certainly lower than in previous surveys.

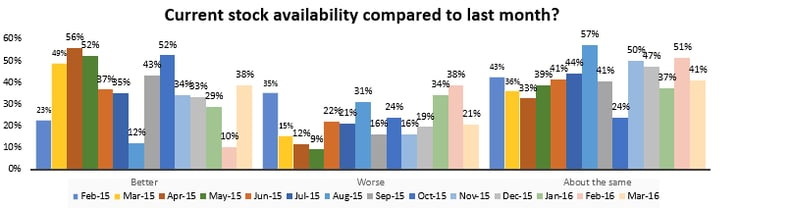

- In the lead-up to Easter, over two-thirds indicated that stock availability had either improved, or they had seen little or no change since February, and the remaining 21% reported it had worsened – the lowest we’ve seen year-to-date.

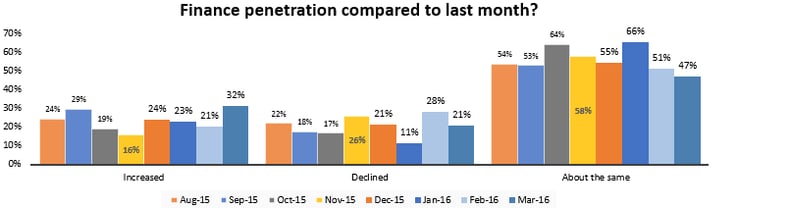

- In the first new-plate month of the year, 32% of those responding, indicated that they had seen an increase in financepenetration, and the majority of the remainder reported it was about the same as February.

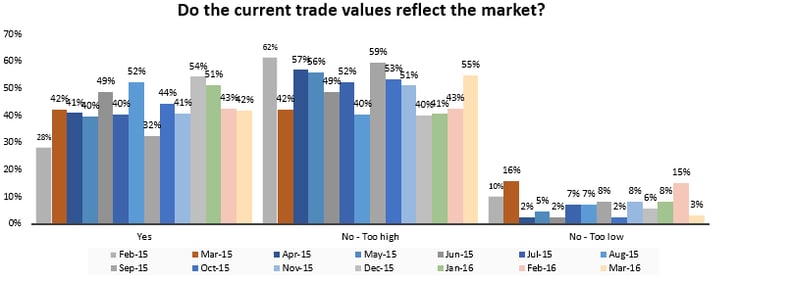

- Over half the respondents claimed that the current trade prices are too high. Adding to this is the pressure on margins, and signs that there is a reluctance from consumers to absorb increased forecourt prices.

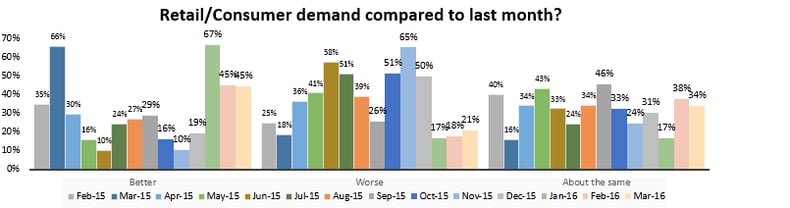

- Both footfall and online activity show that in general, dealers are reasonably positive, the retail and consumer demandaren't too dissimilar, and the overall majority report an improvement, with only a fifth indicating it worsened.

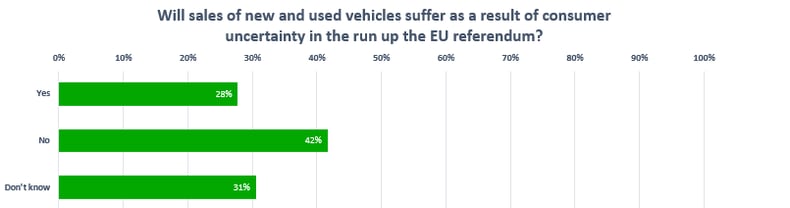

- We asked dealers’ opinion on the impact on new and used sales on the run-up to the EU referendum. The results are equally split between those believing it will, those that don’t, and the don’t knows. However, cap hpi has reported it is unlikely to have any impact on used values, and in the longer term, we do not envisage any significant impact, whatever the outcome of the referendum, although there is potential for changes to the overall economic situation.

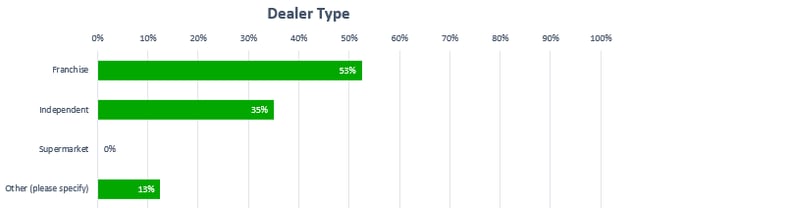

March's results in full: